[ad_1]

ETF Overview

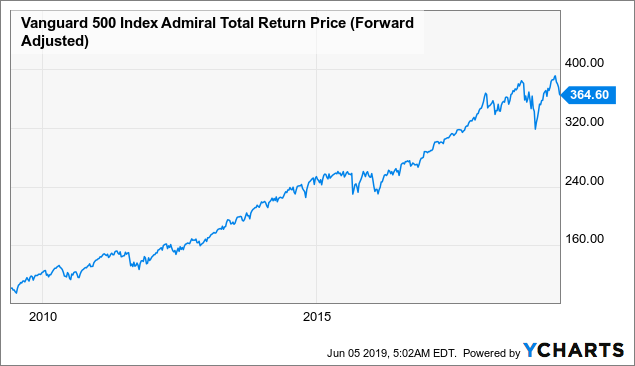

Vanguard 500 Index Fund Admiral Shares ETF (VFIAX) owns a portfolio of 500 largest U.S. companies based on market capitalizations. These companies are companies with strong competitive position and have excellent track records of growth. The fund’s low costs and low turnover rate enable it to efficiently track S&P 500 Index and maintain its performance. VFIAX is a good choice for investors with a long-term investment horizon. However, we are already in the latter stage of the current economic cycle. Therefore, conservative investors may want to wait for a correction before entering.

Data by YCharts

Data by YCharts

Fund Analysis

Market cap weighting strategy relies on market wisdom

VFIAX selects its portfolio of stocks based on its market capitalization. This selection criteria basically picks the 500 largest market cap stocks in the United States. This approach relies on the market’s wisdom to determine which companies are the 500 largest market cap stocks. There may be times that a company’s market cap gets bloated or compressed due to market sentiment, and this may impact the portfolio performance. However, this risk should be mitigated because the portfolio consists of 500 companies.

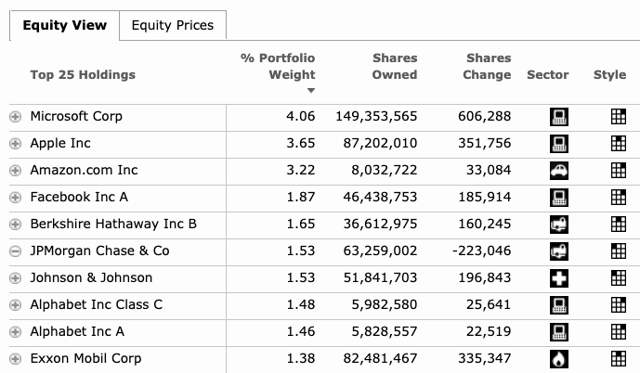

Most of these firms have economic moat

Large cap companies tend to be companies with competitive advantage over its peers. In other words, these are firms that have economic moats against its competitors. These companies may have better products (e.g. Apple (AAPL), or Johnson & Johnson (JNJ)) than its peers, or may have strong network effects that makes it difficult for its customers to switch to another network (e.g. Microsoft (MSFT), Facebook (FB), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), etc.). As a result, these companies tend to be more profitable and consistently deliver strong earnings growth.

Source: Morningstar

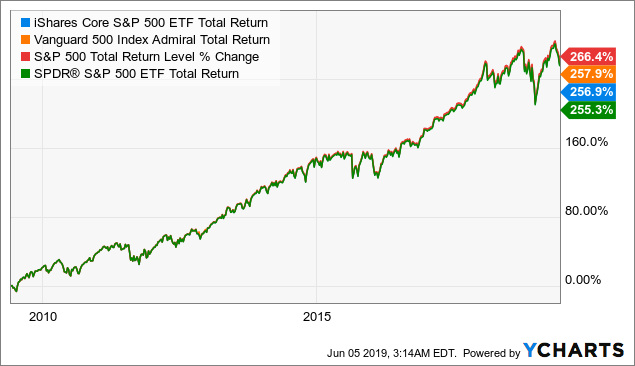

Efficiently tracks the S&P 500 Index

Vanguard charges a very low management expense ratio of 0.04%. This is low compared to the median category fee of 0.65%. It is also comparable to iShares Core S&P 500 ETF’s (IVV) MER of 0.04%. Another advantage of owning VFIAX is its low turnover ratio. In 2018, the ETF’s turnover ratio was only 3.7%. VFIAX’s cost advantage makes it one of the best ETFs to track the S&P 500 Index. As can be seen from the chart below, VFIAX’s return of 257.9% in the past 10 years is better than iShares Core S&P 500 ETF’s 256.9% and SPD& S&P 500 ETF’s (SPY) 255.3%.

Data by YCharts

Data by YCharts

Macroeconomic Analysis

The current economic cycle has been well into its 10th year, and the party is still on. The economy in the United States continues to run at a full capacity. In Q1 2019, U.S. GDP growth rate re-accelerated to 3.2%. In the same time, its unemployment rate dropped to 3.6%. This is the lowest we have seen since 1969. This environment should support strong consumer demand in the United States. Therefore, we expect many large cap companies to continue to perform well.

However, investors should also keep in mind that a lot of the companies in the VFIAX’s portfolio have sizable businesses internationally. Therefore, investors should also pay attention to global macroeconomic trends. The uncertainty surrounding the trade tensions lately may have the potential to derail the global economy. Several additional tariffs that U.S. plans to impose on Chinese and Mexican imports may likely result in higher costs for many of these large cap companies. The uncertain environment may also result in slower economic growth and lower business activities. This is already evident in the U.S. ISM Purchasing Managers Index (a leading economic indicator) where it has fallen from the peak of over 60 reached in early 2018 to 52.10 in May 2019. As can be seen from the chart below, S&P 500’s dramatic pullbacks in the previous two recessions (2002 and 2008) were all preceded by a sharp decline in U.S. ISM PMI. On the other hand, a recovery in U.S. ISM PMI has often resulted in market rallies a few months later. Therefore, we believe investors should closely track this leading indicator. Since we are seeing some signs of deceleration of business activities due to a decline in ISM PMI, we think investors should exercise caution.

Data by YCharts

Data by YCharts

Investor Takeaway

We like VFIAX for its low cost and a diversified portfolio of 500 largest market cap stocks in the U.S. We think this can be a core holding for any investors with a long-term investment horizon. However, since we are already in the latter stage of the current economic cycle, conservative investors may want to exercise caution and wait for a better entry point.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News