[ad_1]

Background

The Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR) is trading at $31.87, right around recent highs of $32 on renewed optimism of trade talks with China.

The fund currently holds 19 companies that primarily engage in real estate related businesses that operate within the Data Centers, Wireless Towers, and Fiber Optic Networks business segments.

This makes SRVR attractive, as these three areas have and will likely continue to experience large tailwinds from technological innovation, including Big Data, AI, and 5G/IoT.

The Global Big Data market is expected to grow to $118.52 billion by 2022, representing a CAGR of 26% from $23.56 billion in 2015. One of the main predicted drivers of this growth is the big data analytics space, as companies across industries are increasingly turning to mining massive amounts of data to gain insights into their business and customers.

The Global AI market is expected to grow at an even faster rate, from a mere $9.5 billion in 2018 to $118.6 billion in 2025, for a CAGR of over 43%. The areas expected to drive this growth are NLP (natural language processing), robotic process automation, and machine learning. Whether its companies in the financial sector using AI to detect suspicious or fraudulent behavior to healthcare companies using it to better treat and predict diseases, the rise of AI transcends all sectors and will continue to be relied upon increasingly as AI capabilities advance.

While both of these segments will likely continue to drive growth for the companies that constitute SRVR, the most lucrative opportunity lies in the ongoing implementation of 5G/IoT.

It is predicted that there will be 20.4 billion IoT devices by the end of 2020, with Business Insider predicting over 64 billion devices by 2025.

Companies as a whole are predicted to spend up to $15 Trillion in IoT by 2025, as the data provided by the interconnection of IoT products becomes increasingly valuable.

This benefits all three segments of companies SRVR holds stock in, as Wireless Towers, Fiber Optic Networks, and Data Centers are all likely to share in the growth driven by the technological revolution.

This is true for data centers in particular, as 90% of the predicted 800 zettabytes data expected to be generated by IoT devices is unstructured, creating a massive need for storage.

Holdings and Performance

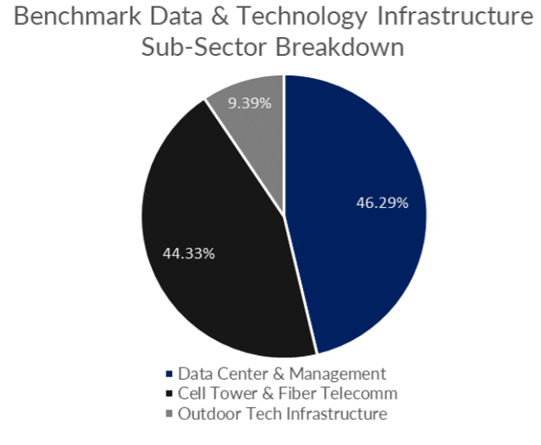

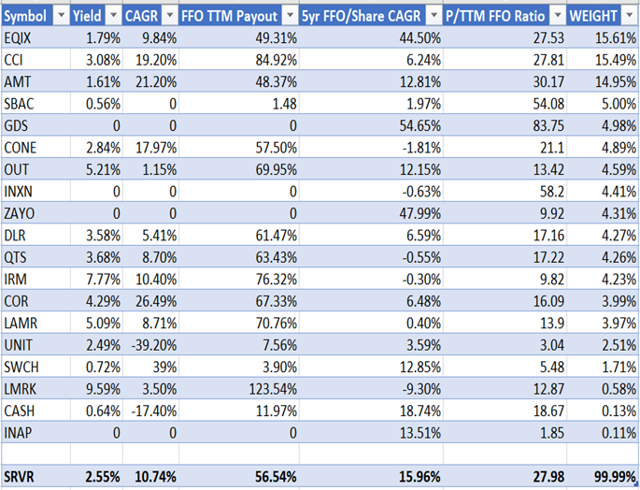

Source: Benchmark Investor Presentation

The graphic above shows the breakdown of holdings by industry, with 46.29% of companies in the Data Center & Management business segment and 44.33% divided between Cell Tower and Fiber Telecom companies.

