[ad_1]

Investment case

Considering the aggressive bond market pricing of Fed rate cuts which has fueled the World Gold Shares SPDR Gold Minishares Trust ETF (GLDM) rally recently, we recognize that a correction of this current pricing could be overdue and produce some downward pressure in GLDM in the near term.

However, we believe that a correction in GLDM would be mild rather than violent because gold has entered a bullish re.g.ime in which speculative positioning in Comex gold becomes more resilient to gold’s ne.g.ative macro forces (e.g., stronger dollar, higher rates) and more sensitive to gold’s positive macro forces (e.g., weaker dollar, lower rates).

Introduction

In this article, we wish to provide a discussion about the currently aggressive bond market pricing of Fed rate cuts and its implications for spot gold prices and the SPDR Gold Trust ETF’s GLDM.

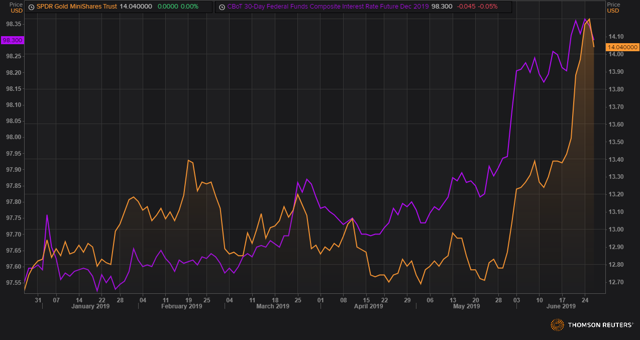

GLDM (orange line in the chart below) has experienced a significant rally following the dovish outcome of the FOMC meeting on June 19. This has been largely caused by a marked dovish repricing of Fed rate cuts evident in the notable decline in the December 2019 Fed Funds futures implied rate (purple line in the chart below).

Source: Thomson, Orchid Research

About GLDM

The Fund summary is as follows:

GLDM offers investors one of the lowest available expense ratios for a U.S. listed physically gold-backed ETF. GLDM also has a relatively low share price/NAV and may be beneficial to investors who desire longer-term exposure to gold. Similar to its SPDR® gold suite counterparts, GLDM offers a convenient way for investors to access the gold market.

By using a physically based methodology, GLDM prevents investors from being hurt from gold prices in contango, i.e., when the forward price is superior to the spot price (normal structure in a commodity market).

GLDM offers the lowest expense ratio of just 0.18% among its peers. Its older brother, the SPDR Gold Trust ETF (GLD), has an expensive ratio of 0.50%.

GLDM is suitable for investors who find inconvenient to store physical gold in a safe but want an exposure to the yellow metal’s price.

As the co-movement between spot gold prices and GLDM is extremely high, we will use gold and GLDM interchangeably throughout this article.

The bond market pricing of the US monetary policy easing cycle is too aggressive

The bond market is pricing in rate cuts this year and yet aggressively. While the Fed sent a dovish message at its latest FOMC meeting, the Fed dots which accompany the monetary policy statement look less dovish than what is priced by Fed funds futures.

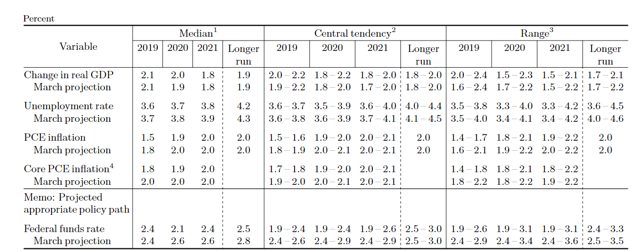

According to the latest Fed dots, FOMC members project a median Fed funds rate of 2.4% by the end of 2019 (unchanged from the March meeting) and of 2.1% by the end of 2020 (down from 2.6% at the March meeting). This implies no rate cut in 2019 and two rate cuts of 25 bp in 2020.

