[ad_1]

After a few months of downside performance in the United States 12 Month Oil Fund (USL), shares of the ETF appear to be on the rebound with the last month seeing nearly a 4% return. In this piece, I will make the case that I believe there is substantial upside in USL due to both its positive roll yield as well as fundamentals and that I believe now is a great time to buy the ETF.

The Instrument

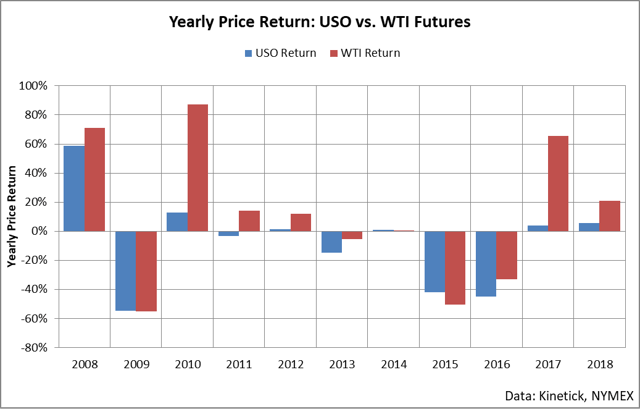

USL is an ETF created by USCF Investments which seeks to alleviate some of the issues from its other popular oil ETF, USO. The main problem with USO is that it has an aggressive scheduling of rolling exposure in WTI futures contracts which can cause substantial performance issues over lengthy periods of time. For example, here is a comparison of the price return of a barrel of WTI versus the price return of the USO ETF for the last decade. This decoupling is due to roll yield which is something we will talk about in a bit.

The reason why this decoupling is so strong is because USO follows a method of rolling in which the entire exposure of the fund is shifted from the front month to the next month during a certain window two weeks before expiry. This means that for a few weeks, USO is entirely exposed to the second month futures contract and roll yield will impact a larger share of returns.

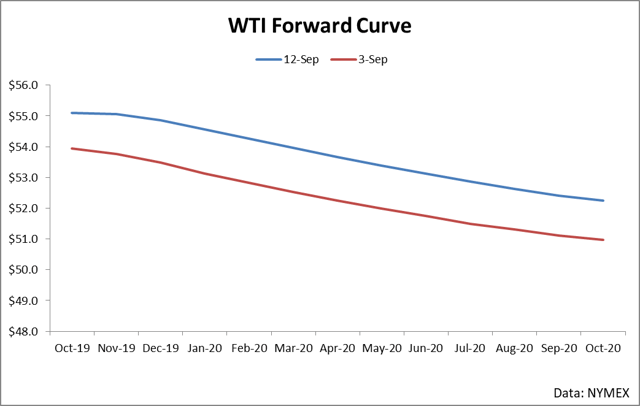

USL seeks to greatly alleviate and reduce these roll issues in that its methodology has it holding exposure across the front 12 months of the WTI futures curve. This means that the structure in any given month is not driving long-run roll returns but rather the general shape of the curve. The implications of this strategy mean that roll yield plays a stronger feature in the returns of the fund (since the vast majority of volume is held in back month contracts) but it does so in a general shape sense rather than just the front-month structure. This can be either a benefit or a detriment depending on market structure. Luckily, we are in a highly beneficial market environment for USL due to strong backwardation giving a strong roll yield across most of the holdings. So what is roll yield and how does it work?

Put simply, roll yield is the gain or loss that arises from holding a futures contract in a month further out on the curve than the front month contract. There is a basic tendency in financial markets for prices in later months to trade towards the spot price (or front month futures contract price) as time progresses. This tendency results in gains or losses through time depending both on the structure of the market as well as the position of the strategy.

For example, when a long strategy is rolling exposure in a backwardated market (front contract priced higher than back month contracts), roll yield will be positive since the contracts in the back of the curve will generally trade up in value towards the front of the curve as time progresses. Conversely, if a strategy is rolling long exposure in a contango market (front contract priced lower than back month contracts), the roll yield will be negative since the contracts established at higher prices will tend to trade down in value as time approaches expiry. If this concept is a little difficult to fully grasp or you’d like more information on this, I suggest reading this paper on SSRN. Lots of misunderstanding surrounds this concept of roll but it is the primary driver of returns for many ETFs and ETNs so a rigorous and practical understanding of the concept can reap dividends. Entire strategies and funds are structured around capturing roll yield due to the fact that futures and forwards tend to approach the spot price as time progresses and in the case of USL, the backwardated roll is a strong benefit for long traders.

