[ad_1]

Originally Published August 15, 2019

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

European-Listed ETFs

Total traded volume

Trading activity on the Tradeweb European-listed ETF marketplace reached EUR 30.67 billion in July, a new high for monthly notional volume. The proportion of transactions completed via Tradeweb’s Automated Intelligent Execution Tool (AiEX) climbed to a record 68.1%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “Our European ETF platform has defied the traditional summer slowdown, against a background of plunging bond yields and a reversal of interest rate expectations. Trading activity was consistent throughout the month, with average daily volumes reaching EUR 1.34 billion, up 60% year over year and more than double since July 2017.”

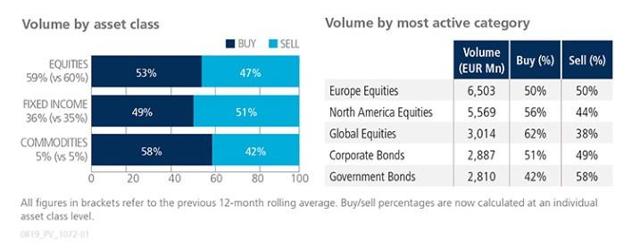

Volume breakdown

After eight consecutive months of net buying, fixed income ETFs were mostly sold in July. In contrast, ‘buys’ in shares- and commodity-based products surpassed ‘sells’ by six and 16 percentage points, respectively. Europe Equities reclaimed the most actively-traded category spot from its North America equivalent, with more than EUR 6.5 billion in notional volume.

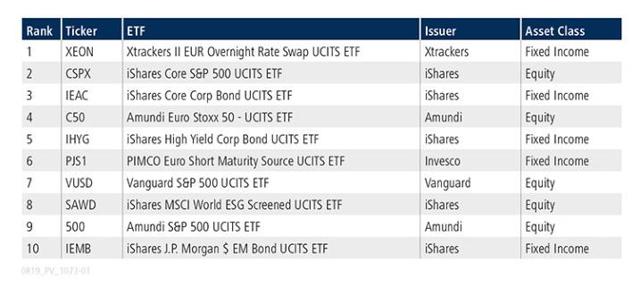

Top ten by traded notional volume

Equity and fixed income products were equally represented in July’s top ten list by traded notional volume. Ranked first, the Xtrackers II EUR Overnight Rate Swap UCITS ETF aims to reflect the performance of the Deutsche Bank EONIA Total Return Index.

U.S.-Listed ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in July 2019 was USD 6.05 billion.

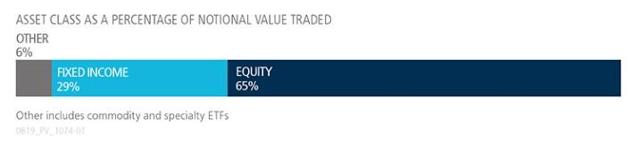

Volume breakdown

As a percentage of total notional value, equities accounted for 65% and fixed income for 29%, with the remainder comprised of commodity and specialty ETFs. During July, 54% of U.S. ETF trades on the platform were executed via the Tradeweb AiEX tool.

Adam Gould, head of U.S. equities at Tradeweb, said: “July was a fairly quiet month for U.S. equities. As expected, the Federal Reserve cut rates 25 basis points and broader macroeconomic pressures remained. While a number of widely-followed equity Indices reached record levels, the Treasury market, particularly the yield curve, was a cause for investor concern.”

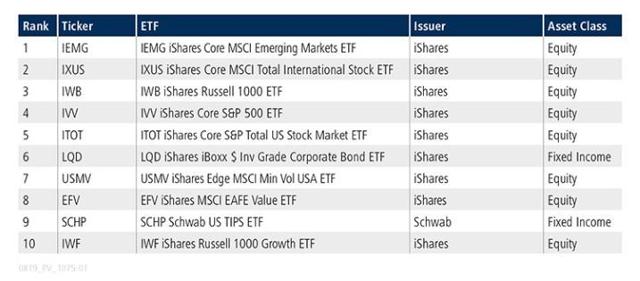

Top ten by traded notional volume

During the month, 510 unique tickers traded on Tradeweb’s U.S. ETF platform, with equity ETFs dominating the top ten list by traded notional volume.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link Google News