[ad_1]

Investment thesis

The S&P GSCI Heating Oil Dynamic Roll Index Excess Return (SPDYHOP) retreated considerably since our last publication, losing 7.4% to $323.57 per share. Yet, with a positive seasonality for the month of September, improving distillate cracks and with signs that the market rests undersupplied, we maintain our bullish view on the complex and believe that the recent weakness constitutes and opportunity.

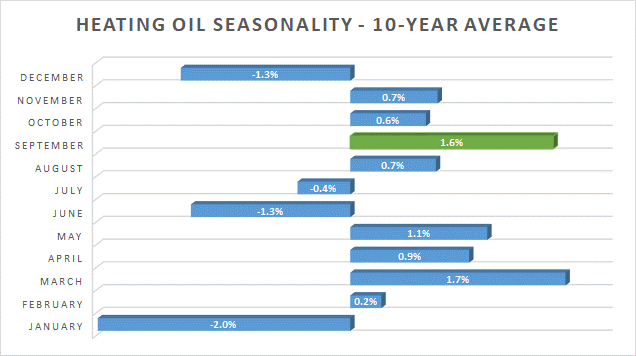

September heating oil seasonal performance is the second highest of the year and is sustained by below average distillate storage

In the last 10 years, heating oil seasonality has been favorable in the month of September, with the complex appreciating during the corresponding month 1.6% and posting the second largest monthly performance after March.

Source: Oleum Research

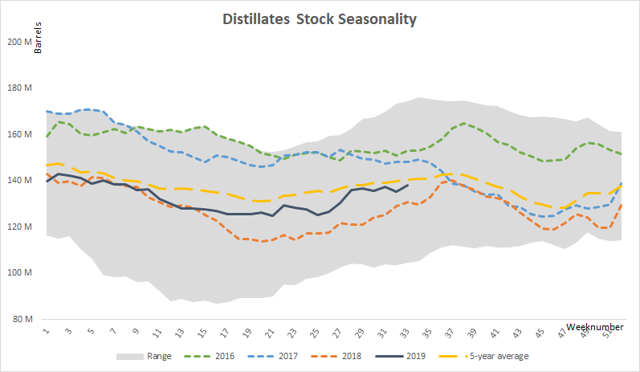

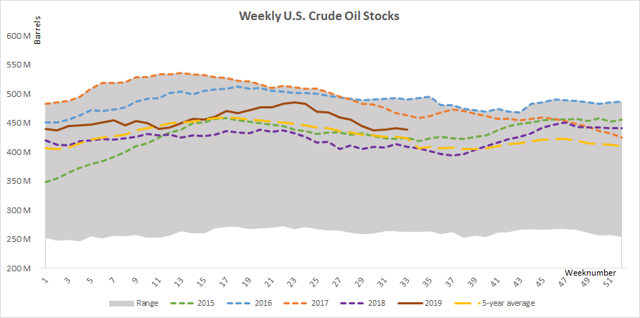

Besides and in spite of the slight distillate stock enhancement during the week ending August 16, up 1.93% (w/w) to 138.1m barrels, distillate stock seasonality remains below its 5-year average, down 1.7% or 2 343k barrels, providing tailwinds to the complex and to the SPDYHOP Index, while sustaining this prior view.

Source: EIA, Oleum Research

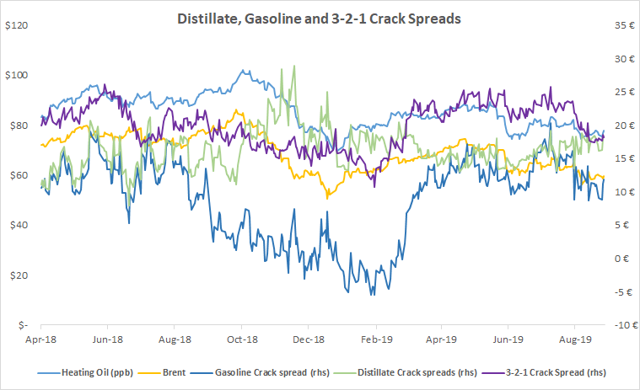

Gasoline and 3:2:1 crack spread weaken, whereas distillate spreads improve, providing tailwinds to SPDYHOP

In the last few weeks, the differential between gasoline and distillate cracks widened, as the storage picture of the blends evolved in opposite directions and are respectively above and below the 5-year mean.

