[ad_1]

As markets chop around from the recent trade war and recession contagion spreads, its hard to find investments that you can park your money in while waiting for things to settle down. This week, I received a message from a Seeking Alpha reader asking if I would look at the PIMCO Enhanced Short Maturity Active ETF (MINT) since a lot of contributors haven’t written about it. Since I have recommended investments like MINT to clients at my investment firm, it was a natural fit for me to do some due diligence and write about this great short-term bond fund income generator. After reading this article, I want you the reader to be able to take away why MINT is an interesting vehicle to use as an alternative to a money market, and why it’s a great investment in times of uncertainty.

An Alternative To Cash

Created in 2009, The PIMCO Enhanced Short Maturity Active Exchange-Traded Fund is an actively managed exchange-traded fund (ETF) that seeks greater income and total return potential than traditional cash investments in exchange for a modest increase in risk. Please note, this is not a risk free investment option, but a very conservative approach to own other yielding securities. With over 811 holdings, you can rest assured your capital is diversified with this $12 billion in assets under management ETF. According to the FDIC, the national average interest rate on savings accounts currently stands at 0.09% APY. You would be amazed at how many investors and savers out there have no idea what their average yield is on their savings accounts. The average money market is paying a whopping .19% on your money, while also limiting how many checks you can usually write against the account. To me, it is a no brainier to look at a fund like MINT, when considering alternatives to cash yielding products.

How Does MINT Currently Distribute 2.67%?

Many fixed income investors are not aware of short-term investment grade corporate bonds. This is a tongue turner meaning these are companies that are capable of paying all your principal back with a small interest payment of 2.67%. With complete fairness, the last time I checked today, MINT is paying an SEC 30-Day yield of 2.43%, which is a little bit lower than the stated 2.67% distribution yield. Either way, the fund focuses on owning very short-term bonds that will pay you monthly interest. Lets take a look below at the largest ten holdings that MINT owns that allows investors to make roughly 2.67%:

Top 10 Exposures

| BROADCOM CRP / CAYMN FI SR UNSEC | 1.43% |

| SHIRE ACQ INV IRELAND DA SR UNSEC | 1.14% |

| FED HOME LN MTGE GLBL NT (500MM) | 1.00% |

| PNC BANK NA SR UNSEC | 0.89% |

| NTT FINANCE CORP SR UNSEC FRN | 0.86% |

| HFLF 2019-1 A1 1MLIB+47BP 144A | 0.86% |

| BAYER US FINANCE LLC UNSEC 144A | 0.81% |

| ENERGY TRANSFER PART LP 4(2) DISC NT* | 0.80% |

| ABBVIE INC 4(2) DISC NT* | 0.77% |

| BARCLAYS PLC | 0.76% |

(Source: PIMCO)

As you can see from the above table, companies like Broadcom (AVGO) and PNC Bank (PNC) are included in the fund. MINT purchases these bond issuances with effective durations of around 2-3 months. This is also great news if for some reason we were to go in a recession and you want your money back quicker, and if the Fed were to increase rates like they did last year.

MINT Risk Measures

Every article I write for Seeking Alpha includes specific risk metrics. Even low duration and lower risk bond funds like this can have an unforeseen risk, so it’s important to run these metrics every time like habit. The table below outlines the most commonly used metrics I look at in any mutual fund or ETF:

| Metric | MINT Measurement |

|---|---|

| Arithmetic Mean (monthly) | 0.12% |

| Arithmetic Mean (annualized) | 1.47% |

| Geometric Mean (monthly) | 0.12% |

| Geometric Mean (annualized) | 1.46% |

| Volatility (monthly) | 0.13% |

| Volatility (annualized) | 0.46% |

| Downside Deviation (monthly) | 0.05% |

| Max. Drawdown | -0.55% |

| US Market Correlation | 0.37 |

| Beta(*) | 0.01 |

| Alpha (annualized) | 1.29% |

| R2 | 13.35% |

| Sharpe Ratio | 2.28 |

| Sortino Ratio | 5.55 |

| Treynor Ratio (%) | 77.30 |

| Calmar Ratio | 22,424,070.38 |

| Active Return | -11.47% |

| Tracking Error | 12.90% |

| Information Ratio | -0.89 |

| Skewness | 0.02 |

| Excess Kurtosis | 1.31 |

| Historical Value-at-Risk (5%) | -0.11% |

| Analytical Value-at-Risk (5%) | -0.10% |

| Conditional Value-at-Risk (5%) | -0.20% |

| Upside Capture Ratio (%) | 4.81 |

| Downside Capture Ratio (%) | -1.13 |

| Safe Withdrawal Rate | 10.85% |

| Perpetual Withdrawal Rate | 0.00% |

| Positive Periods | 96 out of 115 (83.48%) |

| Gain/Loss Ratio | 1.98 |

(Source: Portfolio Visualizer)

For any saver or risk-adverse investor, the positive period calculation metric shows cleanly how many months had positive returns. 96 out of 115 months since 2009 have been positive. The max drawdown or most you could have lost with this fund at any given time was only -.55%. When taking any type of risk of owning a security, this is at the very bottom of risky funds to own. One more calculation I would like to highlight is the beta. The beta or price movement of this security to the overall market stands at .01. MINT will move only 1% of the time compared to the S&P 500. Pretty impressive when trying to build a portfolio of non-correlated assets together.

Recent Performance & Looking Forward

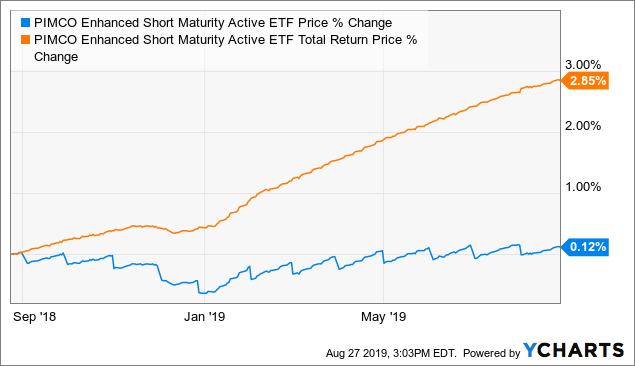

If you are wondering about last year’s performance, just take a look at this visual by YCharts that shows the total return from left to right:

Data by YCharts

Data by YChartsFinancial professionals admire and want upward-sloping return graphs like these ones. You don’t see much price volatility or performance drops over the past year at all. When looking forward to MINT in the upcoming year, I would like to believe that the return graphs will look similar. The 30-Day SEC yield has dropped 20 basis points due to the Fed lowering the discount rate 25 basis points. Even with that lowering of rates, MINT still owns short-term notes that are mostly all yielding more than 2%. This could change, but the portfolio management team looks to be doing a solid job on staying on top of the current yield it’s making for the risk they are taking.

MINT Summary

If you are like me and always want a fund to own as a cash alternative or recession hide out, MINT fits the bill. With over $12 billion in assets, other investors must see the advantages like I do. Instead of making 20 basis points in cash accounts, try out MINT’s annual dividend of over 240 basis points which is paid monthly. The fund has no lock ups or large commissions to worry about as well. So many retail investors still buy bond mutual funds with large sales loads up front which takes at least a year to make back. With MINT from PIMCO, you don’t have to worry about that. You pay them 40 basis points a year, and they will take it from there. Trust some of your savings to MINT and not large commissioned mutual funds or CDs that lock up your cash.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in MINT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Ortner Capital consults clients who own securities like MINT. These are opinions of Mr. Josh Ortner, CTFA, and should not be construed as personal financial advice tailored to your personal situation.

[ad_2]

Source link Google News