[ad_1]

DrDjJanek/iStock via Getty Images

As the equity markets are nervously selling off, more likely due to the reasons I have been discussing since December (i.e. interest rate expectations are eating into growth premia), do exchange-traded funds that rely on analysts’ stock-picking talent and expertise offer a safe haven amidst this raging storm?

To answer that question, I would like to take a closer look at the Motley Fool 100 ETF (TMFC), an around $512 million fund that debuted in January 2018. With the proprietary, rules-based market-cap-weighted Fool 100 Index as a benchmark, this ETF has what I would call a hybrid active/passive investment strategy.

Its essential purpose is to provide returns superior to the U.S. market (which it has successfully delivered since inception). To achieve that, TMFC mixes one hundred high-conviction U.S. bellwether stocks from the Motley Fool analysts’ key picks list. Let us quote page 3 of the prospectus,

To be eligible for inclusion in the Fool 100 Index, a company must be among the 100 largest domestic firms by market capitalization in TMF’s “recommendation universe.” That recommendation universe includes all companies domiciled in the United States that are either active recommendations of a newsletter published by TMF or are among the 150 highest rated U.S. companies in TMF’s analyst opinion database.

The simplest way to break the code of (almost) any ETF’s strategy, no matter how sophisticated are the rules used by its analyst team, is to dissect its portfolio to identify what factors it is most exposed to, from value to growth, quality, size, momentum, etc. And factor exposure can tell a lot about the risk/reward profile.

For that purpose, as usual, we will be using the Quant data downloaded from the screener. The results of that analysis have not surprised me. More on that below in the note.

Portfolio

Investors guessing what tilt the Motley Fool 100 cohort might have will likely be disappointed by the fact the fund follows neither growth nor value style tenets. At least, for now.

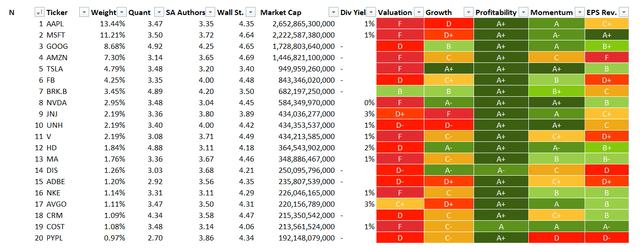

First, its top-heavy mix (~60.5% deployed to just 10 stocks, principally (still) the $1 trillion league members) is dominated by grossly overvalued companies. To corroborate, 89% of its holdings have valuation grades of D+ or worse. For ~4.5%, the valuation rating is neutral. A few remaining percent is spread between stocks that are seemingly undervalued, like Berkshire Hathaway (BRK.B) and Moderna (MRNA). The latter has seen its multiples compressing during autumn 2021, with the dreadful share price performance persisting in 2022. As a consequence, this previously richly priced stock has seen its Valuation grade improving constantly.

Below is the Quant dashboard for the top 20 holdings. Too much red, almost no green, even amid the Wall Street rout we are all watching closely.

Quant dashboard for top 20 holdings of TMFC

Created by the author using data from Seeking Alpha and the fund

What is the reason for almost a trace amount of value stocks in its mix?

The heavy share of overappreciated companies is more likely the consequence of its mega-cap focus. As I have discussed a few times in my articles, large size typically correlates with premium valuations and premium quality, while medium- and small-size players in many cases have fickle margins and uncoincidentally lower multiples.

So close to 83% of its holdings still have market values north of $100 billion, even despite most having seen their valuations trimmed this January, as the status of (principally) tech market darlings has withered amid expectations of hawkish moves from the Fed. The difference between the weighted average and median market capitalizations of the TMFC positions (over $1 trillion vs. $63.5 billion) speaks for itself.

But does it score nicely against growth indicators? Around 34% of the net assets are parked in stocks with at least a B- Growth rating. Fine, but not perfect. Mostly yes, its exposure to the growth style is way larger, but I would not say that the tilt of pronounced here.

Delving deeper, I see over 38% allocation to companies with at least 20% 3-year revenue CAGR, like Netflix (NFLX) and salesforce.com (CRM). Interestingly, around the same amount of the net assets is deployed to companies with consensus forward revenue growth rates north of 20%, including Tesla (TSLA), Block (SQ), Datadog (DDOG), etc. EBITDA growth prospects are even more robust, with 53% invested in companies with no less than 20% forward growth rates; MSFT, AMZN, and GOOG, the fund’s top picks, are on this list.

Its share of top earnings growers is even more substantial as those with above 20% Forward EPS growth rates account for over 64% of the portfolio. The question is if these prospects materialize, or scarcer capital and (probably) economic slowdown result in these rates cut sharply. For example, NFLX has recently dipped again, extending its decline that began with concerns over user (hence, revenue) growth illustrating what can happen when expectations do not meet reality.

