[ad_1]

ETF Overview

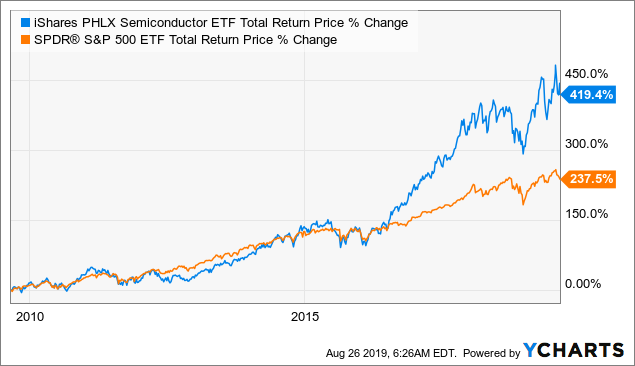

iShares PHLX Semiconductor ETF (SOXX) owns a portfolio of large and giant-cap semiconductor stocks. The fund seeks to track the investment results of the PHLX Semiconductor Sector Index. Stocks in SOXX’s portfolio should continue to enjoy favorable industry fundamental as the semiconductor industry is set to grow at a rate of 7.67% annually through 2024. In addition, stocks in SOXX’s portfolio have competitive position over its peers. However, these stocks are slightly more expensive than its historical averages. Given a weakening global economy, we think investors should patiently wait on the sidelines.

Data by YCharts

Data by YCharts

Fund Analysis

Semiconductors will be in strong demand in the next decade

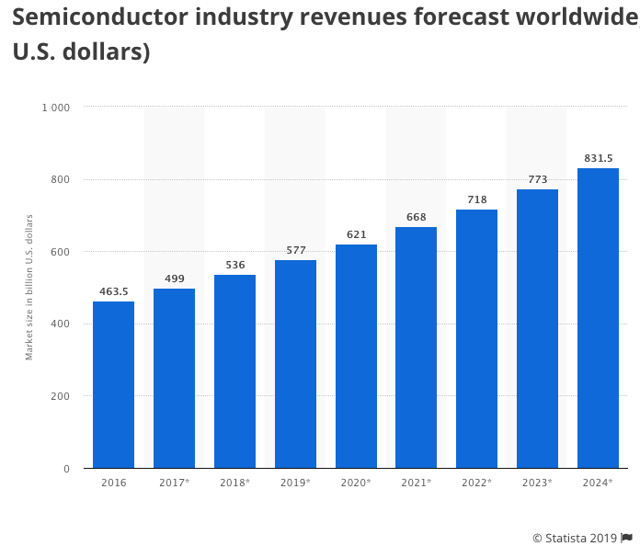

SOXX’s portfolio consists of 35 semiconductor stocks. These companies include integrated circuits design companies, foundries, memory manufacturers, and equipment providers. Semiconductor components are essential components in electronic devices. The industry is set to continue to grow at a fast pace thanks to several growth trends such as Internet of Things, electric vehicles, 5G, data centers, and artificial intelligence in the next decade. As can be seen from the chart below, the global semiconductor market is expected to grow from $536 billion in 2018 to $831.5 billion in 2024. This represents a compound annual growth rate of 7.67% (see chart below). Therefore, we think stocks in SOXX’s portfolio will continue to benefit from these technological trends in the next decade.

Source: Statista 2019

SOXX’s portfolio of stocks are moaty stocks

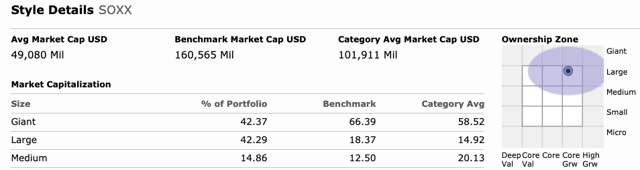

Most stocks in SOXX’s portfolio are large or giant cap stocks that do have deep pockets. These large companies do have the cash to spend money on R&D to maintain its competitive advantages over its small peers.

