[ad_1]

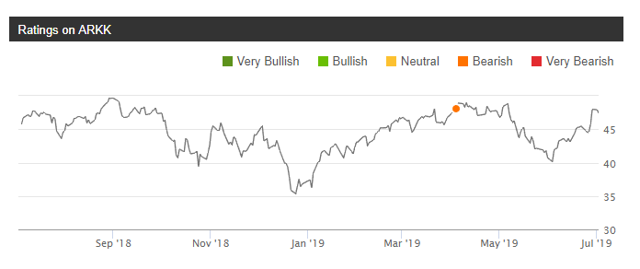

After we warned investors about ARK Innovation ETF’s (NYSEARCA:ARKK) risky holdings, it collapsed nearly 20%, more than double that of the S&P. It has since recovered as the S&P has continued to all-time highs, but we believe this may be another great point to exit ARKK, with a worsening macroeconomic environment likely to dampen growth prospects.

Seeking Alpha

Worsening macroeconomic environment

We don’t claim to be able to predict the movement of the markets, but even we can’t deny that the macroeconomic situation in the US is worsening significantly.

Consumer confidence has dropped dramatically and is the lowest in two years.

The US is also entering into a trade dispute with the EU on top of the trade war with China. Companies are warning that profits may be lower than expected.

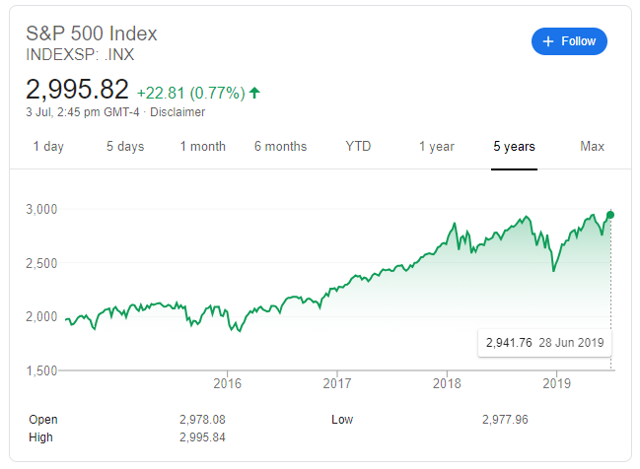

The red flags are waving, but the market doesn’t seem to care. The S&P is at all-time highs, and so are many of the high-flying tech stocks that ARKK owns.

The US economy is also now in the longest economic expansion in history. The question now is not “will the economy grow or shrink?”, but rather “when is the next recession happening?”. With the volatile economic conditions, it’s only a matter of time before we see another correction.

The chink in ARKK’s armour

If we had to use three words to describe ARKK’s holdings, we would describe them as “priced for perfection”. The majority of ARKK’s stocks are profitless and priced for many years of extreme growth. With the economy being this volatile, we wouldn’t bet on that continuing.

The reason ARKK has performed so well is that it sells high and buys low, which has worked out very well for its holdings as investors tend to bid these stocks up after a minor correction. The problem is that even after a correction, these stocks are still extremely expensive. Eventually, ARKK will find itself in a situation where the knife keeps falling even after it makes the position a large part of the fund. This is when its strategy will backfire and it will be forced to liquidate at a lower price.

Take Tesla (NASDAQ:TSLA) for example. ARKK has 10% of its fund in Tesla, and although the price did recover to $240, this is still considered massively overvalued by a large number of people. If Tesla continues to drop, there will be a point in which ARKK will no longer be able to add to Tesla. This is likewise true for ARKK’s other positions.

Although this may seem like it could happen to any stock, it is much more likely to happen to the types of stocks in ARKK’s portfolio, especially since these stocks have no fundamental support. If a profitable business goes down enough, management will initiate a buyback, declare a dividend, or do something about the low stock price. For profitless companies, it is much harder to change the opinion of the market, especially when the company has limited resources.

A collection of red-flag businesses

One of the most interesting aspects about ARKK’s holdings is that they are not only highly valued, but many of the holdings also exhibit one or more red flags, signaling that ARKK is probably so blinded by a particular industry that it ignores serious flaws in order to invest in that industry.

