It seems like every other week there’s word of another hot IPO. This week we’ll discuss the Postmates IPO .

Sometimes these IPOs fizzle out and don’t fare so well. And sometimes we see those that take off like a rocket ship. That’s one of the reasons that some traders love to focus on IPO plays.

Right now, there are a few big names coming through the IPO pipeline.

Today, I’ll examine an upcoming IPO that has a bit of hype attached to it: Postmates.

People have been writing in and asking me to comment on this one. Let’s dive in.

What Is Postmates?

Postmates is a San Francisco–based tech company in the logistics and deliveries field. They have an app and a network of couriers that allows for the delivery of all kinds of food and goods.

Maybe that sounds a bit like UberEats to you. That’s true, but there’s a big difference in the business models. With Postmates you can order more than food — you can also get things like personal items and groceries.

The fact that you can order more than just food means that Postmates is similar to a high-tech courier service. That’s a massive industry that’s as old as the hills. And it’s an interesting space for a company to be in.

In February, Postmates confidentially filed for an IPO. Then, in April, they announced that they’d expanded into 1,000 new towns and cities. The firm is clearly growing in terms of geography. But we can’t see the sales, profits, and other fundamentals since the company’s IPO filing is confidential.

What we do know is that Postmates ran a round of venture-capital funding last December, and apparently the company was valued at $1.85 billion.

As I write this, there’s no set IPO date, but it would very likely be in the second half of 2019.

Make sure to keep an eye on upcoming news stories so that you can watch how it trades post listing…

Bohen’s Take on the Postmates IPO

Okay, so that’s Postmates in a nutshell. Here’s what I think regarding what can happen at its IPO.

Now, let me preface what I’m about to write by stating that I’m a super bullish guy. And I’m especially bullish IPOs. It’s just my nature…

But I have to tell you, I’m completely skeptical about Postmates’ ability to expand and conquer the delivery market.

When I travel, I get my ride from the airport with Uber… Then, when I want food delivered, I get UberEats. Uber has a clear brand-name recognition that Postmates simply doesn’t.

You might argue that Uber doesn’t handle non-food deliveries, and that’s an interesting point. But, really, with Uber’s infrastructure and know-how, when they decide it’s time to expand into non-food deliveries, Postmates probably won’t be in for a good time…

That’s my opinion on the company. Now, when it comes to trading IPOs (and any stock in general) it really comes down to the price action.

Look up a few recent successful IPOs — Pinterest, Uber, Beyond Meat.

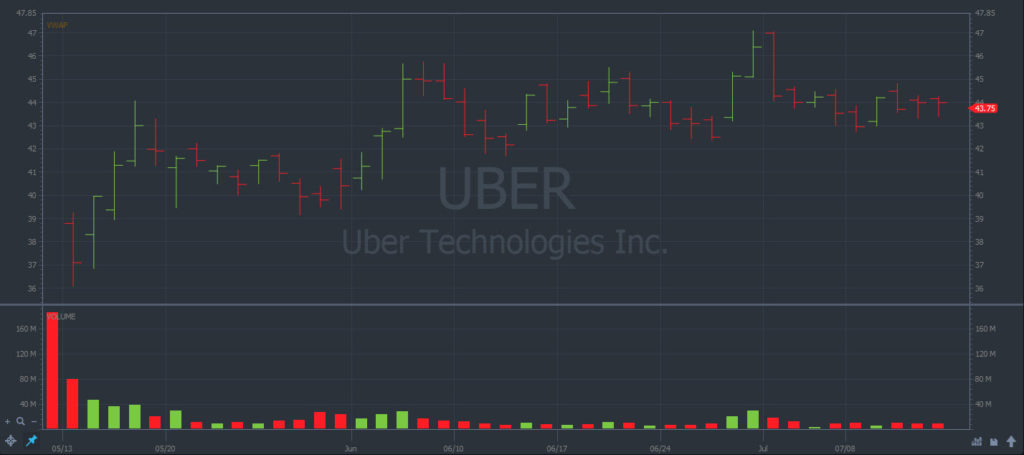

How did they all trade post listing? They spiked straight out of the gate, pulled back in price, then broke the previous highs…

Uber’s (NASDAQ: UBER) post-IPO trading (Source: StocksToTrade)

If Postmates can do something similar, we could see a similar run to these IPOs.

On the flipside, it’s important to remember that with IPOs, the hype really does matter. Pinterest, Uber, and Beyond Meat had crazy hype. Postmates really doesn’t have the same level of publicity, so that’s one mark against it.

Either way, I’ll definitely be watching this stock when it starts trading.

Follow the Latest IPOs with StocksToTrade

The U.S. stock market seems to be in an IPO frenzy lately. Companies big and small are IPOing all over the place — it’s definitely boom time for the U.S.

With any IPO, there’s often a fair amount of hype. And with that hype can often come price movement and most importantly, trading opportunities. That’s why active traders love IPOs.

It’s easy to get into trading IPOs. But to do it well, you should be reading news stories, analyzing charts, and keeping a watchlist of your favorites.

StocksToTrade can help you do all of this. You’ll have access to streamlined charting, unlimited watchlists, and powerful scanning to help you search through news stories and SEC filings.

But it’s not just IPOs. StocksToTrade can help you with all your stock trading needs. It really is a one-stop-shop for traders. Try StocksToTrade for 14 days for just $7 to see it can help you every single trading day.

… TODAY IS THE LAST DAY TO TAKE ADVANTAGE OF OUR 4th of July SALE!

Conclusion

So, there you have it. Postmates doesn’t seem that exciting as a company to a trader like me. Uber and a few other firms seem to have grabbed this space already.

But, it’s important to note that I’m not a research analyst or heavy fundamentals guy. I’m a trader who focuses on stocks that move. If Postmates starts moving heavily after listing, I’ll be watching the chart and ready to trade it. It really doesn’t matter to me if the company’s good or bad.

If you’d like to see how I trade stocks like these, as well as other opportunities I find in the market each day, join me in the StocksToTrade Pro community.

Do you have a stock or upcoming IPO that you’d like me to comment on for the blog? Share your suggestion below and I’ll pick an exciting one!