[ad_1]

Investment Thesis

iShares High Yield Corporate Bond ETF (HYG) focuses on corporate bonds that have ratings below investment grades. The ETF tracks the Markit iBoxx USD Liquid High Yield Index. HYG provides exposure to a broad range of U.S. high yield corporate bonds. In addition, it provides a vehicle for investors seeking higher income. However, high yield corporate bonds such as HYG may perform poorly in an economic recession as default rates will almost certainly spike. Since we are in the latter stage of the current economic cycle, we think investors may want to wait till the beginning of the cycle to invest.

Data by YCharts

Data by YCharts

Fund Analysis

High credit risk

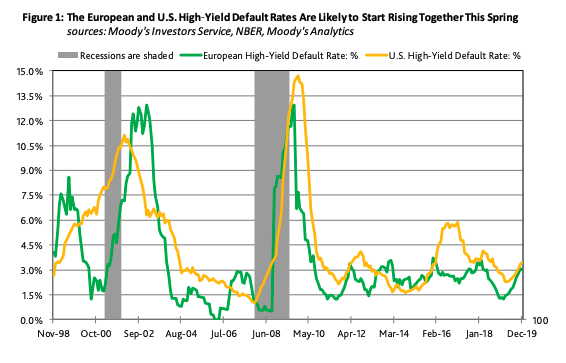

High yield corporate bonds are below investment grades bonds. These bonds tend to be riskier than investment grade bonds and are much more vulnerable in an economic recession. As can be seen from the chart below, high-yield bond default rate has spiked following the past two recessions in the United States (yellow solid line). In the last recession, the default rate spiked to nearly 15%.

Source: Moody’s Capital Markets Research

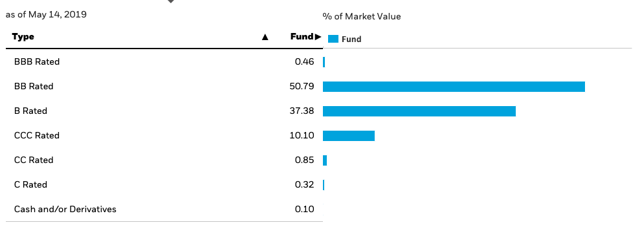

Although HYG may be in a better position than other similar high yield bond ETFs as half of its bonds in the portfolio are BB rated bonds, about 10% of its bonds are CCC rated bonds. For reader’s information, CCC or lower rated bonds have much higher average default rates of 5.9% in the past 20 years than the 1.3% average default rate of BB rated bonds.

Source: iShares Website

Higher sector concentration

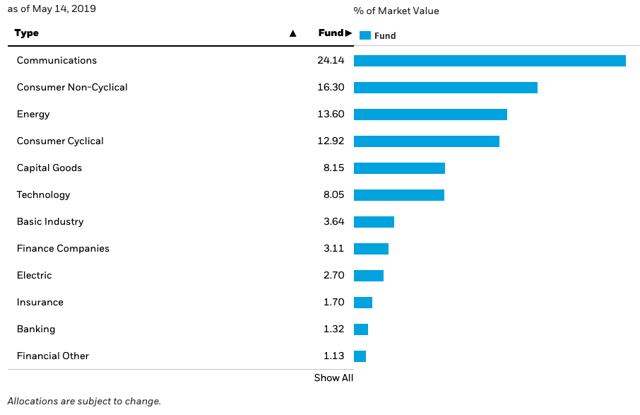

High-yield corporate bonds often do not have good liquidity. This means that management has to apply some portfolio screening rules to only hold bonds with better liquidity. The consequence of this approach is that it may result in much higher concentration in certain industry sectors. As the chart below shows, nearly one quarter of its bonds are concentrated in the communications sector.

Source: iShares Website

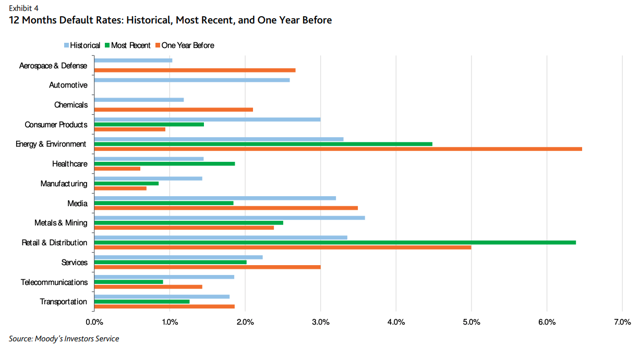

This higher concentration in cyclical sectors such as consumer cyclical (12.9%), and energy (13.6%) sectors may increase the risk of defaults in an economic recession. As the chart below shows, energy sector has one of the highest default rates among all sectors.

Source: Moody’s Investors Service

Relatively higher management expense ratio

HYG has a management expense ratio of 0.49%. This is high compared to other equity ETFs that are typically below 0.20%. Compared to other similar high yield corporate bond ETFs, its MER is also slightly expensive. For example, SPDR Bloomberg Barclays High Yield Bond ETF (JNK) has a slightly less MER of 0.40%. Xtrackers USD High Yield Corporate Bond ETF (HYLB) has a much lower MER (0.20%) than HYG.

