[ad_1]

The Global X Silver Miners ETF (NYSE:SIL) is a collection of the most important mining companies with significant exposure to silver, although many also produce other precious metals. The exchange-traded fund with over $325 million in assets under management has an expense ratio of 0.65%, which is comparable to other industry-focused equity ETFs. SIL offers investors exposure to companies that are typically leveraged to the spot commodity price of silver, along with themes in broader industrial mining. The ETF should outperform silver to the upside but has higher risk overall. Indeed, SIL is up 28% from its 52-week low set in late May, while the iShares Silver Trust ETF (NYSE:SLV) is up a smaller 13% over the same period. This article highlights the bullish case for silver and silver miners.

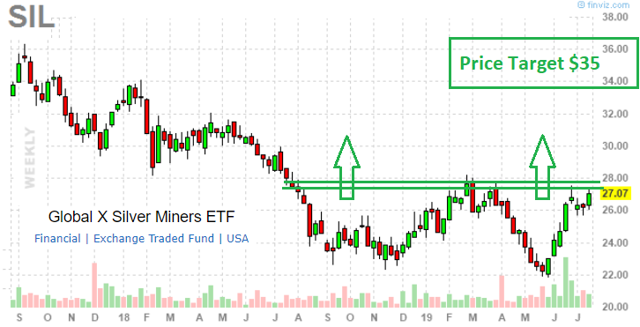

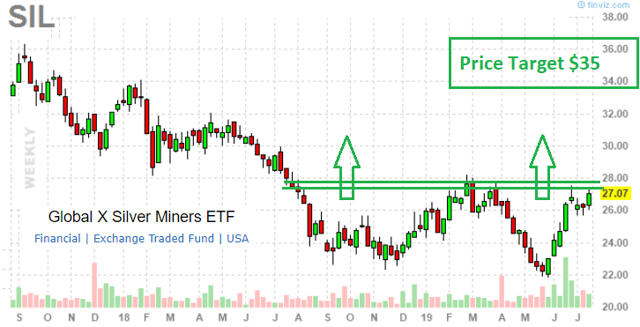

SIL ETF price chart. Source: FinViz.com

SIL Investment Thesis

What’s interesting here is that we believe there is a strong case for silver at the current juncture regardless of the next move in the broader equity market. With the Fed committed to a rate cut in the upcoming July 31st meeting and the market pricing in with near certainty of this occurring, we believe the environment is supportive to a weaker dollar and positive sentiment toward precious metals in general. Looking ahead to the rest of the year, two scenarios may play out.

- Global economy undergoes a “renaissance” of growth with improving trade sentiment driven by an acceleration of the Chinese economy. This set-up would likely be positive to the commodity complex demand drivers and may pressure inflation expectations which is also favorable to gold and silver. To be clear, this is not our base-case assumption, but the point is that it represents a position that some ‘equity market’ bulls envision and would still drive the next leg higher for silver.

- A more bearish view on equities and global growth overall can also support silver prices under the expectation that economic and trade conditions deteriorate despite the upcoming rate cut. Central Banks around the world would likely embark on more aggressive quantitative easing, driving interest rates lower and silver would benefit as a higher beta trade to gold’s flight to safety. This is the scenario we see playing out over the next year and would be expressed in a market rotation out of crowded cyclical equity trades into gold and silver hard money. An offshoot of this theory is that the Fed aggressively cutting rates over the next year to support growth could misfire and lead to a high inflation, low growth ‘stagflation’ type of environment in the U.S. and may actually be the most bullish for silver.

