[ad_1]

As featured in my first article for Seeking Alpha on the topic of gold ETFs, investors seeking to provide a measure of protection for their portfolios often turn to gold.

In that article, I offered a graphic that reveals that gold has provided such protection with approximately 83% certainty, over the period of 1975-2012.

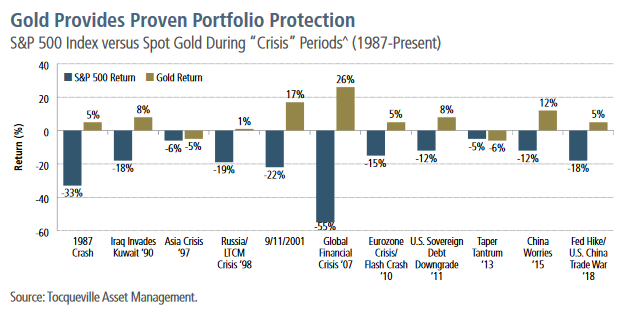

For another visual representation of this, consider the graphic below.

Source: Sprott Physical Gold Trust Fact Sheet

As can be seen, in multiple cases spanning the time frame of 1987-2018, gold has moved inversely to the S&P 500 during periods of market turmoil, thus minimizing volatility in portfolios that held an allocation to the metal.

However, in my most recent article for this platform, I felt compelled to offer readers A 4-ETF Combination To Assuage Fears Over the ‘Bar ZJ6752’ Fiasco.

Why did I feel the need to write that particular article? If you’ve never heard of what I refer to as the ‘Bar ZJ6752’ fiasco, I highly recommend you take a look. If nothing else, I think you will find it an enjoyable read. I’ll give you a little teaser here.

It all has to do with perhaps the best-known gold ETF, the SPDR Gold Shares ETF (GLD). As you might divine from the name, this is an ETF that offers investors a way to own a share in gold bullion. However, back in 2011, CNBC anchor Bob Pisani did a video piece in which he toured the London vault that holds GLD’s gold. During the piece, he held up a gold bar with the serial number ZJ6752 clearly visible. Only problem? There was no gold bar with that serial number on GLD’s current list!

Well, that led to all sorts of conspiracy theories! As I wrote in the article:

After all, if the visit to GLD’s secret London vault revealed a bar that did not belong to GLD, what else might be going on?

Long story short, in that previous article, I offered 4 suggested ETFs to help those concerned about such things to diversify any such risk, whether real or imagined. However, some readers remained unsatisfied. There was much talk of all of these ETFs, collectively, being nothing more than ‘paper gold’ since you are never, as a practical matter, able to get your hands on physical gold.

All the way along, even as I was writing the 4-ETF article, I had been anticipating that response. Here is how I replied to one reader.

There is one other option I am also in the process of exploring, but I won’t give that one away yet as it might form the basis for another article.

But what is that other option? And, why did I decide it deserved a separate article? Come along, and let’s find out.

Introducing the Sprott Physical Gold Trust

This option is the Sprott Physical Gold Trust (PHYS). At a very high level, it offers a very similar investment vehicle to the 4 ETFs in my last article. What do I mean when I say “very similar investment vehicle?” Well, here’s how PHYS is described in its fact sheet (linked under the graphic above):

The goal of the Sprott Physical Gold Trust (the “Trust”) is to provide a secure, convenient and exchange-traded investment alternative for investors who want to hold physical gold without the inconvenience that is typical of a direct investment in physical gold bullion.

Compare that with this excerpt from the prospectus of the iShares Gold Trust (IAU).

The Shares are intended to constitute a simple and cost effective means of making an investment similar to an investment in gold. An investment in physical gold requires expensive and sometimes complicated arrangements in connection with the assay, transportation, warehousing and insurance of the metal.

At their core, then, both the 4 ETFs from the previous article as well as PHYS offer exchange-traded products that reflect an investment in physical gold. In other words, I can buy shares in either IAU or PHYS today, sell them tomorrow if that be my choice, and for such time as I own them have an ownership stake in physical gold without ever having any of the complications of taking delivery and possession of physical gold.

