[ad_1]

It’s two months ago since I wrote my most recent homebuilding article. I did not write anything in July as nothing had changed significantly until now. In this article, I will once again highlight the major resistance homebuilders are facing and tell you what the current recovery of building permits means going forward. It’s getting interesting, and homebuilders are poised to make a big move.

Source: BONE Structure

Two Words: Watch Rates

In this article, I will change things a bit. For example, I am going to start with technical analysis. Below, you see the weekly chart of the iShares US Homebuilding ETF (ITB). I always build my homebuilding articles around this ETF as this is a way to monitor the ‘entire’ homebuilding industry.

Over the past few months, I have often talked about major resistance. As a matter of fact, homebuilders have not gone anywhere since the start of June. The entire year-to-date performance of 29% has been generated in the first five months of this year after homebuilders got slaughtered in the last quarter of 2018.

Source: FINVIZ

Source: FINVIZ

One might think what has happened between the first trading day of this year and the start of June that caused homebuilders to outperform the S&P 500 by 100%.

The number one reason why homebuilders are up this much is the fact that they got slaughtered in 2018 and tend to deliver a lot of alpha during uptrends. Those are just statistical facts and nothing based on fundamentals. Fundamentally, a lot of the rally is due to the massive decline of rates.

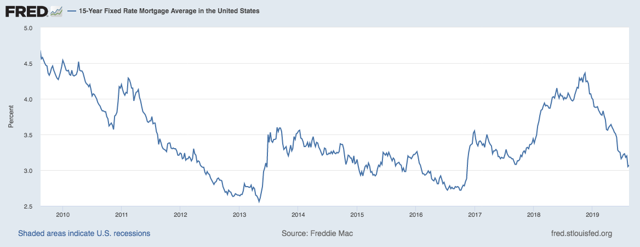

The average 15-year fixed mortgage rate has declined from 4.3% in Q4 of 2018 to currently just a few basis points above 3% as the most recent rates ‘crash’ has erased almost the entire post-2017 uptrend. As a comparison, the US 10-year government bond yield has declined from 3.3% to 1.5% during the same period.

Traders bought homebuilders to bet on an overall healthier housing market where homeowners refinance their mortgages, and new building projects are being boosted by the chance to finally lock in low rates after a steep rate increase in both 2017 and the first 3 quarters of 2018.

Traders bought homebuilders to bet on an overall healthier housing market where homeowners refinance their mortgages, and new building projects are being boosted by the chance to finally lock in low rates after a steep rate increase in both 2017 and the first 3 quarters of 2018.

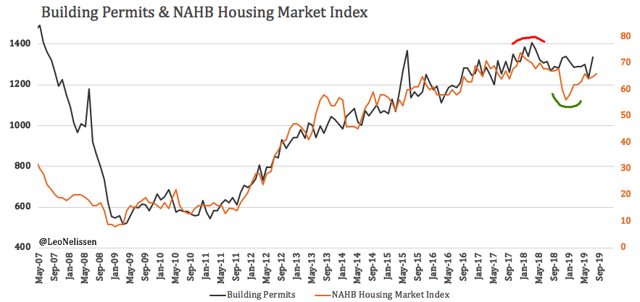

The NAHB housing market index which monitors single-family housing sentiment has improved from 56 in December of 2018 to currently 66. This shows that the situation has indeed improved a bit even though NAHB sentiment is still down on a year-on-year basis. The move from 65 to 66 in August still marks the 10th consecutive year-on-year contraction even though the growth rates have inched up to just -1.5%.

So yes, without a doubt, we are seeing some signs of improvement. And this is confirmed by builders like PulteGroup (PHM) which confirms that a lot of the recent strength is coming from first-time buyers and homeowners who move up (article). Active adult orders were still down 7% in the second quarter. PulteGroup is obviously just one of many builders, but it makes sense as active adults are not the ones to quickly react to changing mortgage rates.

So yes, without a doubt, we are seeing some signs of improvement. And this is confirmed by builders like PulteGroup (PHM) which confirms that a lot of the recent strength is coming from first-time buyers and homeowners who move up (article). Active adult orders were still down 7% in the second quarter. PulteGroup is obviously just one of many builders, but it makes sense as active adults are not the ones to quickly react to changing mortgage rates.

