[ad_1]

SA Essential: BND

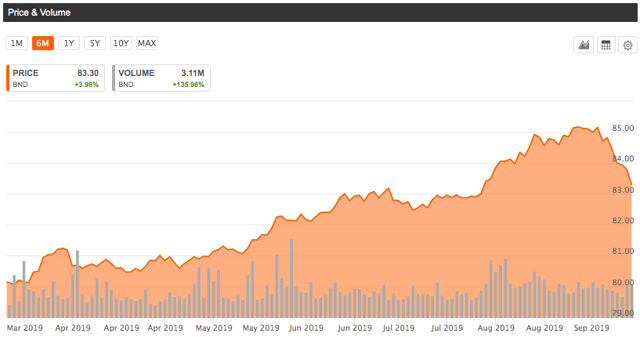

Thus far, September 2019 has not been kind to bond investors. Yields in the US and abroad have made an important reversal, and bond prices move inversely with yields.

SA – Nairu Capital

While there can be legitimate reasons to look for a top in the 35+ year bond bull market (please click the link to Nairu Capital’s piece above), the fact remains that fixed income will likely make up an important portion of most investor portfolios. This is especially true due to the shifting demographic toward an ageing population.

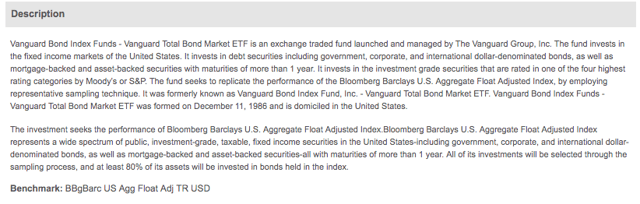

My article will introduce readers to one of the benchmark fixed-income ETFs available on the market: the Vanguard Total Bond ETF (BND). Unless otherwise specified, the visuals below come from Vanguard’s website.

We’ll dive deeper into how the fund is constructed momentarily, but it’s worthwhile to begin by asking who might be expected to incorporate BND into their holdings.

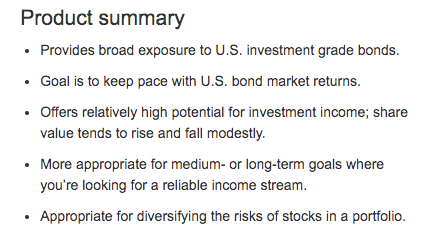

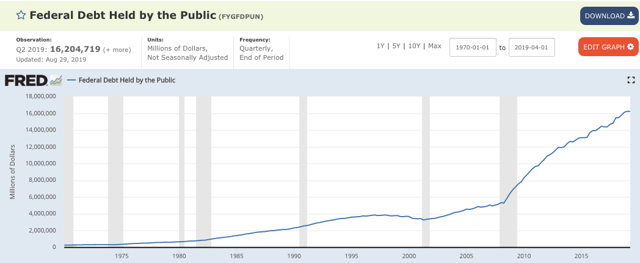

According to Vanguard’s product summary, BND is designed to represent “the investment-grade bond market”. US debt markets are gargantuan: even just the national debt held by the public is over $16T:

Of course, there are large pools of debt floating in the corporate, asset-backed, government-backed mortgage securities, and other sectors of the US economy.

BND, then, grants broad-based exposure to investors looking for investment-grade securities. Vanguard’s product summary mentions that the ETF is more likely to appeal to income-oriented investors as opposed to those looking for capital gains. The final bullet point mentions that bonds can be a good diversifier to a basket of stocks.

Construction Details

SA Essential

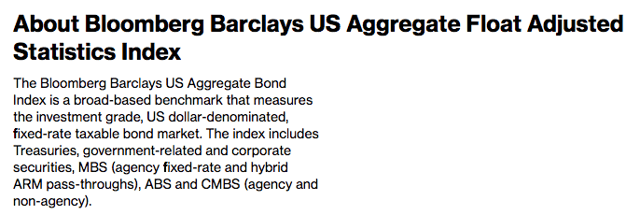

SA provides a good description for BND’s construction framework. The ETF creates an avenue for investing in the Bloomberg Barclays US Aggregate Float-Adjusted Index. Let’s have a look at the Index summary:

Bloomberg

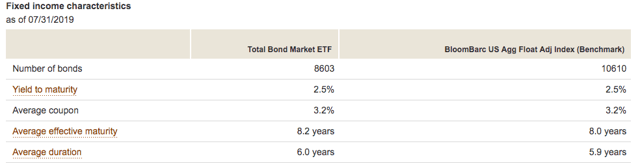

BND engages in a process called “replication” to efficiently track the Index. Different segments of the bond market have varying levels of liquidity, and it can be costly to mimic an index rather than replicating. According to the summary, “representative sampling” is the statistical method employed for the purposes of generating an unbiased replication. This approach is not uncommon for ETF providers.

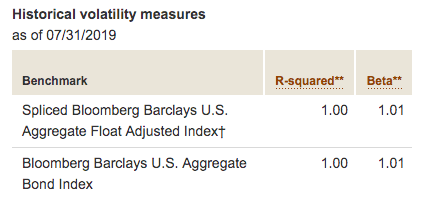

Vanguard’s replication of the Index demonstrates strong effectiveness; the R-squared statistic, which here measures how well changes in the Index explain movements in BND. For an ETF whose goal is to track an index, an R-squared of 1.00 shows that this task has been achieved exceptionally well.

The index beta very near to 1.00 also demonstrates that the bonds that BND holds are not materially different in their risk profile than the Index.

Holdings Classification

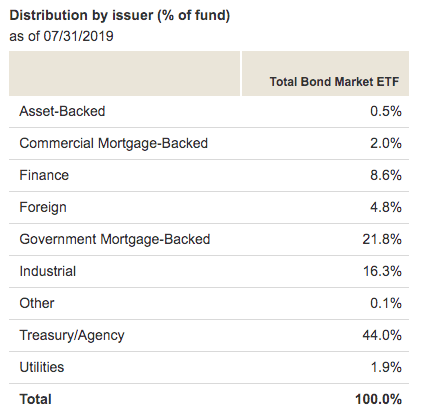

Vanguard breaks down the different bond sectors as follows (keep in mind this is of July 31st).

SA Essentials

The three largest categories that investors are participating in when they purchase BND are Treasury/Agency, Government Mortgage-Backed, and Industrial (“corporate”), in that order. So nearly half of the overall allocation is to Treasury/Agency debt instruments.

This is a diversified basket, and investors may choose a different weighting scheme by buying alternative ETFs that carry differing sector allocations, such as LQD or IEF. For better or worse, a purchase of BND comes with the above sector allocation, which investors should take into consideration before parking funds here.

Fund Fees

As with all its funds, Vanguard takes a leadership position in keeping fees at very low levels. BND comes with an astoundingly low price tag of a mere 3.5 basis points per year – $3.50 per $10,000 invested!

There are other fees connected to trading costs. But the overall cost of ownership for the fund command consideration for those looking to invest in the US fixed-income space.

Wrap Up

Certainly there are reasons why one might not want to invest in the fixed income markets, especially if we consider what kinds of trajectories yields could take over the next decade or so.

If one is seeking to gain low-cost access to a large swath of US investment-grade bonds, BND advances itself as a baseline choice, and deserves investor consideration.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News