Turning to advantages, the fund’s quality is simply impeccable. There is little to add here. It is a mega-cap top-heavy mix with stocks hand-picked by analysts. No coincidence over 96% of the holdings have Profitability grades of at least B+; the A club accounts for slightly above 93%. As my dear readers can notice from the Quant dashboard above, almost all key 20 stocks have an A+ rating. Besides, only three companies in the portfolio are cash-burning, namely Uber (UBER), Unity Software (U), and Twilio (TWLO); they account for a minuscule 0.7%.

Final thoughts

Does TMFC deserve investor attention? With all due respect to the Motley Fool analyst team, it certainly does, especially considering its 50 bps expense ratio looks adequate for a fund executing a hybrid active/passive investment strategy.

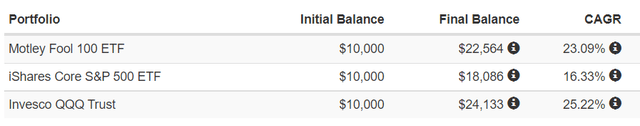

Its performance since inception has been overall robust (excluding the tumultuous start to 2022), while the iShares Core S&P 500 ETF’s (IVV) returns were well softer. As shown below, from 31 January 2018 to 31 December 2021, it managed to deliver a compound annual growth rate of above 23%, with which IVV failed to keep pace.

IVV,QQQ,TMFC CAGRs

Portfolio Visualizer

However, there are nuances.

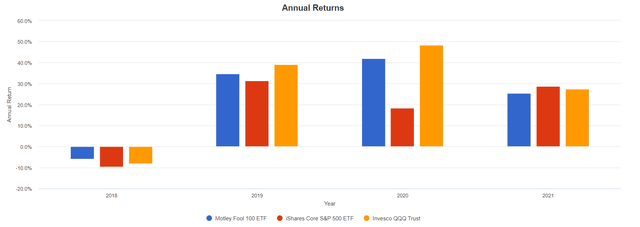

For example, TMFC was unable to outperform the Invesco QQQ ETF (QQQ). As shown above, QQQ’s CAGR is higher by over 2%. Though the end-2018 bear party dragged its price and NAV deeper compared to Motley Fool’s favorite stock picks, the Nasdaq 100 trounced the high-conviction cohort three times afterward, with 2020 being especially strong.

IVV,QQQ,TMFC performance

Portfolio Visualizer

Last year, TMFC underperformed both bellwether ETFs.

It is worth noting that the fund’s holdings overlap with QQQ is rather substantial. Comparing the datasets from the funds, I found out that Motley Fool’s favorite players have around 69% weight in the Invesco ETF. Amongst those missing are pure-value BRK.B, as well as Visa (V), Mastercard (MA), Disney (DIS), Nike (NKE), etc. For better context, 80 TMFC stocks can be found in the IVV portfolio where they have ~45% weight.

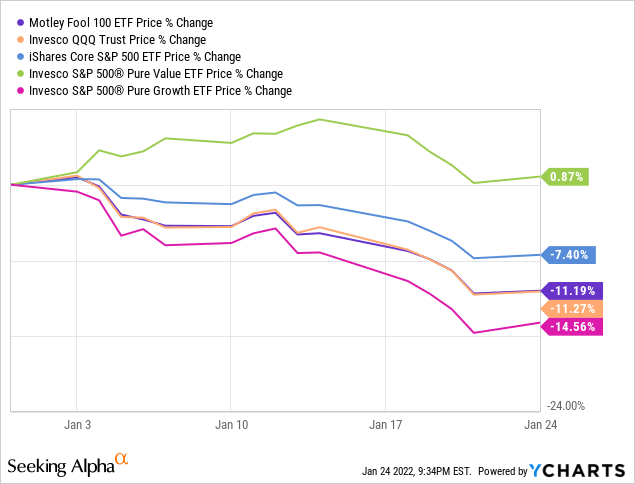

2022 to date has been choppy. Neither TMFC nor larger funds have been immune to bearish forces. But interestingly, the pure value names from the S&P 500 which I discussed in a recent bullish note have fared far better, especially compared to pure growth (RPG). Hence, the recent sell-off has been all about growth premiums becoming thinner.

So is it worth considering investing in TMFC right now, after its ~11.2% decline YTD? I do not think so. The growth premium and terrible valuation are the key issues. As usual, it is up to an investor to decide if it is worth paying 50 bps for a horribly overinflated equity mix amid the market correction, even considering the level of quality. In sum, TMFC is a Hold at these levels.

[ad_2]

Source links Google News