[ad_1]

It must be said that June was certainly an interesting month for the markets as the price of essentially everything was up over the month. Most sources in the financial press attributed this to faith that the Federal Reserve would be reversing course on interest rates and will soon begin to drop them. Indeed, the market is currently pricing in a total of around 100 basis points of cuts over the next twelve months. While I have discussed bonds quite a few times as a way to play this, another somewhat overlooked way is precious metals, which also delivered a very solid performance last month. Moreover, there are a lot of reasons to believe that precious metals still have plenty of room to run with silver potentially better than gold in this regard. Perhaps the best way to play this, without purchasing the precious metals themselves, is the Sprott Physical Silver Trust (PSLV).

Why Invest In Silver?

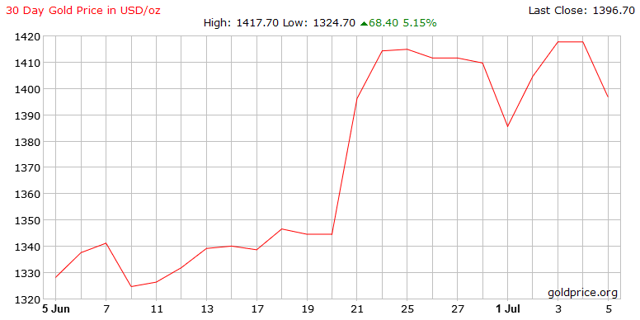

As mentioned in the introduction, precious metals delivered a very solid performance during the month of June. This is very obvious by looking at the chart of gold prices over the period:

Source: Goldprice.org

Source: Goldprice.org

We also see the same thing if we look at the price chart for silver over the same period:

Source: Silverprice.org

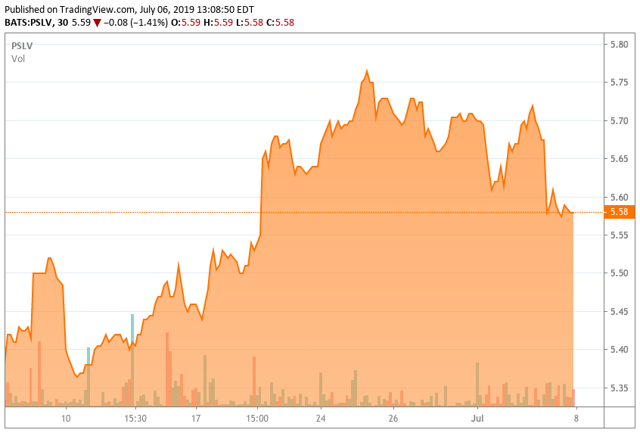

As might be expected then, PSLV, the closed-end fund that I recommended in the introduction as a good way to invest in silver, also delivered very impressive price performance over the month:

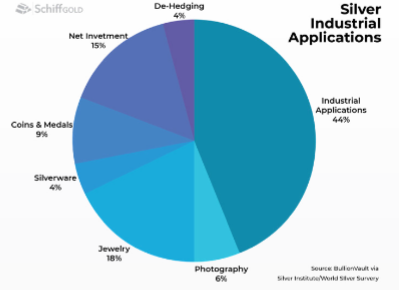

Silver is somewhat unique among the precious metals as it is both a historic store of wealth, much like gold, but it also has numerous uses in industry. While some readers may be quick to point out that this is also true for both platinum and palladium, the truth is that neither of those metals has anything close to the same volume of industrial uses. Silver’s industrial uses largely come about because the metal is the best conductor of electricity that we have on Earth. This results in the metal being used extensively by the electronics industry for the construction of cellular telephones, computers, and other similar electronics. In fact, the volume of metal currently used in industrial applications outstrips its use as an investment metal:

Source: SchiffGold

Source: SchiffGold

In recent years, another use of silver has been causing demand pressure. That comes from silver’s use in the production of photovoltaic cells. As nearly anybody that follows the news knows, there has been an increasing level of concern among the policymakers of various nations about the carbon emissions produced by society’s use of fossil fuels as a source of energy. This has led to a desire to stimulate the production of renewable energy such as from solar power. As I have discussed before, the production of photovoltaic cells requires a great deal of silver. According to Casey Research, it requires approximately 200-300 milligrams of silver to construct a cellular telephone and 750-1,250 milligrams to construct a laptop computer. In contrast, it requires about 20,000 milligrams of silver to construct a photovoltaic cell. Clearly then, we can see how growing demand for solar energy can cause the demand for silver to increase exponentially. As the law of supply and demand tells us, this should have a positive impact on silver prices.

