[ad_1]

European banks have been a disappointment lately

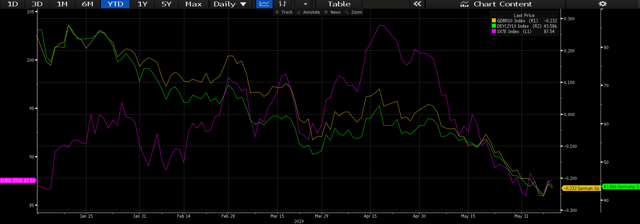

European banks (EUFN) have been one of the worst performing sectors both in Europe and globally over the past 12 months. As shown below, the iShares MSCI Europe Financials ETF has underperformed MSCI World, S&P500 and MSCI Eurozone by 16%, 20%, and 6% respectively. There was a rally in March-April due to better than expected 1Q results, however, it was short-lived.

Source: Bloomberg

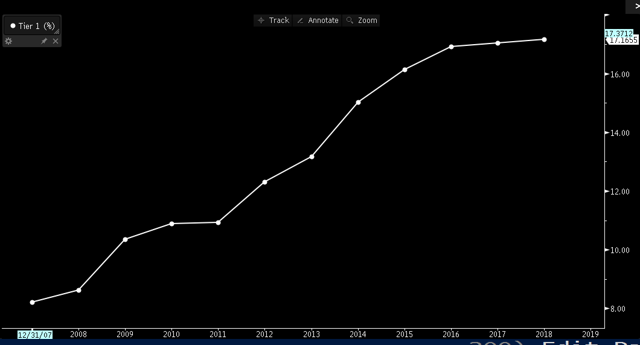

Such a subpar performance should come as no surprise given the recent developments in the European sovereign bond market. As the chart below demonstrates, there has been a very strong correlation between European banking stocks, the yield on the German 10-year bond, and, most importantly, the spread between the yields on the shorter-term and longer-term bonds. Unsurprisingly, the narrowing yield spread put pressure on the banks’ margins.

Source: Bloomberg

In addition, Deutsche Bank (DB) remains the elephant in the room. The German bank still has multiple issues including weak capital position, sluggish revenue growth, and subpar operating efficiency.

TLTRO is unlikely to be a game-changer

On 6th June, the ECB announced a new series of targeted longer-term refinancing operations (TLTRO III). The rate for the TLTRO III will be set at just 10bps above the ECB’s deposit rate, which is now minus 40bps. In other words, the ECB will be paying banks for taking loans from it. The TLTRO should support the sector’s loan growth, however, it is highly unlikely to be a game-changer as European banks have stable funding sources and they have problems on the demand side rather than on the supply side.

But don’t overlook the positives

With falling bond yields, sluggish credit demand and troubled companies like Deutsche Bank, it seems hard to justify a constructive look on the sector. However, we do see several factors that make EUFN an attractive buying opportunity, especially given current depressed levels.

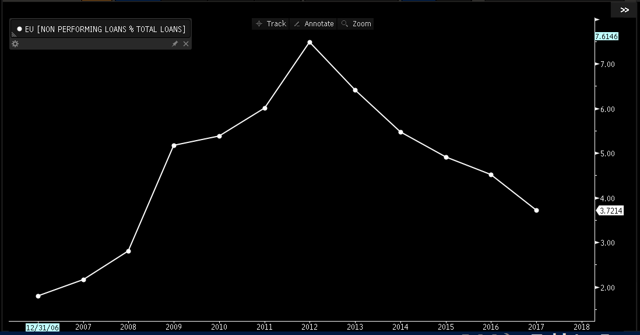

First, the European banking sector now has a much better capital position compared to both the 2007-2008 and 2011-2013 periods. As shown below, the sector’s Tier 1 has improved from around 8% in 2007 to more than 17% in 2018.

Source: Bloomberg

Second, the sector’s asset quality metrics remain benign and the NPL ratio has been declining over the past seven years or so. Cost of risk is also quite low, which should come as no surprise given the current low-interest rate environment and muted credit growth.

