[ad_1]

(Image Source)

President Trump wasn’t the only one grateful for a Fed-inspired distraction last week, as it gave game retailer GameStop (GME) some breathing room after a week of increasingly dire news. First came the news of a proxy battle with two shareholders looking to turnaround the wayward company, followed by announcements that everyone is now building out platforms for streaming games, including Google (GOOG, GOOGL) and Walmart (WMT). Even the news that GameStop hired a veteran of the retail wars as its new CEO couldn’t lift the stock. But Friday’s sell-off inspired by a yield curve inversion might have some people thinking that it’s time to take another look at little company with a very big dividend yield of over 14%.

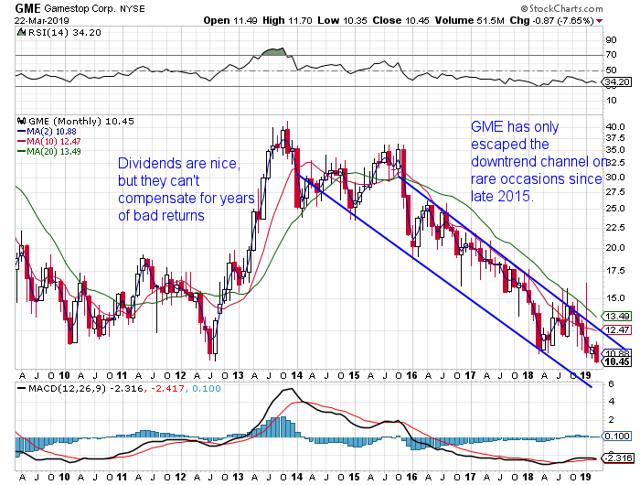

They’d be wrong, of course, as people who buy stocks because they come with a fat dividend yield typically are. GME only sports such a high yield because five years of negative returns have pushed the share price to its current low of $10.54 from a peak of over $57.6 in late 2013. That’s a five-year annualized return of -14% earned the hard way; a bricks-and-mortar strategy with flat sales, weakening margins, declining cash flow and, finally, a big write-off in the 3rd quarter that sent the earnings into negative territory. No wonder the company is attracting activist investors, although our advice would be that the biggest threat to GME share price isn’t competition from Google or Valve but losing its heavy ETF ownership.

Small Stock, Big Presence

Of course, we’re not in the investment business/activist investing game and don’t own any shares in GameStop (or any stock for that matter), but if we had been asked our opinion on a GME makeover from an ETF perspective, the answer would be a more professional version of “Dude, run!” From our point of view, GME is a very difficult situation made even worse by the ETFs that own it, making any turnaround plan a voyage between a rock and a hard place.

(Note, the chart uses adjusted share price.)

We understand that the only thing a value investor loves more than a fat dividend is one attached to a company with good turnaround potential to go with it (although we’d recommend not getting excited till GameStop reports its 2018 earnings next week), and GameStop has a story every retail investor is familiar with. First, a new company enters an old industry with a better business model – in this case online delivery of games – which, along with the slowing growth of the console market, put serious strains on GME’s business strategy, leading to lower profits and inevitable disappointment for investors. At its peak in 2013, the company was trading with a market cap of over $6 billion, compared to a mere $1 billion today. Gone are the flashy and colorful pages that start most annual reports, along with at least 10% of its U.S. stores, and not to mention 5 CEOs in 2 years. And while sales are roughly flat over the past five years, margins have been seriously eroded, leaving the company in an increasingly precarious position.

However, GameStop is still producing positive free cash flow, roughly $179 million over the trailing twelve months ending November 28th, according to Morningstar. That helps pay for the dividend, which, along with a healthy cash position, leads some to think there might be more value to be had. Enter Hestia Capital Partners and Permit Capital Enterprise Fund, which, having accumulated around 1.3% of GME stock, is now making a play right out of the activist investor handbook. Their goal is to earn seats on the board to help effect a turnaround, while also pushing the company to commit using its excess cash to buy back more shares. (You can read their letter to GME investors here.)

GameStop may be a shell of the company it once was, at least measured by market cap, but one area where it continues to excel is in the percentage of that market cap held by ETFs, currently around 20% and one of the highest ownership percentages of any stock we track not in a gold mining fund. Comparisons aren’t easy to come by, given that the “electronics store” segment of the market is relatively small, but two companies of similar size in the services industry with dedicated stores, Rent-A-Center (RCII) and Buckle, Inc. (BKE), have ETF ownership percentages of roughly 13% and 11% respectively, while mega-cap stocks like Google and Walmart are typically mid-single digits.

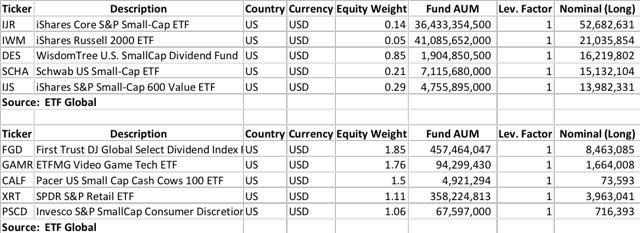

Who are the biggest holders of GME stock? Currently, there are nearly 90 funds that include the stock in their portfolios, although there’s a big difference between being a small part of a big fund and vice versa. As you can see in the table below, the 5 largest $ owners of GME are typical big index replicators, while the largest % owners are dividend income funds and one industry ETF.

We’ve discussed the benefits of higher ETF ownership before, most recently in our article on Tesla (“ETF Inclusion Of Tesla: Profits Over Production”), where being excluded from the S&P 500 cost the company more than $1 billion in lost liquidity by our estimates. The issue in that case was a lack of profitability that prevented Tesla from joining the S&P 500 at a time when its flailing share price desperately needed it. With GME, the danger is that its recent flirtation with unprofitability could lead to a similar outcome.