Source: Morningstar

Indeed, stocks in SOXX’s portfolio are companies with moats. As can be seen from the table below, 9 out of the top-10 stocks in SOXX’s portfolio receive narrow or wide moat status according to Morningstar’s research (these top 10 stocks represent 60.54% of its total portfolio). Most of these stocks either hold key important intellectual properties, or manufacturing know-hows (with patents) that are difficult for its competitors to replicate.

|

as of 08/23/2019 |

Morningstar Moat Status |

% of ETF |

|

Nvidia (NVDA) |

Narrow |

8.57% |

|

Texas Instrument (TXN) |

Wide |

8.24% |

|

Qualcomm (QCOM) |

Narrow |

7.87% |

|

Broadcom (AVGO) |

Narrow |

7.73% |

|

Intel Corp. (INTC) |

Wide |

7.30% |

|

Micron Technology (MU) |

None |

4.71% |

|

Applied Material (AMAT) |

Wide |

4.17% |

|

Lam Research (LRCX) |

Narrow |

4.10% |

|

NXP Semiconductor (NXPI) |

Narrow |

3.97% |

|

KLA Corp. (KLAC) |

Wide |

3.88% |

|

Total: |

60.54% |

Source: Created by author

SOXX is not cheap right now

SOXX has delivered an excellent total return of 509% in the past 10 years. This is much better than the S&P 500 Index’s total return of 292%. SOXX’s forward P/E ratio of 17.69x is slightly less than the ratio of 18.32x of the S&P 500 Index. Similarly, SOXX’s price to cash flow ratio of 9.01x is also slightly lower than the S&P 500 Index’s 9.55x.

|

as of 08/23/2019 |

SOXX |

S&P 500 Index |

|

Forward P/E Ratio |

17.69x |

18.32x |

|

Price to Cash Flow Ratio |

9.01x |

9.55x |

|

Sales Growth (%) |

9.75% |

7.10% |

Source: Morningstar, Created by author

The average forward P/E ratio of SOXX’s top-10 holdings is 16.12x. This is slightly higher than its 5-year average P/E ratio of 15.34x. Therefore, we think SOXX’s valuation is slightly expensive.

|

as of 08/23/2019 |

Forward P/E |

5-year Average P/E |

|

Nvidia (NVDA) |

31.15 |

28.72 |

|

Texas Instrument (TXN) |

22.94 |

19.59 |

|

Qualcomm (QCOM) |

17.04 |

13.71 |

|

Broadcom (AVGO) |

11.34 |

13.22 |

|

Intel Corp. (INTC) |

10.66 |

12.73 |

|

Micron Technology (MU) |

13.85 |

8.70 |

|

Applied Material (AMAT) |

12.20 |

14.01 |

|

Lam Research (LRCX) |

14.16 |

13.46 |

|

NXP Semiconductor (NXPI) |

13.16 |

13.92 |

|

KLA Corp. (KLAC) |

14.71 |

15.29 |

|

Average |

16.12 |

15.34 |

Source: Created by author

Risks and Challenges

Investors should keep in mind of these risks

Semiconductor industry is highly-cyclical

Semiconductor industry is highly cyclical. Even though stocks in SOXX’s portfolio are large-cap or giant-cap stocks, they will likely face sales decline when supply exceeds demand. In fact, the semiconductor industry was on a downward cycle in the first half of 2019.

China represents about 41% of the total semiconductor demand in the world

In 2018, China’s semiconductor consumption accounted for 41% of the global total consumption. According to a research by Deloitte, China is expected to account for 57% of global semiconductor consumption by 2024. However, the current trade tension between the United States and China has resulted in a deceleration of China’s economy. Therefore, China’s consumption of semiconductors may decline in 2019 and perhaps even 2020 if the trade tensions escalate. In addition, many of the stocks in SOXX’s portfolio have sizable businesses in China (e.g. Intel, Qualcomm, etc.).

Investor Takeaway

Stocks in SOXX’s portfolio should continue to grow over the next decade thanks to several technological trends. However, these companies may be slightly overvalued especially consider that China, the largest semiconductor consumption market, is experiencing an economic slowdown. Therefore, investors may want to wait for a pullback before initiating a position.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News