Source: Fed

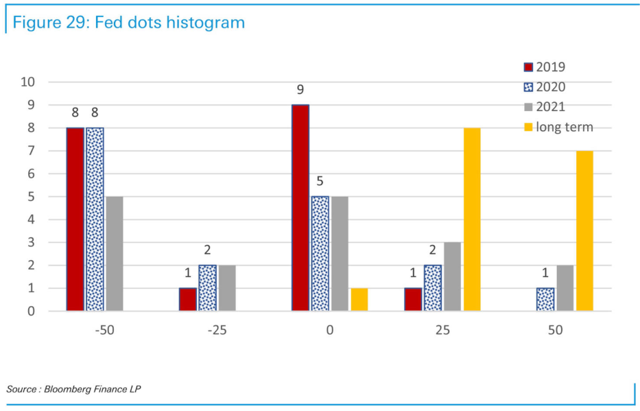

For this year, 9 FOMC members are in favor of no rate cut versus 8 FOMC members in favor of two rate cuts of 25 basis points (and 1 FOMC member projecting 1 rate cut of 25 bp).

For next year, 8 FOMC members are in favor of two rate cuts versus 5 members in favor of two rate cuts of 25 basis points (and 2 members arguing for only one 25bp rate cut).

The chart from our friends at Deutsche Bank illustrate the Fed dots ele.g.antly.

Source: DB

In striking contrast, Fed funds futures price a rate of 1.67% at the end of 2019 and 1.23% at the end of 2020, as the chart below shows.

Source: Thomson Reuters, Orchid Research

This implies 3 rate cuts of 25 basis points this year and another 2 rate cuts of 25 basis points next year.

A correction of this aggressive rates market pricing could undermine GLDM

Against this, we could argue that the rates market is pricing too aggressively a recession risk and a correction to the current pricing could be overdue.

In this case, we would expect the dollar and US (nominal and real) interest rates to move abruptly higher, which could in turn trigger some speculative selling in Comex gold.

Historically, we found that changes in net long speculative positions in Comex gold are highly correlated with the movements in the dollar (ne.g.ative correlation) and US real rates (ne.g.ative correlation).

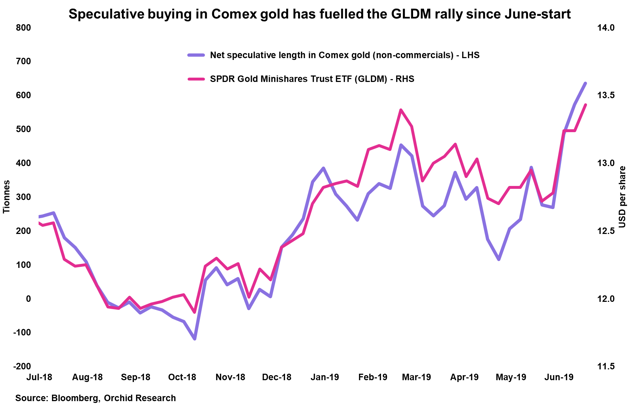

Most observers would agree that the significant rally in GLDM so far this month (+9% MTD) has been largely driven by a massive wave of speculative buying on the Comex (equivalent to 366 tons between May 28 and June 18, according to the CFTC, or nearly 10% of annual physical gold consumption), as the chart below illustrates.

Source: Bloomberg

Therefore, some practitioners could argue that a subsequent wave of speculative profit-taking (triggered by a correction of this aggressive market pricing of Fed rate cuts) could produce a violent sell-off in spot gold prices and GLDM.

Mild consolidation in GLDM possible, a violent sell-off unlikely

While this constitutes a downside risk to GLDM in the near term, it is important to recognize that the sensitivity of speculative positioning to the changes in macro forces relevant to gold (principally the dollar and US real rates) is never constant, as we wrote in a previous note (see: GLD Enters A New (Bullish) Re.g.ime, June 26, 2019).

Our work shows that gold has recently entered a bullish re.g.ime in which good news impacts more positively its price than bad news impacts ne.g.atively its price.

As a result, if gold has entered a new bullish re.g.ime – and we think it has, gold could experience only a mild correction should investors be.g.in to anticipate less rate cuts in the forthcoming monetary policy easing cycle. Although the dollar and US real rates would move higher, speculative positioning would prove resilient – speculators would shrug off the moves in the dollar and US real rates due to their conviction that gold offers 1) an attractive recession hedge, 2) a cheap sovereign-risk free asset, and 3) an efficient diversifier in a balanced portfolios, and 4)a positive price outlook over the long term.

Conclusion

In summary, we see the risk of a violent sell-off in GLDM as limited in the near term, despite the currently aggressive bond market pricing of the forthcoming monetary policy easing cycle. In any case, we would be inclined to buy the dips in GLDM.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

[ad_2]

Source link Google News