[ad_1]

The iShares U.S. Aerospace & Defense ETF (NYSE:ITA) is an industry specific exchange-traded fund offering exposure to companies that manufacture commercial and military aircraft, along with related defense equipment and services. The fund has an inception date of May 2006 with current total assets under management of $5.2 billion. This year some of the major developments include a pickup in M&A activity along with the headline making Boeing Company (BA) 737 Max aircraft disasters leading to the unprecedented fleet grounding. Overall, industry earnings have been strong with companies continuing to benefit from growth tailwinds. This article highlights the performance and valuation metrics of the underlying holdings in ITA including themes and trends defining the industry.

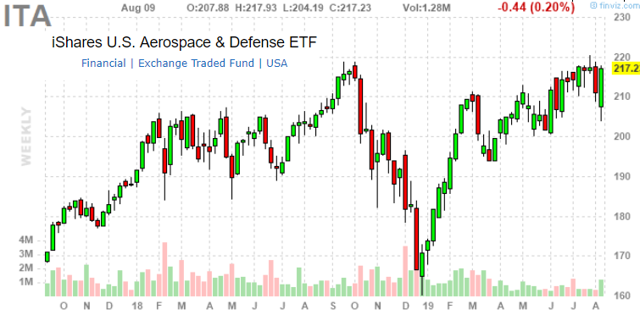

ITA stock price chart. Source: FinViz.com

ITA stock price chart. Source: FinViz.com

ITA Background and Performance

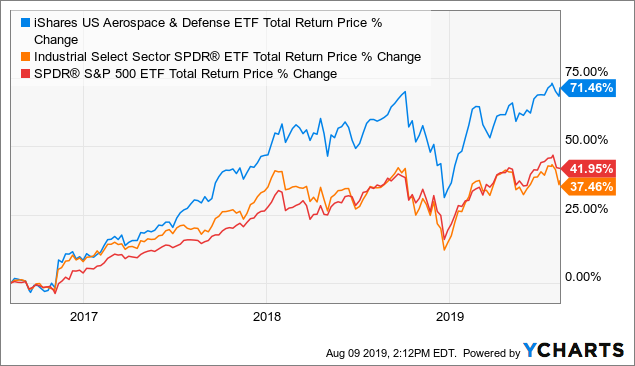

Returns have been impressive with ITA up 26% year to date, outperforming the S&P 500 (SPY) and the broader Industrial Select Sector SPDR ETF (XLI) as a comparison. Technically, aerospace and defense is a sub-sector or industry within the more general industrial group. We note that ITA has outperformed SPY and XLI rather convincingly over the past decade across different periods.

| Cumulative Total Returns – includes reinvested dividends (%) | |||||

| YTD | 1YR | 3YR | 5YR | 10YR | |

| ITA | 26.2 | 7.5 | 71.5 | 119.7 | 459.0 |

| XLI |

18.5 |

1.3 | 37.3 | 60.3 | 269.1 |

| SPY | 17.9 | 4.3 | 41.8 | 66.8 | 252.5 |

Performance data. Source: YCharts

ITA is up 71.5% over the past three years compared to 42% for SPY and 37.5% for XLI. The fund with 33 equity holdings has benefited to the upside from both its concentration within the ongoing bull market and otherwise a selection of strong companies that have grown from specific factors. Annual growth of global air travel at an annual rate around 7% over the past decade is just one data point that highlights the market for aircraft exceeds underlying economic growth. Increased defense spending from government globally, and strong financial profile from end user markets are also fundamental drivers. There is also some crossover among constituents of ITA that could also fall into the technology sector, like L3Harris Technologies Inc. (LHX) and Teledyne Technologies Inc. (TDY) together represent 12% of the fund. Indeed, systems digitization and a move towards automation are trends in the industry.