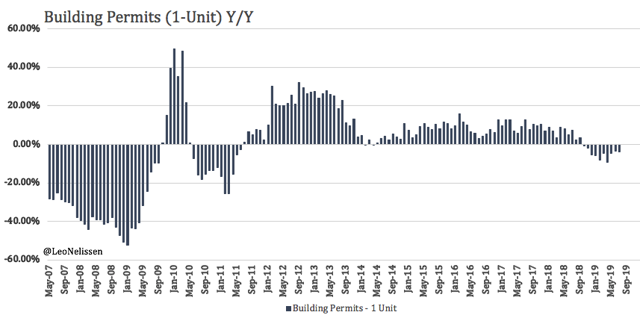

They might be right as building permits are just now showing signs of strength. In other words, even though NAHB sentiment has been in an uptrend since the start of the year, we are just now seeing positive building permits news. Building permits were up 1.5% in July as you can see in the graph above. Unfortunately, 1-unit housing was down 3.8%, which makes it 30 basis points worse than the 3.5% decline in June.

In other words, as I have said before: the situation continues to be extremely fragile. One should also not forget that the entire economy continues to be in a downtrend as I discussed in this article (and many more). As general economic growth is down, it makes even more sense to suggest that the biggest part of the homebuilding rally was provided by lower bond yields.

In other words, as I have said before: the situation continues to be extremely fragile. One should also not forget that the entire economy continues to be in a downtrend as I discussed in this article (and many more). As general economic growth is down, it makes even more sense to suggest that the biggest part of the homebuilding rally was provided by lower bond yields.

And, let’s be honest, we were not just dealing with a yield downtrend. What we witnessed was one of the biggest bond rallies since the recession. Entire yield curves in Europe went negative and traders bought everything related to lower yields.

The graph below shows the boost homebuilders got from falling yields. Note that I inverted the 10-year yield.

Source: TradingView

Source: TradingView

So, even though I have been bullish on bonds and bearish on economic growth, since 2018, I did not buy homebuilders. I was and still am on the sidelines to buy once serious fundamental strength returns.

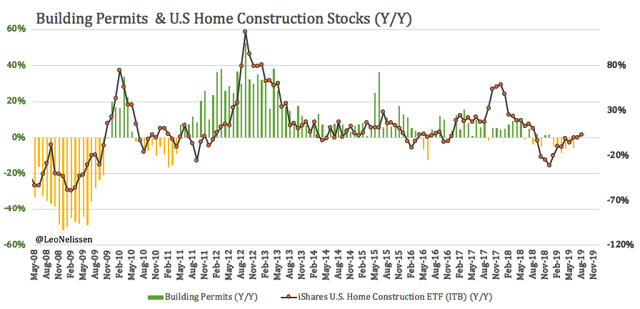

One of the reasons why I am writing this article is the graph below. The year-on-year return of the ITB ETF is highly correlated to the year-on-year performance of building permits (leading indicator). That said, at this point, homebuilders have priced in very slow growth, which gives ITB a fair price at this point. Unfortunately, the year-on-year performance increases to 25% going into the last months of this year. This is simply based on the fact that stocks were much lower in the second half of 2018. So, if ITB remains at current prices, we are seeing that building permits need to rise more than 10% to justify the homebuilding rally.

This means that we have two options that will likely happen in the second half of this year.

This means that we have two options that will likely happen in the second half of this year.

Either…

- … building permits (housing in general) start to gain a lot of momentum

or…

- … homebuilding stocks start to fall again to further justify very slow housing growth

Based on everything so far, we once again see that it is fully justified that ITB is having a lot of trouble breaking its major resistance around $40. Traders have started to pull back as bond yields are currently the number one reason to own homebuilders while building permits and sentiment continue to be very slow. What we need for a second major rally is confirmation that economic growth is picking up indeed. Without the support from building permits, we will not get an extended homebuilding rally. It’s just not happening with economic growth being in a downtrend and 1-unit building permits still being well below the neutral 0% growth line.

I will continue to stay on the sidelines and look forward to the next few months. Times are already interesting and poised to become even more intense as we are at a resistance that is increasingly turning into a make-or-break battle between the hopes of higher housing demand and the real economy.

On a side note, a different reason why I am not short is because I expect homebuilding stocks to rally once they break $40. This could be fundamentally justified once building permits eventually recover or because yields continue to plunge even more.

Let’s see what happens!

Thank you very much for reading my article. Feel free to click on the “Like” button and don’t forget to share your opinion in the comment section down below!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

[ad_2]

Source link Google News