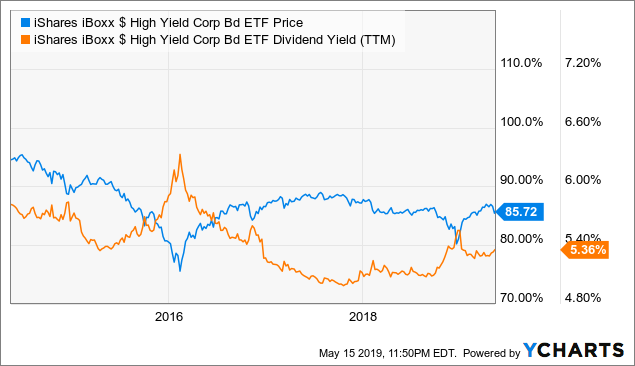

A 5.4%-yielding dividend

HYG investors will receive dividends with a yield of about 5.4%. As the chart below shows, its yield is towards the low end of its 5-year yield range. However, its yield is on a rising trend. Investors should keep in mind that corporate bonds are fixed income bonds. This means that investors should not expect dividend growth. Hence, the rising yield trend means that its fund price is on a declining trend. Therefore, this may not be the best time to invest in HYG.

Data by YCharts

Data by YCharts

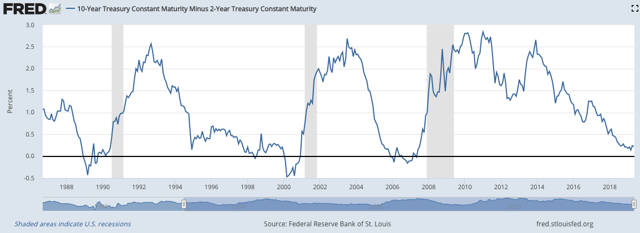

Macroeconomic Analysis

The current economic cycle has been well into its 10th year. Nevertheless, there are already many signs that we are already in the late cycle environment. For example, treasury yield (10-year minus 2-year) is now near the point of inversion (see chart below). As can be seen from the chart below, economic recessions often precede with yield inversions (when the 10-year yield minus 2-year yield falls below 0%).

Source: Federal Reserve Bank of St. Louis

Besides yield inversion, we are also seeing signs of investors rotating from riskier assets (e.g., energy, industrial, etc.) towards defensive sectors (e.g. telecom, utilities, REITs, etc.). This equity rotation is often a sign of a late cycle environment.

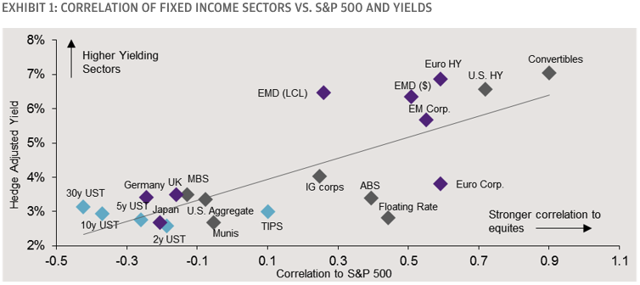

We think investors should not simply seek for high yield in a late cycle environment. The chart below shows the yield of different fixed income sectors to their correlations to equity market performance. As can be seen from the chart, high yield bonds (e.g. U.S. HY or Euro HY in the chart below) have a much stronger correlation to equities (often considered as riskier assets). In an economic recession, equities will be much more vulnerable to a price correction. Therefore, investors should keep in mind that high yield corporate bonds can mean higher risks.

Source: Bloomberg, JPMorgan

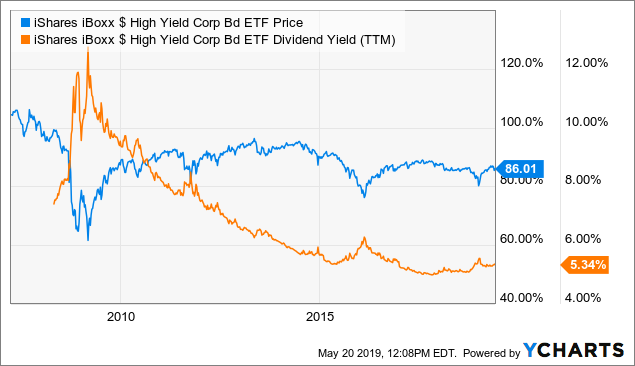

Since high-yield bonds have a higher correlation to equities, the best time to invest in high-yield bonds or related funds such as HYG is at the beginning of a new economic cycle and hold on to it until the late stage of the cycle. This is because high yield bonds will have a much higher yield at the beginning of the cycle. As can be seen from the chart below, in the beginning of the current economic cycle in 2010, HYG’s yield was as high as 10%. As the economy continues to improve, its fund price will also go up. However, as the economy moves towards latter stage of the cycle, its yield will also flatten and fund price cease to move higher. This is often a sign of a possible reversal. Hence, we believe HYG’s fund price is fairly valued.

Data by YCharts

Data by YCharts

Investor Takeaway

Since we are already in the late stage of the current economic cycle, we think investors should take a more conservative approach especially knowing the fact that high-yield bonds such as HYG will likely not do well in an economic downturn. Therefore, we continue to recommend investors wait on the sideline.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News