Data by YCharts

Data by YChartsITA Underlying Holdings

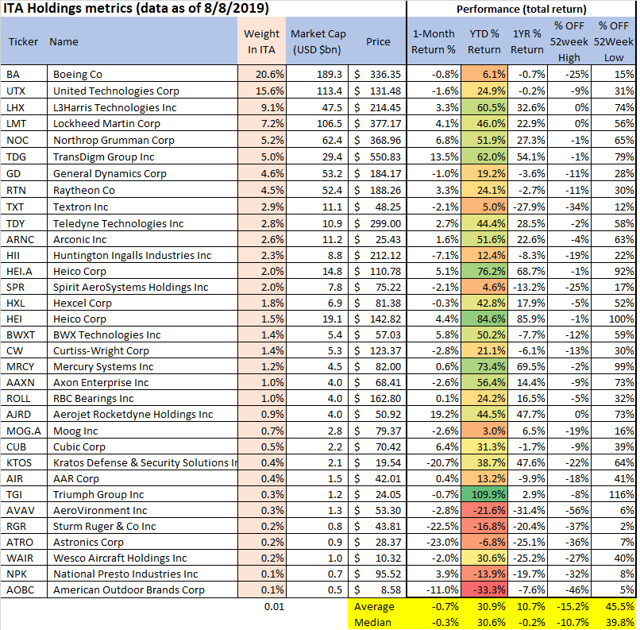

ITA underlying holdings performance. Source: data by YCharts/author table

The Boeing Company is the largest holding in ITA with a 20.6% weighting. Considering the ongoing investigation regarding two deadly crashes involving its 737 Max aircraft over the past, it’s almost incredible the stock is still up 6% in 2019. The headlines of course have led to significant volatility as the stock has declined by 25% from its highs.

The aircraft model is grounded and banned from flying in various countries worldwide pending regulatory approval of any fix. The company continues to produce new units but at a curtailed pace. The impact stretches to various component suppliers in the industry.

Reports suggest the issue is with the fight control software (MCAS), and Boeing is attempting to produce a solution possibly by installing a second redundancy flight computer as a safety measure. Any such fix will need to pass testing and before a final approval. The expectation is that the grounding of Boeing’s 737 MAX aircraft will drag out through at least the first half of 2020. The issue here is that BA’s performance has largely dragged ITA lower and there is a lot of uncertainty in the process.

The other major development in recent months has been the planned merger between United Technologies Corp. (UTX) and Raytheon Co. (RTN) reported back in June. Management sees “Significant near- and long-term benefits expected from uniting complementary portfolios of platform-agnostic capabilities, resulting in more than $1 billion of gross annual cost synergies by year four, as well as new revenue opportunities from combined technology”.

There has been some push back to the deal among vocal shareholders including Bill Ackman from Pershing Square which is now reported to have exited its stake in UTX. While President Trump initially gave mixed signals on the deal, the current expectation is that it gets approved in early 2020 to create a new company called “Raytheon Technologies”. Both stocks are up about 25% year to date.

Triumph Group Inc. (TGI), an aircraft component and systems manufacturer representing just 0.3% of the fund, is the best performing stock year to date in ITA, up 110%. Other notable winners include HEICO Corp. (HEI)(HEI.A), up 85% and 76% across share classes, and Northrop Grumman Corp. (NOC), up 52%.

The biggest losers this year have been concentrated among the smallest companies and subsequently the smallest holdings. Coincidentally, out of the 33 equity holdings, only six have negative returns for the year and 6 of which are within the bottom 7 holdings of the fund. Firearm brands including Sturm Ruger & Co. Inc. (NYSE:RGR) and American Outdoor Brands Corp. (AOBC) are each down this year related to weak gun sales nationwide. RGR recently reported Q2 earnings, with management noting that weak sales trends in the industry resulted in a 25% y/y drop in revenues this quarter. While only a small part of the ITA ETF, the two firearm small caps are worth watching through the election cycle that is likely to bring calls for further restrictions on gun ownership especially following the recent headline-making mass shootings. This could create interesting trading opportunities.