One of the more prominent examples is Square (NYSE:SQ), in which the CFO resigned last year and the auditor resigned in June of this year. SQ is the fifth largest position in ARKK’s portfolio.

2U (NASDAQ:TWOU) is another example. 2U has received a lot of criticism from investors on Seeking Alpha about how it isn’t truly a SaaS company. Even tech investors could see how 2U did not have any operating leverage and was just a glorified for-profit university. But for some reason, ARKK continues to hold onto 2U, both before and after the bubble burst.

Or take Netflix (NASDAQ:NFLX). It has been spending massive amounts on content, yet is facing significant competition from Disney (NYSE:DIS) and other entertainment companies. CNBC recently put out an article noting how Netflix doesn’t even own most of its original content.

These are only three examples of companies in ARKK’s portfolio with major red flags, but there are a lot more of these companies it is holding. Honestly, we think these red flags signify a lack of due diligence on ARK Invest’s part. Maybe ARKK is right on some of these stocks, but we don’t think buying companies with questionable red flags that are trading at a high valuation is a good way to generate long-term alpha.

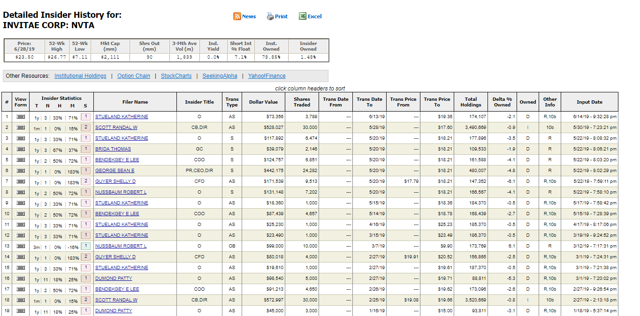

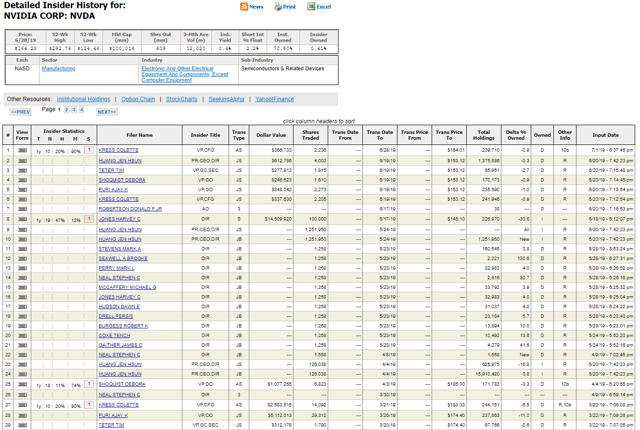

Severe insider selling

Even if the companies don’t have major red flags, most of the companies in ARKK’s portfolio have severe insider selling.

InsiderInsights

Maybe it’s just us, but we doubt insiders would be selling if they really believed that the company could be worth much more. It’s not just insiders trying to benefit from a high stock price either, there is even insider selling for stocks that have corrected.

InsiderInsights

ARKK’s strategy seems like that of a retail investor, chasing the hottest stocks in town, regardless of the overvaluation or flaws in the company, regardless of whether management is truly aligned with shareholders.

In fact, many of ARKK’s stocks are popular with retail investors, with Tesla, Netflix, and Square being some of the most popular stocks on Robintrack. How can you generate long-term alpha buying stocks everyone else loves? We’re not sure.

Takeaway

ARKK is overall an extreme bet that growth investing will be successful. If you believe that fast-growing, money-losing companies with an uncertain future are worth 10x revenues or more, ARKK is probably for you. If you are more skeptical, you may want to skip out on ARKK.

Even if you are an investor in ARKK, we believe this may be a good time to sell, considering worsening macroeconomic fundamentals will likely cause more volatility in the market at some point, which isn’t going to be good for ARKK or its holdings. Either way, there is no reason to own ARKK.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News