[ad_1]

After writing a recent article here on Seeking Alpha about the S&P 500 high dividend low volatility index, a subscriber asked me to write about the SPDR® Portfolio S&P 500® High Dividend ETF (SPYD). Not knowing about the fund at the time, I did what any other good fund manager would do. I went ahead and ran the performance numbers, risk metrics, and compared it to other similar ETFs. SPYD is one of the low cost core SPDR Portfolio ETFs, a suite of portfolio building blocks designed to provide broad, diversified exposure to core asset classes. This fund is designed to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® 500 High Dividend Index. For those who are saving for retirement or currently in retirement, this can be a great addition to your overall equity portfolio.

SPYD Return Breakdown

Data by YCharts

Data by YChartsOne mistake I often see investors make when researching an investment fund is they find a chart of just the price. What you have to remember when running the performance numbers is to look at total return. This will include dividends paid out to you that often doesn’t reflect in the price charts. Since late 2015 when the fund was launched, SPYD has returned roughly 25.97% in capital appreciation, and 23.19% in dividends. Half of the equity returns is credited to appreciation, while the other half is credited to dividend income. This is a great illustration on how investors should look at investing.

SEC 30-day yield of 4.64%

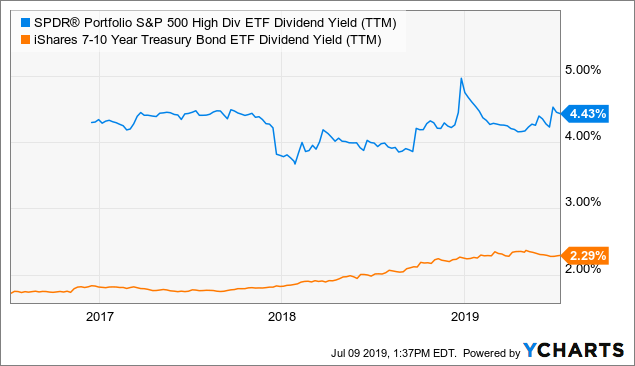

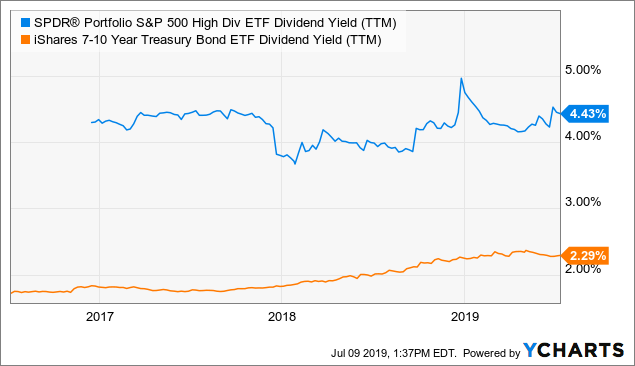

One of the biggest draws to this fund is clearly the 30-day SEC yield of 4.64%. Another focus right now for investors is to compare the yield of this dividend fund to that of the 10-year treasury note (IEF). If you can make 4.64% in dividends per year from this dividend fund, why would you lock your money up for ten years at 2.29%?

Data by YCharts

Data by YChartsFor short-term investors who think equities are overbought, then it wouldn’t make sense to purchase shares of SPYD right this second. However, if you are like me and a longer-term thinker, it might make sense to continuously dollar-cost average that income into an ETF that pays 2x what the 10-year note is paying.

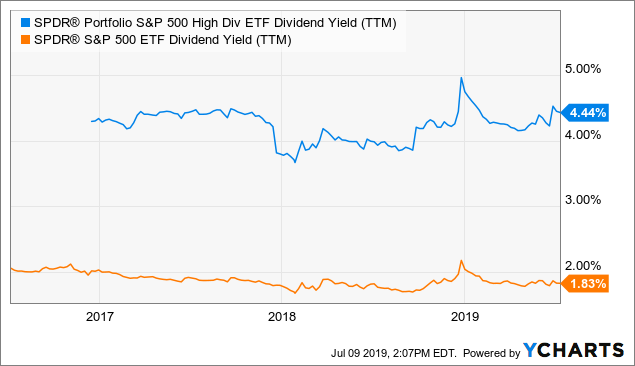

Let’s take a look at one more chart here below:

Data by YCharts

Data by YChartsThis chart does a great job of comparing what you can yield with SPYD vs. the SPY. The current yield of SPYD is 261 basis points more than that of the S&P 500. Another key point to take in when thinking about where you should allocate your equity capital.