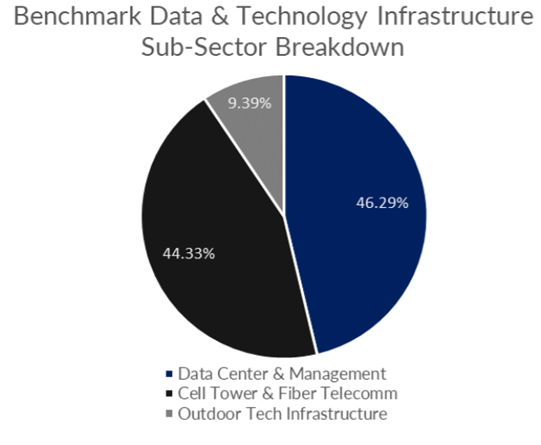

Data Source: Companies Financial Statements

The table above shows the yield, dividend CAGR, TTM FFO payout ratio, 5-year FFO/Share CAGR, P/TTM FFO ratio, and weight of each holding, respectively. Since the fund is market-cap weighted, slightly over 45% of the fund consists of three positions; Equinix Inc (EQIX), Crown Castle International Corp (CCI) and American Tower Corp (AMT).

Overall, the funds yield equates to 2.55%, with a CAGR of 10.74% and payout ratio of 56.54%. The five-year FFO/share CAGR for the companies in the fund is 15.96%, showing the strength of the industry as a whole.

The P/TTM FFO ratio is also reasonable at 27.98, especially given the high level of FFO growth.

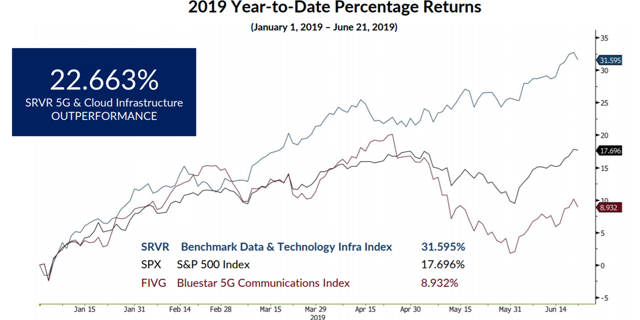

Source: Investor Presentation

Performance for SRVR through June was strong at 31.59%, significantly higher than the S&P’s return of 17.70% during the same time period.

As of today, the total YTD return for SRVR has been 38.8%, from $23.04 to $31.98. Compared to the S&P’s performance of 14.68% during the same time period, this outperformance is remarkable.

Source: Yahoo Finance

When comparing the charts of the SRVR ETF to the S&P 500 tracking ETF SPY, the outperformance comes primarily in times when the SP500 has experienced the most significant sell-offs. This is one of the reasons why the Data Center industry is particularly attractive; it shares much of the growth of the Technology Sector while being somewhat insulated from the recent volatility of the sector. While the tenants of Data Centers have been directly affected by the impact of tariffs, the Data Centers themselves are not. Data Centers tenants often consist of the largest technology companies in the world, who’s need for data storage won’t change even in the face of a global slowdown. With no resolution to the current trade issues with China, it is likely that SRVR will continue outperforming the SP500 for the foreseeable future.

Conclusion

AI, 5G/IoT, and Big Data are predicted to experience rapid growth over the next five years. This has and will continue to drive demand for companies that provide Data Centers, as well as Cell Towers and Fiber Optic telecom services.

SRVR holds 19 positions of companies in these segments, allowing investors to benefit from broad exposure to some of the fastest growing segments in the economy.

While the ETF has significantly outperformed the SP500 YTD, strong FFO/share growth and a reasonable valuation of the companies that make up SRVR will likely lead to continued outperformance for the foreseeable future in the face of uncertain economic conditions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News