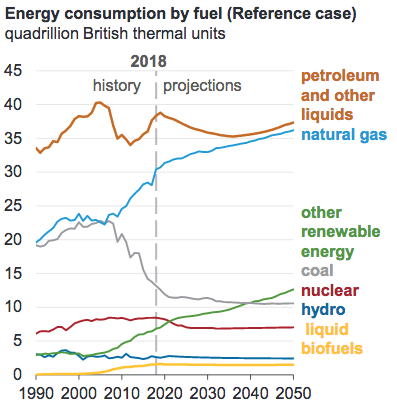

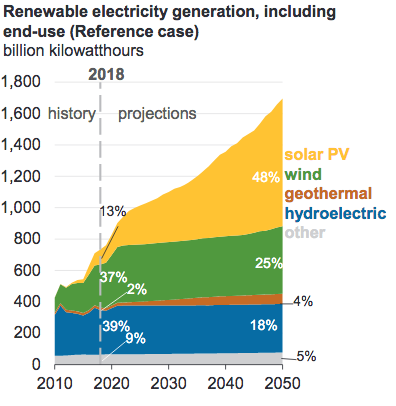

The common belief on many investment forums is that solar energy will become a larger share of the energy mix in both the United States and globally over the coming years, which would strengthen our above thesis for silver. The Energy Information Administration reinforces this belief. As we can see here, the agency projects that only two fuels – renewables and natural gas – will see growing consumption over the next three decades:

Source: Energy Information Administration

Source: Energy Information Administration

Of this growth in renewables, the overwhelming majority will be in solar:

Source: Energy Information Administration

Source: Energy Information Administration

This growth will boost the overall demand for silver in order to manufacture the photovoltaic cells to make this growth in solar possible. This higher demand for silver should have a beneficial effect on the price of silver.

A second reason to be invested in silver is because of its historical use as a store of value. This is a characteristic that it shares with gold and is something that will likely prove to be beneficial to its price over the coming years. This comes from the fact that the Federal Reserve is almost certain to maintain an expansionary monetary policy into perpetuity, which pushes up the price of risk assets and pushes down the value of the dollar. This is something that I have discussed in several previous articles, such as this one.

One reason that we can draw this conclusion is that the federal government requires interest rates to remain relatively low in order to maintain its own solvency. During the month of May, the federal government posted a budget deficit of $208 billion, which was the highest deficit on record for the month of May. More importantly, though, from October 2018 until May 2019, the federal government spent a total of $354 billion just on interest on the national debt, which represents an 11% increase over last year’s levels. This puts the federal government on track to shell out $591 billion in interest during this year, which would represent a new record.

It is important to keep in mind that this is happening during a period of time at which interest rates are still at historically low levels, despite the fact that the Federal Reserve was hiking rates last year. This is also happening during a supposedly strong economy. Thus, we are left with a situation in which the federal government cannot afford even normal rates during a strong economy. Federal spending generally increases during recessions, so when the next recession hits and the budget deficit increases (growing the national debt further), it will be even more difficult to raise rates. As low rates typically expand the money supply, we can easily see that the end result here will be a continuously expanding money supply. This is good for the price of precious metals due to the fact that they cannot be printed out of thin air like fiat currency can.

Earlier in this article, I stated that silver could very easily deliver better forward returns than gold. One reason for this is that silver will benefit from the growing demand for it from industrial sources. Gold does not have the same variety of uses outside of investment. In addition to this, silver is historically underpriced relative to gold. As I, along with other commentators here, have noted, silver has historically traded at around a 16:1 ratio to gold. This roughly reflects the rarity of the two elements as silver is approximately nineteen times more common in the Earth’s crust than gold is. Currently, the ratio is sitting at 93:1, so if silver were to simply regain its historic pricing relative to gold, then it would need to trade at $87.44 given gold’s current price of $1,399. This alone would represent a 483% gain over today’s prices. This potential is in addition to all of the other already discussed price drivers, so we can clearly see how silver appears tremendously underpriced today.

Why This Fund?

I also already mentioned that PSLV is perhaps the best way to play a rising silver price aside from owning the actual precious metal. The reason for this is that unlike other silver funds, shares of PLSV are fully backed by and redeemable for the actual precious metals. Thus, we do not have the uncertainly that the fund does not actually own the precious metals that it claims to have.

This is reinforced by the fact that PSLV holds its silver in a fully allocated account at the Royal Canadian Mint. In contrast, most precious metals ETFs actually hold their metals in an unallocated account. With an allocated account, the account holder holds title to specific individual serialized bars. The custodian is not free to lend out the silver to other parties. With an unallocated account in contrast, the account holder simply holds a claim to a certain amount of silver in the custodian’s vault. In practice, this just means that the silver ETFs are owed a set amount of silver, and like any other loan, there is both default risk and counterparty risk. PSLV does not have this same risk, giving it major advantages over other silver funds.

Conclusion

In conclusion, there are a lot of reasons to add silver to your portfolio as both a store of wealth and as an investment. In fact, silver may be even better than gold in this respect. The Sprott Physical Silver Trust is the best way to play this other than holding the actual physical metals due mostly to the fact that it is the only fund whose shares are backed by and redeemable for the actual precious metals. Overall then, it would certainly be a smart idea to consider investing a portion of your portfolio into the fund.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News