[ad_1]

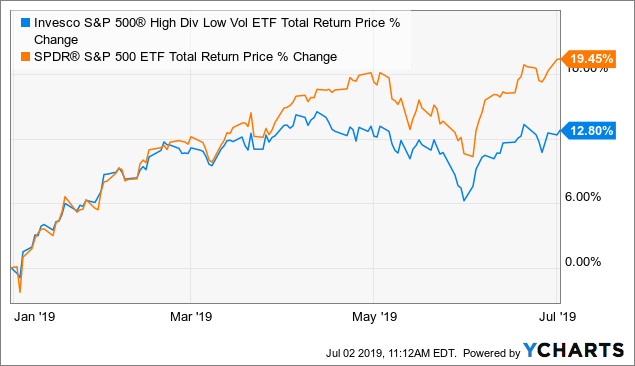

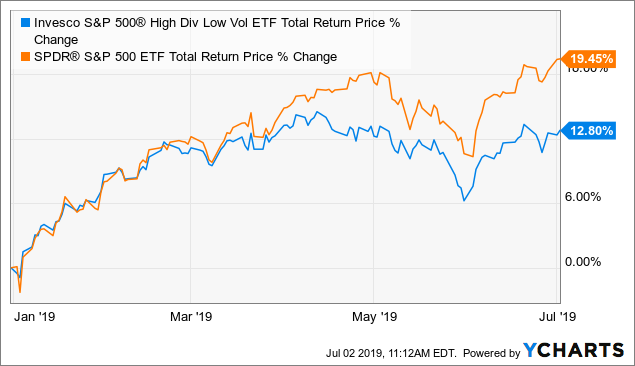

As equities are hitting new highs, it is becoming harder for fund investors to ignore higher price-to-earning ratios of equity funds. The Invesco S&P 500® High Dividend Low Volatility ETF (SPHD) is simply being ignored due to recent under-performance compared to the S&P 500 (SPY). This is creating an interesting opportunity for long-term investors to rotate into an ETF that is yielding a much higher dividend then the S&P 500. Lets take a look at the recent under-performance of SPHD vs. SPY:

Data by YCharts

Data by YCharts(Source: YCharts.com)

As you can see from the above chart, the SPHD started lagging the S&P 500 around April of this year. This is creating an opportunity for dividend focused investors to buy some shares.

SPHD is offering investors a P/E ratio of 14.31 vs. the S&P 500 of 21.96

What prompted me to take a look at the P/E ratio of SPHD was a recent conversation with a fellow low volatility investor, who expressed concern with the higher P/E ratios of the equity markets. Lets take a look at what Invesco has provided us here with the recent fund characteristics:

- Price/Earnings Ratio: 14.31

- Price/Book Ratio: 2.00

- ROE: 17.33%

Please note that these numbers are based on March 31st, as we do not have June 30th numbers yet.

SEC 30 day yield of 4.63%

The biggest draw of attention to this fund is clearly the high dividend yield. Coming in at 4.63%, the SPHD is yielding over double that of the S&P 500.

- SEC 30 Day Yield: 4.63%

- Distribution Rate: 4.37%

- 12 Month Distribution Rate: 4.07%

When looking at any investment, I always look at what I am getting paid, vs. what I could make on capital appreciation. If we continue to make 4.63% per year, the fund only has to have a capital appreciation of just 3.4% to make an annual return of 8%. This is a simple yet important calculation to take a look at. There will be times the fund will drawdown in price, but if we continue to hold it, there is a great chance we will average that 3% annual appreciation in the underlying shares.

Annual Returns

When looking at the lagging returns as of late, many investors lose focus of what the long-term returns are. The SPHD actually outperformed the S&P 500 in 2014, 2015, and 2016.

| Year | SPHD | SPY |

|---|---|---|

| 2013 | 20.82% | 32.31% |

| 2014 | 19.99% | 13.46% |

| 2015 | 5.17% | 1.25% |

| 2016 | 22.36% | 12.00% |

| 2017 | 11.89% | 21.70% |

| 2018 | -6.15% | -4.56% |

| 2019 | 12.18% | 18.32% |

(Source: PortfolioVisualizer.com)

The past few years of under-performance has gave equity investors a chance at picking up these 50 high dividend paying stocks at a discount to the overall market.

Risk Metrics

Before investing in any ETF or mutual fund, an investor has to look at what the potential risks are.

Metric SPHD SPY

| Arithmetic Mean (monthly) | 1.06% | 1.15% |

|---|---|---|

| Arithmetic Mean (annualized) | 13.49% | 14.70% |

| Geometric Mean (monthly) | 1.01% | 1.10% |

| Geometric Mean (annualized) | 12.88% | 13.97% |

| Volatility (monthly) | 3.05% | 3.29% |

| Volatility (annualized) | 10.56% | 11.39% |

| Downside Deviation (monthly) | 1.71% | 1.97% |

| Max. Drawdown | -7.47% | -13.52% |

| US Market Correlation | 0.79 | 0.99 |

| Beta(*) | 0.71 | 0.97 |

| Alpha (annualized) | 3.08% | 0.63% |

| R2 | 61.69% | 98.96% |

| Sharpe Ratio | 1.14 | 1.16 |

| Sortino Ratio | 2.01 | 1.90 |

| Treynor Ratio (%) | 17.05 | 13.58 |

| Calmar Ratio | 0.97 | 1.04 |

| Active Return | -0.81% | 0.29% |

| Tracking Error | 7.36% | 1.22% |

| Information Ratio | -0.11 | 0.23 |

| Skewness | -0.22 | -0.56 |

| Excess Kurtosis | 0.89 | 0.86 |

| Historical Value-at-Risk (5%) | -4.26% | -6.11% |

| Analytical Value-at-Risk (5%) | -3.96% | -4.26% |

| Conditional Value-at-Risk (5%) | -6.79% | -7.36% |

| Upside Capture Ratio (%) | 76.99 | 99.93 |

| Downside Capture Ratio (%) | 60.69 | 97.53 |

| Safe Withdrawal Rate | 25.92% | 26.21% |

| Perpetual Withdrawal Rate | 10.69% | 11.62% |

| Positive Periods | 54 out of 78 (69.23%) | 58 out of 78 (74.36%) |

| Gain/Loss Ratio | 1.14 | 0.84 |

(Source: PortfolioVisualizer.com)

When looking at the risk metrics above, the max drawdown is what catches my eye. A maximum drawdown is the maximum observed loss from a peak to a trough, before a new peak is attained. Maximum drawdown is an indicator of downside risk over a specified time period. The max drawdown of the SPHD is -7.47% vs. the S&P 500 of -13.52%. Investors are getting some downside protection while also earning double the average dividend yield.

Summary of SPHD

When looking at equity funds to purchase in the near-term, consider the SPHD. The SPHD has an average P/E ratio of around 14.3, a dividend yield of 4.63%, and potential to reduce drawdowns. For any passive equity investor, this would be a great way to add some style factor investing while focusing on earning higher dividends long-term. According to FutureAdvisor, dividends can make up to 45% of an investors total return. These dividends tend to be less volatile over the long-term then earnings, which tend to help the share prices be less volatile. Take a second look at the SPHD for part of your equity allocations today.

Disclosure: I am/we are long SPHD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Ortner Capital consults clients who own SPHD. These opinions are that of Josh Ortner, CTFA. Please consult a certified professional before acting on any information provided in this article.

[ad_2]

Source link Google News