Source: Bloomberg

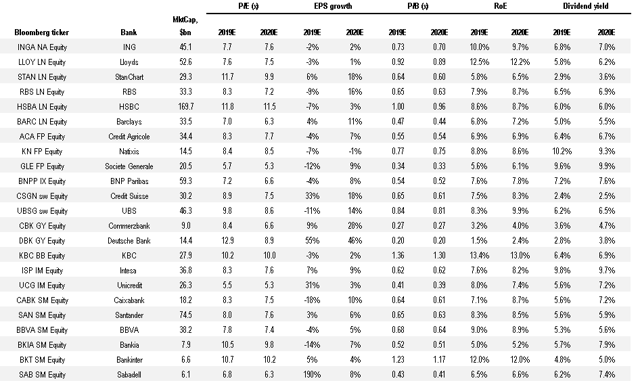

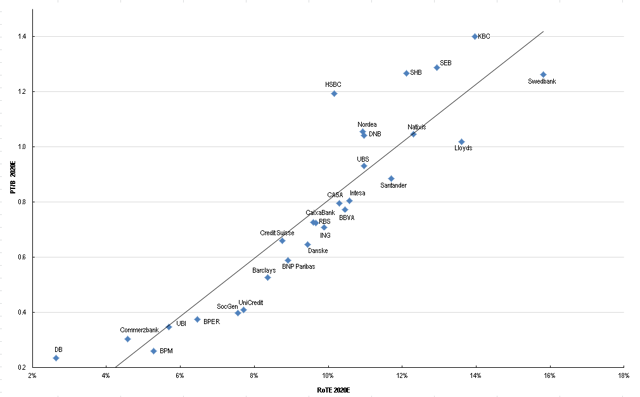

Valuation, growth, and dividends

As shown below, European banking stocks do not look attractive in terms of EPS growth. We believe that is unlikely to change in the near-term given sluggish loan growth and a lower-for-longer interest rate environment. With that being said, multiples remain reasonable and most stocks offer compelling dividend yields, which, as noted earlier, are supported by the sector’s strong capital position.

Source: Bloomberg, Renaissance Research estimates

Source: Bloomberg, Renaissance Research estimates

Final thoughts

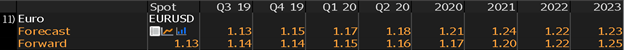

Lastly, it is also worth mentioning that EUFN is a good hedge against a weaker USD as the ETF is $-denominated. Most economic models suggest that EUR does look cheap relative to USD, and the current Bloomberg consensus implies that EUR/USD should go higher from here.

Source: Bloomberg

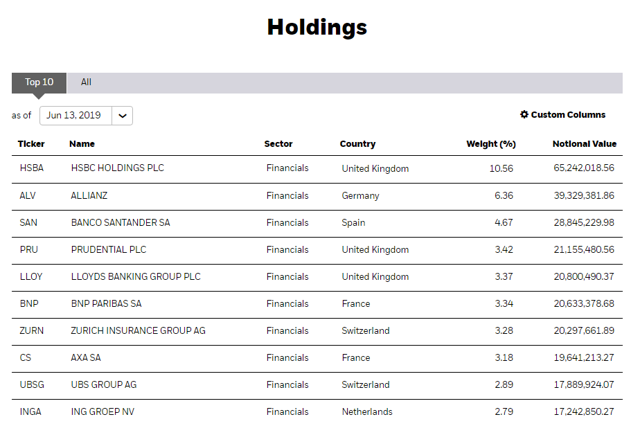

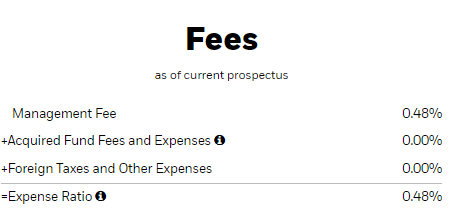

iShares MSCI Europe Financials ETF

Source: iShares

Source: iShares

If you would like to receive our articles as soon as they are published, consider following us by clicking the “Follow” button beside our name at the top of the page. Thank you for reading.

Disclosure: I am/we are long EUFN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News