A Small Cog in a Very Big Machine

Let’s start by looking two of GME’s largest ETF owners, the iShares Core S&P Small-Cap ETF (IJR) and the iShares S&P Small-Cap 600 Value ETF (IJS), which between them have over $66 million in long exposure to the stock. Throw in another nine funds linked to the S&P 600 and you can bring that figure to over $76.3 million! That’s over 35% of GameStop’s ETF ownership and slightly more than 7% of its total market capitalization, which makes it vitally important to keep the company in the S&P 600 Index. After all, while the returns have been anemic, they have also been distinctly less volatile than either Rent-A-Center’s or Buckle’s.

Our regular readers will know that you need to be profitable to be included in the S&P 1500, the most important of S&P Dow Jones investment universes that feeds three smaller benchmarks, including the ubiquitous S&P 500, that are the heart of passive index replication. Hundreds of billions in assets are invested in funds that pull their investments from the S&P 1500, and countless billions more are invested with active managers who use some segment of the S&P 1500 as a benchmark. In other words, being a member has its privileges, but you need to keep making money to be a member.

There’s no hard and fast rule that says GME will be excluded if the TTM earnings are negative for XYZ amount of time, which is good given a recent, one-time writedown that sent the company’s earnings deep into negative territory! Inclusion or exclusion from the S&P 1500 is determined by a committee and can be done at any time, and we’d hope that the good people at S&P Dow Jones would look at the company’s overall financial profile rather than one quarter’s reports. But a clear trend might work against GameStop’s interests, and the company’s earnings trajectory was already heading in the wrong direction – and any further hits, say from a general recession, could be enough to send earnings over the edge.

While GameStop won’t release its results for 2018 until April 2nd, the net profit margins were already depressed from their historical levels, seriously restricting the “margin” for error. In FY 2013, the net profit margin was 3.9%, while if we used GME’s last quarterly report, adding back the goodwill impairment and making an educated guess on the estimated taxes, we’d get a net profit margin somewhere between 1% and 1.3% for the 39 weeks ending November 28th, 2018. And while we may not yet have the 4th quarter results, which include the vital Christmas season, expectations are decidedly low after a January 18th press release that detailed a 5% drop in annual yoy holiday sales. That drop was being driven by falling sales in the lower-margin hardware and new game segments, but can the other business segments grow enough to carry the company?

Less Money, More Problems

Losing that S&P component status would be a major hit to the share price, but the alternative might not be any better. GME has been careful to grow its dividend and even manage a substantial buyback program using its ample free cash flow, driven largely by keeping reinvestment in the business minimal, but even that might soon be too much. By boosting its payout, the company has earned a spot in multiple dividend funds, some of which weight by dividends per share or dividend yield, which boosts GME’s exposure to even higher levels! That’s added a lot of buying support to a stock under pressure over the last few years.

But by focusing on dollars and cents, it becomes clear that the party might sooner be over. GameStop’s anticipated annual dividend is now $1.52 per share, which, given the roughly 101 million shares outstanding, would equal an annual payout of $153 million versus TTM FCF of $179 million. That doesn’t leave a lot of excess cash for capital investments, especially if store sales and overall profitability continue to fall, although the company did have ample proceeds from the sale of its Spring Mobile business. Then again, it has also chosen to pay off $350 million in notes due later this year, along with adding $130 million to the share repurchase program.

Let’s assume the worst-case scenario and that GameStop is eventually forced to pull a GE and cut its dividend to fund reinvestment in the business. What would be the outcome for ETF investors? The answer, of course, is nothing good given that dividend funds are big holders of the stock, with 10 funds currently investing just over $38 million in the company. That’s nearly 18% of the entire ETF ownership %, as well as 3.8% of the overall market cap, which, when added to the percentage controlled by the S&P 600 index funds, represents more than 10% of the overall market cap of the company. Remove those two categories and the long ownership percentage drops right to the same levels as Rent-a-Center and Buckle.

In fact, given the number of dividend income funds, being held by just 10 might sound light – and you’d be right. We’re currently tracking 83 funds in our high-dividend category – where GME might seem a natural fit – which begs the question, why isn’t it in more funds? Most of the dividend funds that hold GME focus strictly on dividend payout, whereas the big trend in the space over the last few years has been on sustainable dividends versus total payout. How you define sustainable is up to the fund sponsor, with some focusing on payout ratio, others on income growth, and even more with combinations of the two. So, while GameStop might be sporting a high dividend, its lack of earnings growth has likely helped keep the stock out of more than a few funds, costing the company even more liquidity. But cutting the dividend, or even substantially trimming it, could lead to major complications with a significant chunk of its ETF ownership.

Final Thoughts

With over 50% of the ETF ownership held either by funds linked to the S&P 600 or those focused on dividends, activist investors risk upsetting the apple cart by doing something that loses one faction or the other. Cutting the dividend to raise capital will alienate one large group of shareholders who are only interested in income, not the ability to continue paying it going forward. But allowing the situation to continue as is will likely lead to more losses and eventual banishment from the S&P 600. Frankly, the only decision left is which painful future to embrace.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. ETF Global LLC (“ETFG”) and its affiliates and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively ETFG Parties) do not guarantee the accuracy, completeness, adequacy or timeliness of any information, including ratings and rankings and are not responsible for errors and omissions or for the results obtained from the use of such information and ETFG Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of such information. ETFG PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall ETFG Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

ETFG ratings and rankings are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. ETFG ratings and rankings should not be relied on when making any investment or other business decision. ETFG’s opinions and analyses do not address the suitability of any security. ETFG does not act as a fiduciary or an investment advisor. While ETFG has obtained information from sources they believe to be reliable, ETFG does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor.

[ad_2]

Source link Google News