We can put this knowledge to action by looking at the actual forward curve for WTI futures right now. As you can see, the market is heavily in backwardation across most of the curve.

At present, the average month-to-month differential for the first 12 months of the WTI forward curve is at 23 cents per barrel. Since USL holds positions across these two months, this means that as time progresses and each of these contracts rolls up towards the spot price, roll yield will be positive for the instrument.

Fundamentals

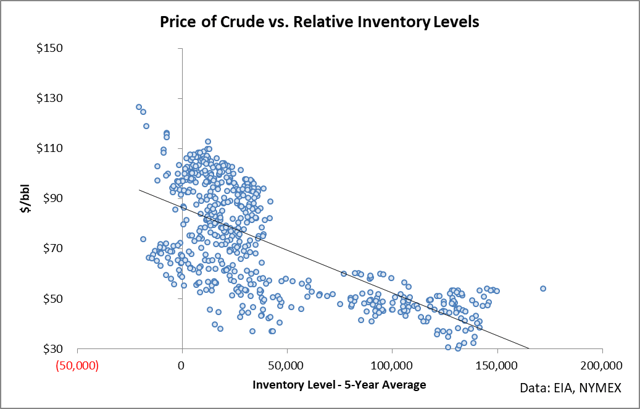

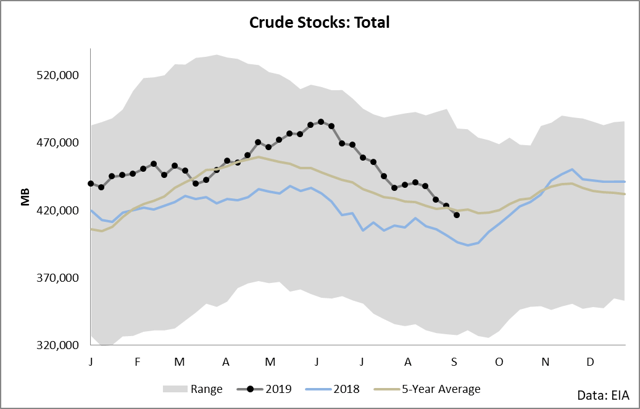

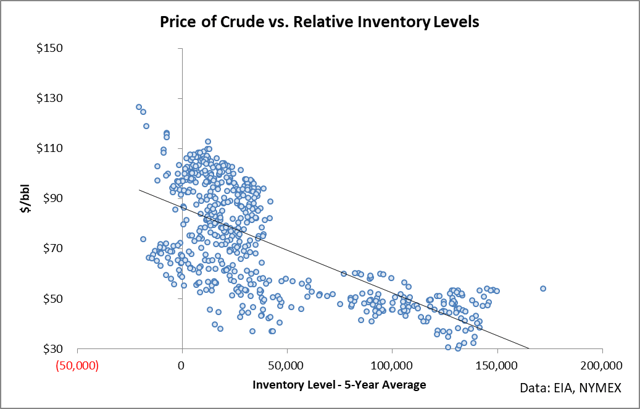

Even with a strong roll, there are other reasons to buy USL. Not only does the instrument provide excellent roll, but also the fundamentals support buying crude oil. The reason has to do with the fact that crude inventories are basically collapsing and the most recent reading of DOE data has put the current inventory level below the 5-year average.

As inventories drop against the 5-year average, prices to tend to rise.