Top 10 Sector Holdings

Looking at the holdings below of the SPYD, one can see that real estate is by far the favorite with a 21.39% weight.

| Real Estate 21.39% |

| Consumer Discretionary 14.22% |

| Utilities 12.92% |

| Energy 10.75% |

| Information Technology 10.04% |

| Financials 10.03% |

| Consumer Staples 8.14% |

| Communication Services 4.64% |

| Materials 3.36% |

| Industrials 2.41% |

| Health Care 2.11% |

(Source: SPDR)

The fund is designed to track the performance of the top 80 high dividend-yielding companies within the S&P 500 Index.

SPYD Risk Metrics

Taking a look at the risk metrics of SPYD, the fund is very similar to that of the S&P 500 (SPY), yet, the investor can make double the dividend yield while taking on this similar risk. Either way, investors have to be prudent and run the risk measurements.

| Metric | SPYD | SPY |

|---|---|---|

| Arithmetic Mean (monthly) | 1.06% | 1.09% |

| Arithmetic Mean (annualized) | 13.50% | 13.92% |

| Geometric Mean (monthly) | 1.01% | 1.03% |

| Geometric Mean (annualized) | 12.75% | 13.12% |

| Volatility (monthly) | 3.38% | 3.49% |

| Volatility (annualized) | 11.71% | 12.09% |

| Downside Deviation (monthly) | 2.02% | 2.26% |

| Max. Drawdown | -8.67% | -13.52% |

| US Market Correlation | 0.87 | 1.00 |

| Beta(*) | 0.81 | 0.96 |

| Alpha (annualized) | 2.21% | 0.65% |

| R2 | 75.55% | 99.29% |

| Sharpe Ratio | 0.99 | 0.99 |

| Sortino Ratio | 1.61 | 1.49 |

| Treynor Ratio (%) | 14.33 | 12.50 |

| Calmar Ratio | 1.07 | 1.04 |

| Active Return | -0.19% | 0.18% |

| Tracking Error | 6.27% | 1.15% |

| Information Ratio | -0.03 | 0.15 |

| Skewness | -0.39 | -0.82 |

| Excess Kurtosis | 1.80 | 1.37 |

| Historical Value-at-Risk (5%) | -6.85% | -6.83% |

| Analytical Value-at-Risk (5%) | -4.50% | -4.65% |

| Conditional Value-at-Risk (5%) | -7.78% | -7.85% |

| Upside Capture Ratio (%) | 81.52 | 98.47 |

| Downside Capture Ratio (%) | 67.05 | 95.88 |

| Safe Withdrawal Rate | 42.42% | 40.12% |

| Perpetual Withdrawal Rate | 10.73% | 11.07% |

| Positive Periods | 31 out of 42 (73.81%) | 34 out of 42 (80.95%) |

| Gain/Loss Ratio | 0.85 | 0.54 |

(Source: Portfolio Visualizer)

The SPYD and SPY have very similar volatility measurements, yet, the SPYD is producing alpha of 2.21% annually. If you own a passive equity portfolio, the SPYD is a no-brainer to look at vs. the typical market cap-weighted index fund. The main key point to takeaway from the risk measurements is if you are taking very similar risks to that of SPY, why not earn 2x the dividend yield?

In Conclusion

As equity markets continue to increase in value and hit new highs, it’s pivotal the investor becomes more active in finding funds that might be cheaper to the overall markets. With the SPYD multiple at 17x earnings, the ETF investor can be more selective in owning areas of the market that might be cheaper. With $1.4 billion in assets, it’s easy to see why this ETF is popular. What makes this fund easy to follow is the high 4.64% dividend, while being diversified with 80 common stocks. You are not buying high-yield bonds or double long funds, but high dividend-paying blue chip stocks. When doing your semi-annual review this quarter, take a second look at SPYD and its 4.64% dividend yield.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SPYD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please consult a certified professional on your own objectives and risk tolerances before making any investment. This article is the opinion of Mr. Josh Ortner, CTFA.

[ad_2]

Source link Google News