This has contributed to lifting distillate cracks sustaining the complex and the SPDYHOP Index. Yet, with higher distillate cracks, refiners are incentivized to boosting the blend’s supply, which is likely to weigh on the SPDYHOP Index in the medium to long term.

Source: Oleum Research

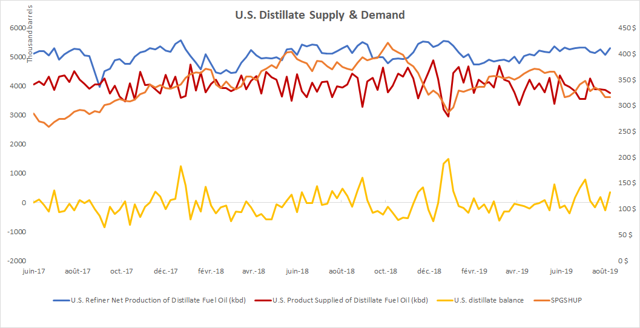

On the other side, the distillate supply-demand equilibrium becomes oversupply by 341k barrels on the week ending August 16. This is due to the moderate appreciation of supply up 4.51% (w/w) to 5 308k barrels, the steep decline of distillate export, down 12.46% (w/w) to 1 419k barrels and the slim decline of distillate demand, down 2.62% (w/w) to 3 758k barrels. While these developments are likely to bring some downside on the complex, the undersupply witnessed in the previous weeks should partly offset that.

Source: EIA, Oleum Research

The distillate and crude oil supply gap remains favorable for the appreciation of SPDYHOP

In the meantime, the supply of medium and heavy oil has fallen over the past year, in spite of the significant oversupply of U.S crude oil storage compared to last year’s level.

Source: EIA, Oleum Research

The supply gap between crude oil and distillates has contributed to lift distillate cracks, supporting the complex. Besides, Canada continues to suffer from pipeline bottlenecks, capping flows of heavy oil sands and with declining heavy oil in Mexico and sanctions on Venezuela and Iran having knocked 2-3 million barrels per day of medium and heavy barrels offline, the distillate blend should remain undersupplied for the coming weeks, providing tailwinds to the SPDYHOP Index.

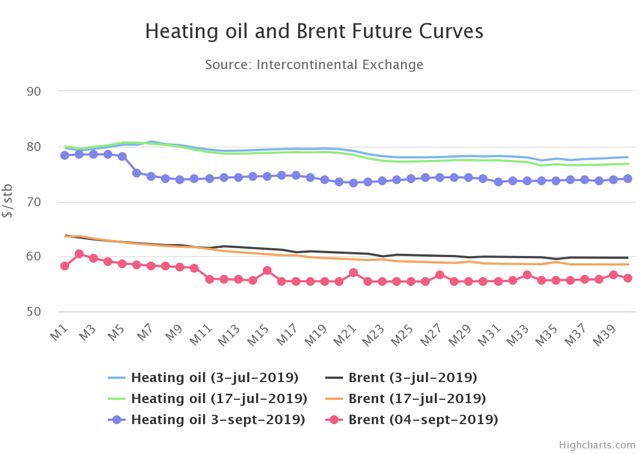

Besides, crude futures slid downwards moderately compared to July pricing, whereas heating oil future contract dipped significantly and is now establishing in a stronger backwardation.

In this context, we maintain our bullish view on the SPDYHOP for the moment, following supportive distillate cracks spread, favorable price seasonality in September and signs that the complex remains slightly undersupplied.

We look forward to reading your comments.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News