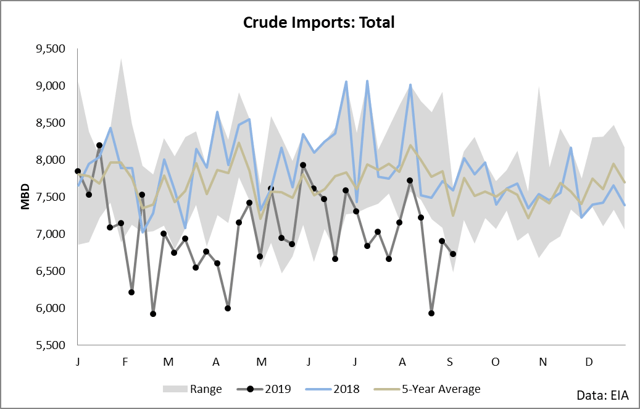

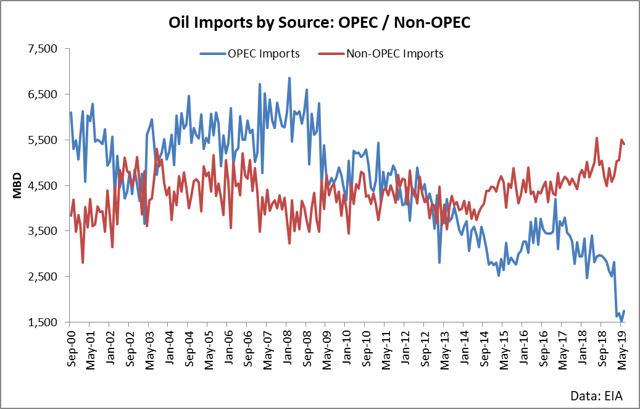

The reason for this drop in stocks has to do with the fact that OPEC cuts have simply smashed supply into the United States. As seen in the following two charts, inventories are at the lowest year-to-date level in several decades and OPEC is the culprit.

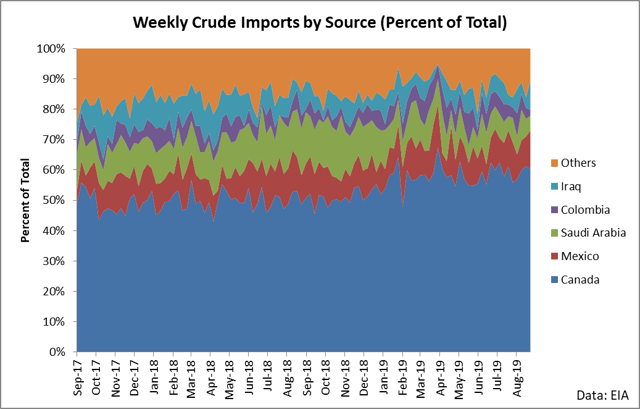

From a percentage share standpoint, as OPEC nations have stepped out, more Canadian barrels are needed to supply U.S. refining.

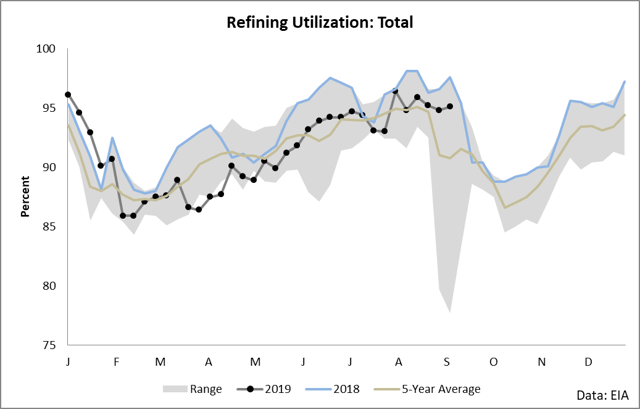

What is noteworthy about this situation is that these lagging imports which are dragging down stocks come in the face of weak refining demand.

In other words, even with lackluster refining demand for the majority of this year, inventories are dropping because supply (as expressed through imports) is so compressed that inventories are simply unable to prop themselves up. The risk is to the upside for crude oil in that if we see any sort of economic rebound, refining runs will most certainly surge (more people working harder = more petroleum demand). Even if refining demand stays weak, we will likely see imports continue to be lackluster due to OPEC’s stated objective of sustaining these cuts into March of 2020.

Due to the fact that OPEC is pulling down United States inventories and as inventories fall, prices rise, it makes a lot of sense to be long crude oil. USL offers an attractive investment option through its heavily backwardated roll structure and as time progresses I expect it to strongly perform. It’s time to buy USL.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News