[ad_1]

Main Thesis

The purpose of this article is to evaluate the SPDR Wells Fargo Preferred Stock ETF (PSK) as an investment option at its current market price. While I have been recommending preferred shares for a while, and remain long PSK, my current outlook has become less bullish on the asset class as a whole. While I still find PSK’s yield attractive and I expect defaults in the investment grade space to be extremely minimal, I expect future returns to be modest compared to the recent performance. This is because prices for preferred shares have been rising, given the heavy demand for the asset class, and history shows us that when prices reach their current levels, the returns are underwhelming.

Furthermore, as the probability of lower interest rates increases, preferred shares investors face “call risk,” which is the risk that the securities are redeemed prior to maturity. If this happens, it prevents investors from realizing any future gain on the security. It also means new shares will be issued at prevailing (lower) rates, limiting the total return potential compared to what it was before the shares were called. That said, I am not bearish on PSK, primarily because the fund’s Financial exposure should keep returns positive. Large banks are reporting strong earnings, and the likelihood of any defaults from this sector is extremely low at this time.

Background

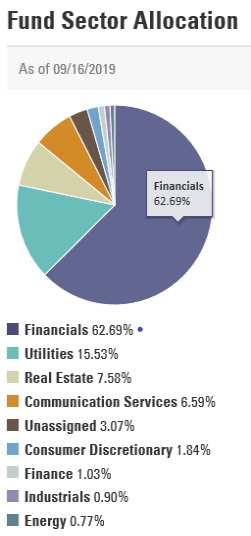

First, a little about PSK. The fund “seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Wells Fargo Hybrid and Preferred Securities Aggregate Index.” This index holds preferred shares from investment grade companies, with a heavy emphasis on the Financials sector, as well as including a fair amount of exposure to Utilities and Real Estate. The fund currently trades at $43.52/share and has a current annual yield 5.53%.

I was bullish on PSK when I reviewed the fund for the first time back in June. I was looking to add some diversity to my portfolio, and was shifting away from some broad market exposure. To do so, I added to preferred shares and municipal debt. In hindsight, this turned out to be a decent move, as PSK has returned around 2% since that time, as shown below:

Source: Seeking Alpha

Source: Seeking Alpha

While I am generally pleased with PSK’s performance so far, it has seen some pressure in the short term. Therefore, I wanted to re-evaluate the fund to see if I should change my “bullish” outlook. After review, I believe further gains will likely be capped, and a “neutral” rating is more appropriate, and I will explain why in detail below.

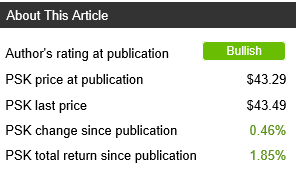

Preferred’s Have Competitive Yields

To start the review, I want to discuss a primary reason why investors will still want to buy preferred shares, and PSK by extension. While my outlook is less optimistic than a few months ago, the fact remains that PSK still offers an attractive yield, at over 5.5%. This is pretty much in-line with preferred shares across the market, as the average yield is 5.7% within the asset class. While this yield is below high-yield corporates, it still beats most other fixed-income options, as shown below (yields as of 8/30):

Source: Charles Schwab

Clearly, preferreds are offering yields that are comparably high for the fixed-income world, which should continue to draw investor interest. Furthermore, while they are offering less than high-yield corporates, I still favor preferred share exposure. This is because the spread between the two is modest, at less than 1%, yet preferred share funds like PSK are made up entirely of investment grade debt. This means investors are taking on less credit risk to obtain a similar yield, which is an attractive proposition. Therefore, my takeaway here is that preferred securities still warrant a place in investor portfolios, as the income stream is desirable. I simply feel investors need to remain realistic about what the short-term returns will be heading into 2020.

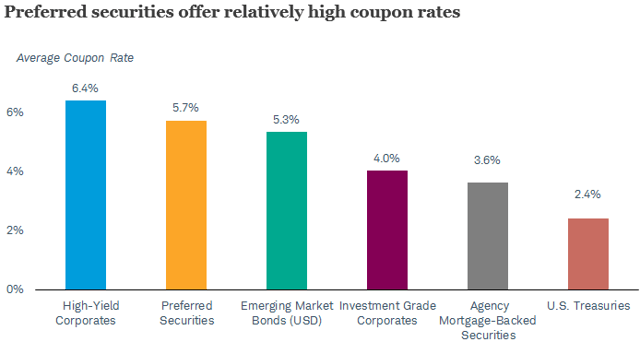

History Shows Returns Will Be Low

As I alluded to above, I expect modest returns for PSK, and similar funds, going forward. The rationale behind this outlook has to do with the run-up in prices, and the historical returns when preferred shares have reached current prices in the past. In fact, according to data compiled by Charles Schwab, when prices for preferred securities average at the current levels, total returns are below 3% for the following year, as shown in the following chart:

Source: Charles Schwab

Source: Charles Schwab

As you can see, based on index prices for preferred securities, prices are sitting at high levels historically, and that generally translates into much lower returns. Of course, this is just based on historical averages and not a guarantee of what will happen, but this data should make investors cautious going forward. Clearly, the story behind preferred shares is well-known at this point, and investors have been handsomely rewarded over the past year. But this reality has sent prices to a level that suggests similar performance is not likely to continue over the next twelve months.

Interest Rates And Call Risk

My second point on why my outlook on PSK has cooled has to do with call risk, as it relates to interest rates. Preferred shares are unique in that they have the added risk of being callable, which means that a corporation can “call” the shares (essentially retiring them), when they feel it is advantageous to do so. A reason for doing this would be if the company expects interest rates to decline, or if rates have already declined, and then to reissue preferred shares at the prevailing, lower rates.