However, by my research, there are 5 key differences between PHYS and the other exchange-traded products. For the remainder of the article, I will briefly cover each difference and offer an opinion as to which product holds the advantage in that category.

1. Structure of the Trust

In the case of the 4 ETFs in the previous article, they are trusts but genuinely structured as Exchange-Traded Funds. For a brief, yet comprehensive, discussion of those mechanics, please see this educational article.

In contrast, PHYS is a closed-end mutual fund trust, established under the laws of the Province of Ontario. In short, that means that it does not constantly have to buy and sell gold – including at least temporarily holding that gold in an unallocated account – to create and redeem baskets of shares.

There is one other wrinkle that you may find interesting. On page 9 of the prospectus, you will find that PHYS is required to hold a minimum of 90% of the assets of the trust in physical gold bullion in London Good Delivery bar form. However, it can hold up to 10% in a combination of other highly liquid assets. These include things such as debt obligations of or guaranteed by the Government of Canada or a Province of Canada, debt obligations of the U.S. Government or a state thereof, even short-term investment grade corporate debt. While the quality of these liquid assets appears to be solid, one is still left pondering the fact that up to 10% of the value of the trust can be comprised of something other than gold.

In summary, as compared to our 4 ETFs, I will call this one a tie. I like the benefits of the closed-end mutual fund trust structure. Offsetting that in a slightly negative way, however, is the concept that up to 10% of the assets in my “gold” fund might not be, well, gold.

Advantage: Tie

2. Redemption for Physical Gold

As mentioned at the outset of the article, critics of traditional gold ETFs often refer to them somewhat dismissively (even derisively?) as nothing more than ‘paper gold’ since you are never, as a practical matter, able to get your hands on physical gold. Here, then, is perhaps the single biggest area in which PHYS differentiates itself. Here’s the key paragraph in the prospectus.

Subject to the terms of the Trust Agreement, trust units may be redeemed at the option of a unitholder for physical gold bullion in any month. Trust units redeemed for physical gold bullion will be entitled to a redemption price equal to 100% of the NAV of the redeemed trust units on the last day of the month on which NYSE Arca is open for trading for the month in which the redemption request is processed. (Bold mine, for emphasis)

In short, you can redeem units for physical gold and have this shipped to the location of your choice via armoured (yep, spelled the Canadian way in the prospectus) transportation service carrier.

Sounds great, right? Well, there are just a few caveats you need to be aware of. I’ll list them very briefly here, in bullet-point format.

- First, the minimum redemption amount is “one London Good Delivery bar.” Such a bar must weigh between 350 and 430 troy ounces, and most bars fall between 390 and 410 ounces. As I write this, on May 20, 2019, the spot price for an ounce of gold is $1,279.30. So, even if a 350-ounce bar could be found for you, that’s a cool $447,755. As an interesting reference point, a quick check of Zillow shows the median U.S. house price as $226,800. I’ll leave it up to you to decide, then, how useful this is for all but the largest investors.

- The redeeming unitholder is responsible for all expenses involved in the entire process, including redemption fees, fees charged by the Mint to process the redemption, delivery fees, and the like.

- The Gold Redemption notice must be processed through a qualifying broker and passed to the transfer agent no later than the 15th of a given month to be processed that month.

- Following all processing, the armoured transportation service carrier will receive the physical gold bullion approximately 10 business days after the end of the month in which the redemption notice is processed. In other words, there will typically be at least a full-month lag between the time an order is processed and the gold is released.

- Finally, the prospectus notes that such bars will only retain their London Good Delivery status if delivered to an institution in North America authorized to accept and hold such bars. Otherwise, it will lose such designation once received by the unitholder.

My take? This is a wonderful feature for investors who are of such status that they could handle all of the above. For the smaller, or even average investor, this ability may be of conceptual interest, but not so much practical possibility. Still, I will list the advantage in this category as going to PHYS, for those for whom it might be meaningful.

