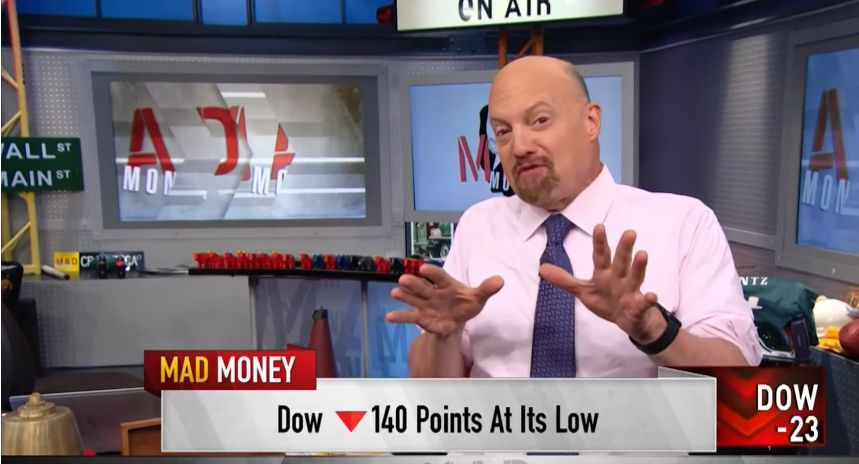

Market maven and CNBC’s “Mad Money” host Jim Cramer says a global economic slowdown is definitely a real threat as evidenced by German chemical manufacturer BASF who may slash its full-year earnings forecast by 30%. The cut comes courtesy of a U.S.-China trade war and its potential ramifications.

“Now we’ve got real concern, real reason to be worried. While the Federal Reserve believes business is strong because we just got a terrific labor report last Friday,” the “Mad Money” host said. “The weak forecast from chemical giant BASF suggests that the global economy might be in rougher shape than that employment number might indicate.”

Where can investors turn? Thus far, it’s been into the technology sector.

“Suddenly, we lost our favorite place to hide in a BASF-highlighted slowdown,” Cramer said. “It flowed into the stocks of tech companies with fast growth that do not need a strong economy to make the numbers. These tech companies are all about making other businesses more productive, either using the cloud or big data or analytics, [and]will do fine in a slowdown.”

Here are three defensive ETFs to consider:

- Invesco S&P 500 Low Volatility ETF (SPLV): SPLV seeks to invest at least 90% of its total assets in common stocks that comprise the Index. The Index is compiled, maintained and calculated by Standard and Poor’s and consists of the 100 stocks from the SP 500 Index with the lowest realized volatility over the past 12 months. Volatility is a statistical measurement of the magnitude of up and down asset price fluctuations over time. The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August and November.

- SPDR S&P 500 ETF (NYSEArca: SPY): SPY seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500 Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index, with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

- iShares Edge MSCI Minimum Volatility USA ETF (USMV): USMV seeks the investment results of the MSCI USA Minimum Volatility (USD) Index. The fund will invest at least 90% of its assets in the component securities of the index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents. The index measures the performance of large and mid-capitalization equity securities listed on stock exchanges in the U.S. that, in the aggregate, have lower volatility relative to the broader U.S. equity market.

For more market trends, visit ETF Trends.