This harms investors because they are not necessarily able to “lock-in” the higher income streams with preferred shares the way they can with other fixed-income instruments. If, for example, a preferred share yielding 5% is called early, and then reissued at 4%, the investor who picks up the new shares has now seen their income stream drop. While the principal was safe, the total return has taken a hit.

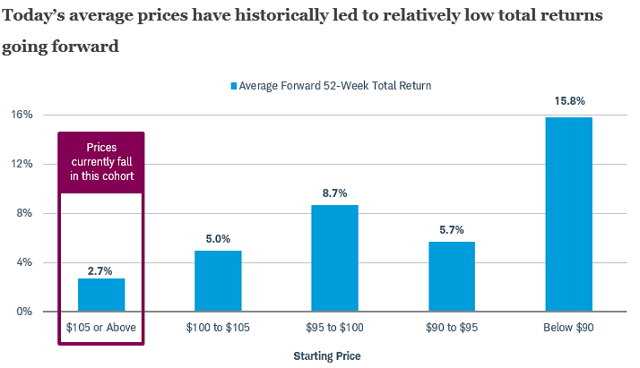

I bring this point up because it is especially relevant in today’s market. While investors have been piling into fixed income as interest rates have declined, investors need to be more cautious in doing so with preferred shares. The reason is that while rates have already declined markedly this year, with a second Fed rate cut occurring this week (on 9/18). This impact of declining rates so far has not been too substantial on preferred securities year-to-date, but this is a risk that is certainly present in a declining interest rate environment.

To compound this risk, it is important to consider that the next move could be even lower rates. At this point, investors are not anticipating rates to move higher by year-end. The only options, currently, are for rates to remain in neutral or to move lower, with the drop likely being by another .25 basis points. After the recent Fed announcement, investors are pretty split on whether the Fed will act again by the end of their December meeting. But they are unanimous that a rate hike is not going to happen, according to data compiled by CME Group, shown below:

Source: CME Group

Source: CME Group

As you can see, investors are still placing a fairly high probability on a further decline, which means investors may see more preferred shares being called than they have over the past few years. Considering that current prices already predict lower short-term returns for this asset class, when we add in this call risk, the outlook becomes a bit cloudier indeed.

That said, I want to reiterate I am still not terribly worried about the sector, but rather trying to set realistic expectations. Even if my concerns materialize, I still expect positive returns from the sector. As I mentioned, defaults in the investment grade corporate space are rare, and I don’t see a scenario where this changes heading into 2020. Furthermore, even if the shares are called and re-issued, the new yields will still be competitive.

As we saw at the beginning of the article, preferred shares still have a spread of almost 2% over other investment-grade corporates, and their spread over treasuries is more than double what treasuries offer. This tells me that funds like PSK can afford to see their yields decline modestly, and still attract plenty of investor interest in their income streams. Given this backdrop, the neutral rating makes plenty of sense to me.

Financial Firms Borrowing Less

My final point relates to borrowing within the Financial sector, and how this impacts my outlook on PSK. As I mentioned, I am remaining long PSK, yet this article had a bit of a negative tone. While I am less optimistic than I was a few months ago, I still like this exposure, primarily because of PSK’s underlying holdings. The fund is heavily exposed to shares within the Financials sector, which actually make up almost two-thirds of total assets, as shown below:

Source: State Street

Source: State Street

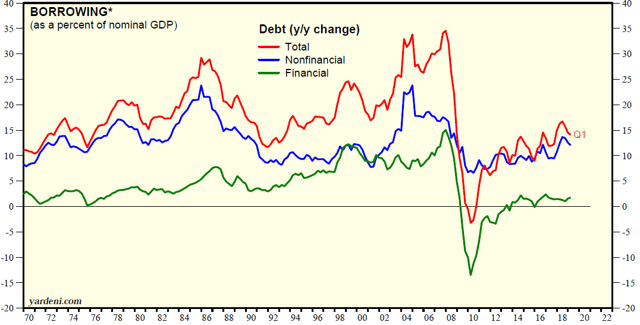

Clearly, this fund is not very diverse in terms of sector weightings. While there are a lot of sectors represented, it is heavily concentrated in one area, and that could give investors pause. However, the Financials sector is an area where I want exposure, especially when it comes to preferred shares, primarily because the sector is borrowing less heavily than the market as a whole. To illustrate, consider the chart below, which details total corporate borrowing as a percentage of GDP, from both the Financial and nonfinancial sectors:

Source: Yardeni Research

Source: Yardeni Research

As you can see, Financial sector borrowing, while increasing slightly in the short term, has remained relatively stable after a steep increase post-recession. However, borrowing among non-financial firms remains markedly higher, which has been a consistent story for years. With corporate debt at extremely high levels, I want exposure to stocks and sectors that are borrowing less aggressively than the market. The Financial sector fits this bill, and PSK offers majority exposure to this area.

Bottom Line

While my outlook for preferred securities has cooled somewhat, I still believe they offer a reliable income stream in a low interest rate world. While history tells me total returns will be limited from here, that data also suggests positive returns going forward, which should give investors some comfort. PSK offers a yield that is well above what other asset classes are offering, and the fund’s exposure to the Financials sector, which is less indebted than the average market sector, indicates to me that the income stream is safe for now.

Looking ahead, this asset class does have some call risk right now, especially if interest rates decline measurably. However, even if that scenario occurs, I believe the pain will be short-lived. This is because even with a reduction to the current yield, funds like PSK will still offer competitive yields compared to alternatives. Therefore, I remain cautious, but optimistic, on PSK, and suggest investors give this fund a look at this time.

Disclosure: I am/we are long PSK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News