Advantage: PHYS

3. The Custodian

In the case of the 4 ETFs in my previous article, the custodian was a financial institution, such as HSBC (HSBC) or JPMorgan Chase (JPM). Here’s what the PHYS prospectus reveals about its custodian.

The Trust employs two custodians. The Royal Canadian Mint (the “Mint”), acts as custodian for the Trust’s physical gold bullion pursuant to the Gold Storage Agreement (as defined below). The Mint is a Canadian Crown corporation, which acts as an agent of the Canadian Government, and its obligations generally constitute unconditional obligations of the Canadian Government. The Mint is responsible for and bears all risk of the loss of, and damage to, the Trust’s physical gold bullion that is in the Mint’s custody, subject to certain limitations, including events beyond the Mint’s control and proper notice by the Manager. (Bold mine, for emphasis)

Hmm… I’m going to go with…

Advantage: PHYS

4. Insurance

For this section, once again, I will use IAU’s prospectus as a sample of the language you will tend to find for our 4 ETFs when it comes to the question of insurance.

The Trust does not insure its gold. The Custodian maintains insurance on such terms and conditions as it considers appropriate in connection with its custodial obligations under the Custodian Agreement and is responsible for all costs, fees and expenses arising from the insurance policy or policies. The Trust is not a beneficiary of any such insurance and does not have the ability to dictate the existence, nature or amount of coverage. Therefore, Shareholders cannot be assured that the Custodian maintains adequate insurance or any insurance with respect to the gold held by the Custodian on behalf of the Trust. (Bold mine, for emphasis)

In the case of PHYS, there is no specific discussion of insurance in the prospectus, other than to note that “Trust units are not “deposits” within the meaning of the Canada Deposit Insurance Corporation Act (Canada) and are not insured under provisions of that Act or any other legislation.”

Piecing it together, however, per the emphasized sections of the excerpt quoted in the previous section discussing the custodian, it would certainly appear to this writer that PHYS holds the clear advantage in this area.

Advantage: PHYS

5. Tax Advantages and Complications

This area is interesting. You will notice I included two words in the heading; advantages and complications. In short, this portrays it very accurately.

In brief, as noted in the educational article I linked at the outset of section one above, gold is generally taxed as a “collectible” and subject to higher tax rates than other assets such as stocks or bonds. So, for example, if you hold gold for a period even longer than a year and then sell it for a gain, you will generally incur a higher tax bill than if you held a stock for that same period and sold it for a gain.

Closed-end unit trusts such as PHYS offer a potential shield from that, since shares represent an undivided interest in the fund’s entire investment portfolio. As such, gains are taxed at long-term capital gain rates as opposed to the higher rates on “collectibles.” That is the potential advantage.

The complication is that you have to file specific tax forms and potentially make certain elections to take advantage of this. If you fail to do so, you lose out on the benefits.

If you feel this information is potentially relevant in your situation, you would do well to start by checking out this January 2015 article in Journal of Accountancy. And, of course, run all of this past your personal tax advisor.

I’m going to call this one a tie. I will leave it up to each investor to decide whether the potential tax advantages warrant the required complications in your case.

Advantage: Tie

Summary and Conclusion

From my review, it appears that PHYS offers a compelling alternative to gold ETFs. As can be seen, in the 5 areas in which I offer a comparative evaluation, PHYS takes the win in 3 of the 5, with the other two areas, in my opinion, evaluating to a tie.

I feel obligated to note that, with an all-in expense ratio of .46% per the fact sheet linked above, PHYS is the most expensive of all the options I have listed. At the same time, it is my belief that many investors who desire to include gold in their portfolios consider it as “insurance” against things such as geopolitical instability, currency devaluation, and the like. For such investors, the advantages of PHYS listed above may be worth paying a little extra for.

What about you? Would you include PHYS in your portfolio? Or do you prefer the 4-ETF combo I suggested in my previous article? Feel free to share your view in the comments section below.

As always, until next time, I wish you…

Happy investing!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.

[ad_2]

Source link Google News