ITA Valuations

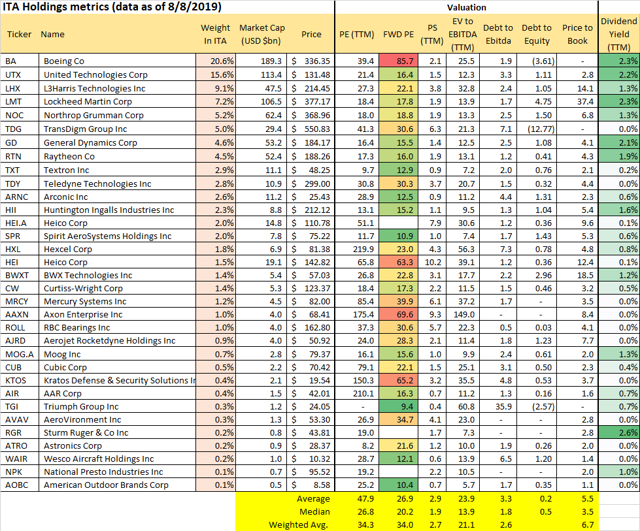

ITA underlying holdings valuations. Source: data by YCharts/author table

Taking a look at valuation metrics among the constituents, the ratios here are otherwise reasonable. We calculate a median average price to earnings ratio of 20.2x, and if you look at the top half of the table (with the exception of Boeing), there are plenty of stocks trading in the teens of forward P/E.

One of the dynamics we observe in the entire market is the difficulty in finding true value stocks. Essentially, if a stock appears cheap, there is likely a concerning underlying issue. That’s the case here with Spirit AeroSystems Holdings Inc. (SPR) which at face value appears to be something of a bargain within the group with a forward P/E of 10.9x and trading at just 7.4x EV to EBITDA. Buyer beware, however, as SPR is coincidentally a major supplier to Boeing’s 737 Max which has dampened sentiment on the stock while production on the aircraft by BA has been cut amid the ongoing investigation. The stock is down about 25% from its highs in March prior to the scandals unfolding.

Textron Inc. (TXT) is another case where the stock looks cheap trading at just 9.7x last year earnings, although the issue here is declining growth. The Q2 revenues just announced declined 14% from last year and now represent 4 consecutive quarters in contraction. The manufacturer of small aircraft and helicopters, including the well-known Cessna, Beechcraft, and Bell brands, among a military aircraft portfolio, has just lost sales momentum over the past year. Favorably, reports have emerged of the company exploring strategic options to potentially divest some non-core units like fuel tanks. Will be interesting to see how this one plays out.

At the other end of the scale, Axon Enterprise (AAXN) is the quintessential growth stock of the group trading at 70x forward earnings and 9.3x sales. Revenue growth has averaged about 25% per year since 2016, although moderating towards the high teens this year. The company manufactures police officer wearable cameras which has been a growth driver for the company with ambitions of a global expansion. There’s a lot of optimism in the company as it trades near its all-time high and up 56% year to date.

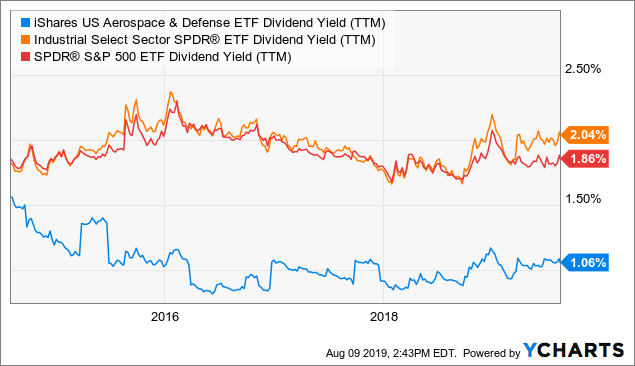

We highlight that 22 of the 33 stocks pay a dividend while the yield for the fund is currently 1.1%, reflecting small payouts particularly from the smaller stocks in the group. As a valuation indicator, we note that the dividend yield for ITA has averaged right around 1% over the past 4 years. For context, the dividend yields of XLI and SPY are both higher, 2% and 1.9% each, respectively.

Data by YCharts

Data by YChartsForward Looking Commentary

ITA and the industry have largely been bullet-proof in recent years with continued strength evident by its outperformance to the market. We are more cautious going forward recognizing the more concerning global macro dynamics and emerging signs cyclical weakness worldwide. Within the fund, we tend to favor the less cyclical stocks.

Given the size of BA in the fund, investors should closely monitor developments of the ongoing 737 Max investigation. We think the approval process has the potential to drag out longer than currently expected as regulators will likely want to be 120% sure of the safety to avoid not only another disaster but to also counter reputational harm as questions regarding the original certification process remains. It will likely take time for various governmental organizations around the world to follow any decision from the NTSB in the United States.

We are neutral on ITA with a “hold” rating, recognizing the quality of the leading companies and reasonable valuations balanced by our macro concerns. We hope the data presented above is useful for further research. Leave a comment on which stocks might be good long or short picks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News