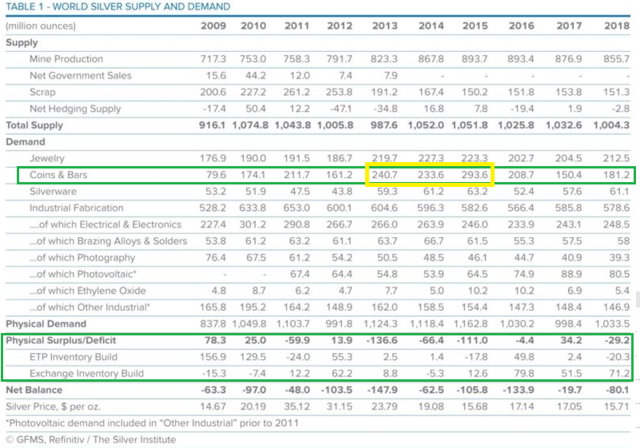

The other consideration is that a current slight supply deficit of physical silver in the market may widen, driven by a return of ‘coin & bars’ investors. According to the Silver Institute, this category represented 17.5% of total physical demand in 2018 but was as high as 25% in 2015. We see this latest momentum in the silver market prices over the past month as preceding a new wave of ‘investment coin & bars’ buyers that typically follow the market higher. It may take a few months from here for the data to reflect this renewed dynamic.

In some respects, higher prices have driven enthusiasm and demand over the past decade in these products. We see coin and bars investment demand approaching 250 million ounces in 2020, representing the average amount between 2013 and 2015, but more importantly a ~40% increase compared to 2018 levels. If confirmed, this would drive the silver market supply deficit to approach the highest level since 2013. Investors can also expect exchange traded products to drive physical demand growth going forward. Overall, the market fundamentals are bullish beyond the technical breakout.

Silver market supply and demand. Source: SilverInstitute.org

ETF Analysis

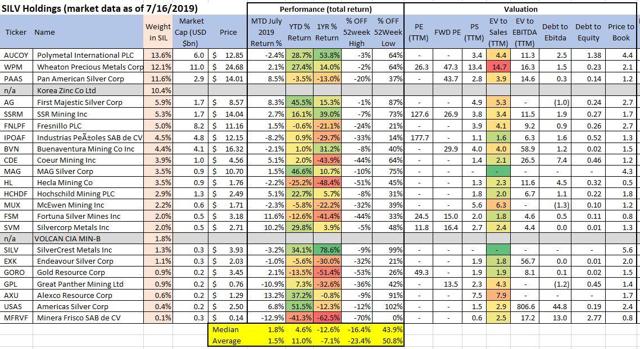

9 of the current 24 miners in the SIL ETF have risen over 20% this year; we see significantly more upside. The average stock is still down 23% from its 52-week high. If indeed silver does continue to build momentum from here as we expect, consider the tide to lift all boats and most of the miners in the group will present annual gains by the year-end.

We like Fortuna Silver Mines (NYSE:FSM) with a market cap of $435 million and representing about 2% of the ETF as our top pick. The company is profitable trading at a forward P/E of 15.0, and its EV/revenues multiple of 1.8x is below the group average. The company just reported Q2 earnings with silver production up 5%, and ahead of previous guidance.

Micro cap Americas Silver Corp. (NYSE:USAS) is the biggest winner, up 51% year; the company has improved its liquidity position with new financing this year and is set to benefit from higher prices. First Majestic Silver (NYSE:AG) with a market cap of $1.6 billion and a 5.9% weighting in SIL is also a big winner – 45.5% year to date. The company reported a 15% increase in production in its last quarter earnings release. The company now commands a premium to the group, trading at 4.9x sales but we view this as a sign of quality.

SIL ETF holdings metrics. Source: data by YCharts/table author

SIL ETF holdings metrics. Source: data by YCharts/table author

Keep in mind that the significant exposure to small- and micro-cap companies representing nearly 35% of the ETF highlights not only the high level of risk but expected volatility going forward. For bullish investors, this simply means that dips will be a buying opportunity.

SIL ETF key stats. source: YCharts.com

Conclusion

At the time of publishing this article, silver prices are approaching the $16.00 spot price per ounce level. Our target here is for the market to move towards $19.00-20.00 by the end of the year, representing 20% upside. Considering the implied leverage of the underlying mining companies in the ETF, SIL may have more upside on percentage terms.

We prefer silver miners here over physical or even the iShares Silver Trust ETF with the expectation of more upside. The miners as a group have struggled in recent years but the higher commodity price will be a positive for the operating environment. The story here will be growing momentum and expect increasing levels of news coverage and investment analysis adding to the bullish sentiment. To the downside, a close below $14.50 per ounce for silver and ~$24 for SIL would require a reassessment of the bullish case. Long Silver, Long SIL.

Disclosure: I am/we are long FSM, SIL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News