[ad_1]

The Invesco Dynamic Software Portfolio ETF (PSJ) is an interesting spin on investing in the software sector. It’s an ETF that largely follows a momentum strategy for selecting software stocks to invest in. Expenses are on the high side for index ETFs, and historical relative performance versus other alternatives have been mixed. However, the software sector has attractive economics, and the fund’s absolute returns have been stellar. We’ll go over how the ETF is constructed and what some other alternatives to the fund may be, but we’ll ultimately leave it up to investors whether or not they think it’s an investment that could serve a role in their portfolio.

Combining Momentum and the Software Sector

PSJ follows a unique index, the Dynamic Software Intellidex Index. The index has a fixed size of 30 stocks selected from “companies that are principally engaged in the research, design, production or distribution of products or processes that relate to software applications and systems and information-based services”.

Within that sector stocks are screened for 47 separate factors in five broad categories (they call them super factors): price momentum, earnings momentum, quality, management action (e.g., capital expenditures, share buybacks, and dividends), and value. The index methodology fact sheet doesn’t provide much more explanation than that. But given that two of the five “super factors” cited are momentum-based versus only one based on value, it’s probably safe to classify the fund as having a significant momentum component.

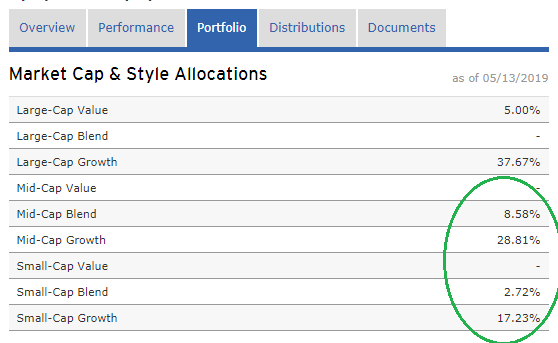

The indices in the family are equally weighted but only re-balanced four times a year, so individual stock weightings can vary significantly. This is especially true for this particular one given its heavy exposure to small- and mid-cap software companies whose prices can swing wildly.

(Source: Fund website, highlights author)

In fact, almost 60% of the fund is in small or mid-sized companies.

Performance and Alternatives

As you might expect, PSJ has performed very well on an absolute basis. Technology stocks have been some of the best performers since the Great Recession, and software companies are some of the best performers of the technology sector!

The table below shows the fund’s performance.

(Source: Fund website)

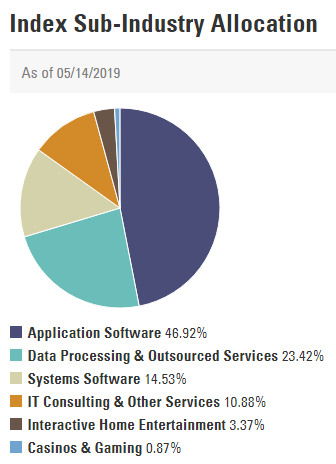

One thing worth noting is the use of the S&P Composite 1500 Software & Services Index as the benchmark for the fund. PSJ is a pure software fund, while the benchmark chosen also includes services firms such as IT outsourcing providers and financial services companies.

(Source: SPDR funds website)

We can see from the index breakdown (taken from the website of an ETF based on the S&P Composite 1500 Software & Services Index) that almost 40% of the index isn’t in software companies.

Investors may be better off comparing the performance of PSJ to funds that are pure software funds. In that case, the iShares Expanded Tech-Software Sector ETF (IGV) might be the best comparison. Expenses for the fund are lower at .47%, and returns have been similar.

The iShares website lists returns going back to calendar year 2014. Annual average performance for the fund from 4/30/19 over the past five years was 23.26%. For the same time period, PSJ’s return was 23.19%. As a point of reference, Nasdaq returns for the same time period would have been 18.17% (note this figure is for the index, not QQQ). It seems that any fund with a heavy weighting towards software or technology would have posted very similar performance numbers.

Summary

Given the attractiveness of the software sector, investors are likely to get satisfactory returns no matter what software-centric fund they pick. A broad sub-sector fund like IGV, a momentum-oriented fund like PSJ, or even a broad index like Nasdaq that is overweight technology and software compared to other indices like the S&P 500 or the Dow Jones are all likely to perform well. The software sector has high margins, is reasonably (but not completely) insulated from a US-China trade war and tariffs threats, and many software companies have strong economic moats. Additionally, the sector as a whole sports above-average returns on invested capital.

The only caveat we would add is that many software companies, particularly SaaS companies, sport very high valuations. While there are some unique business model quirks that can make using traditional valuation metrics difficult for many SaaS companies, many are still expensive on those metrics versus historical averages.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We are long the software sector through individual stocks.

[ad_2]

Source link Google News