[ad_1]

Main Thesis

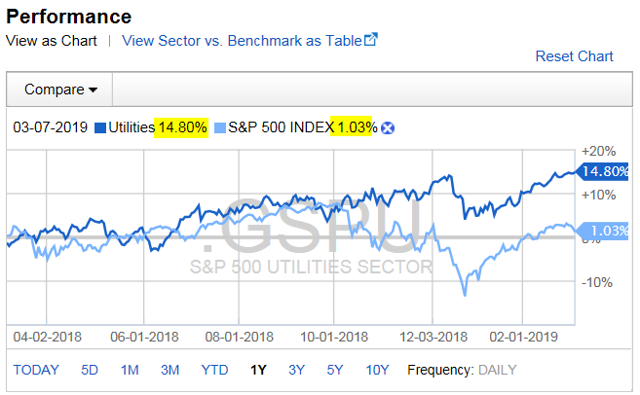

The purpose of this article is to evaluate the Vanguard Utilities ETF (VPU) as an investment option at its current market price. As a fund that focuses exclusively on the Utilities sector, investors would want to have a favorable outlook on that particular area before jumping in. As someone who was rotating out of Utilities for the better half of last year, I began rotating back in when it became clear that the Federal Reserve was going to switch gears after a relatively aggressive 2018 (in terms of interest rate hikes). As growth fears materialized in Q4, coupled with a dovish 2019 forecast from the Fed, the Utilities sector ended up being one of the top performing sectors by year-end and has continued to perform well as the new year began, as illustrated below:

Source: Fidelity

Source: Fidelity

As you can see, the Utilities sector has been exhibiting a lot of strength and, more importantly, I believe this strength can continue going forward. As 2019 has gotten underway, the Fed seems committed to a “wait and see” approach, and investors are currently forecasting rates to remain constant, or even decrease, by year-end. This will help demand for higher yielding sectors, like Utilities. Furthermore, after a weak December, housing starts saw a stunning turnaround in January, reversing a worrying downtrend in new home construction. This will help grow the demand for residential electricity, an overall benefit to the sector. Finally, the underlying companies within VPU are performing relatively well, which gives me confidence this is a good area to be exposed to, especially as growth forecasts worldwide continue to be cut.

Background

First, a little about VPU. The fund’s stated objective is “to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector” and it is managed by Vanguard. Currently, the fund trades at $127.26/share and yields 3% annually, based on its current price and the fund’s 2018 distributions. This is my first review of VPU, and has come about because I have been increasingly interested in the Utilities sector. In fact, I have been recommending multiple dividend funds with above-average exposure to this area. Given that interest, I wanted to review a fund with only Utilities exposure, and VPU fits this bill because it is one of the largest ETFs in this space. While the past year, as a whole, has been quite positive for this sector, there are a few key reasons why I remain bullish on this investment theme going forward, and I will explain those in detail below.

Interest Rates Remain A Key Factor

I want to begin the article with a few reasons on why I am bullish on the Utilities sector as a whole from a macroeconomic perspective. After laying out my principal reasons, I will then drill down on why VPU specifically is a decent way to gain this exposure.

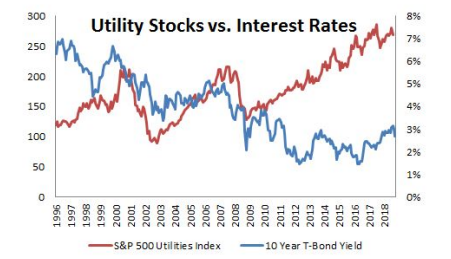

My first point has to do with interest rates, which have played an important role in the performance of the Utilities sector, in both the long-term and short-term. This relationship exists for a couple of reasons. One, when interest rates are low, bond proxies such as high yielding stocks tend to generate a lot of investor interest because of the income streams they provide. The Utilities sector, and dividend-paying funds in general, have performed quite strongly over the past decade, as the Fed has kept interest rates low to stimulate economic growth. Two, if there was substantial economic growth, leading the Fed to raise rates, that would not only harm the income stream from dividend payers, but would also be an indication that investors could earn higher returns from growth-oriented sectors. Utility companies, because of their steady revenue streams but low growth rates, are generally seen as more defensive, so we would expect them to under-perform in a rising rate environment that is also accompanied by strong economic growth.

Of course, that explanation is just theorizing what can happen during times of interest rate shifts, and not necessarily what will happen. However, there is historical evidence to prove those points. Consider the graph below, which shows a fairly consistent inverse relationship between share prices of utility stocks and interest rates over the past twenty plus year:

Source: Edward Jones

Source: Edward Jones

My takeaway here is that the Utilities sector performance should remain consistent and positive, as long as interest rates stay neutral, or decrease.

With that in mind, we have to consider the short-term outlook for interest rates, because my bullishness for utility shares is largely based on a dovish outlook. For now, this outlook appears to be supported by the Fed quite strongly. Just this past week, two Fed officials spoke out on the importance of monitoring economic conditions and remaining patient before raising rates further. On 3/6, NY Federal Reserve President John Williams was quoted:

“We [the Fed] can afford to be flexible and wait for the data to guide our approach”

And the following day, Federal Reserve Governor Lael Brainard echoed this sentiment, as she was quoted:

“I see the appropriate posture as watchful waiting”

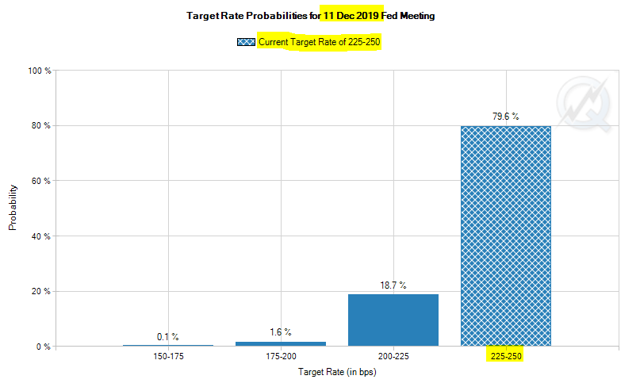

Clearly, the Fed has reversed course a bit from last year, which was predicted by most market participants when 2018 wrapped up. What has changed, however, has been the outlook by year-end of 2019. While the Fed was widely expected to pause rates when the year began, the original forecast for 2019 was for at least two rate increases. Currently, investors have taken recent Fed statements, coupled with lower economic growth forecasts, to mean that rates will end the year at the same level where they began. According to data compiled by CME Group, which tracks the futures market for investor sentiment on interest rates, there is zero chance of a Fed rate hike by the December meeting, and a 20% change of a rate decrease, illustrated below:

Source: CME Group

Source: CME Group

This is a sharp turnaround from just a few months ago, and further illustrates why higher yielding funds, such as VPU, should continue to remain in favor throughout 2019.

Housing Starts – Sharp Uptick

A second point on why I like the Utilities sector has to do with the housing market. This is another area that has shifted recently, as December numbers for housing starts indicated a large decline in activity, which was not a positive sign. However, this appeared to be a short-term dilemma, as January housing starts saw a sharp increase over the previous month, and reversed what had been a growing downward trend. The following graph shows that while housing starts had been increasing for years, they plateaued in 2018 and dropped steadily to end the year. However, 2019 started off strong, illustrated below:

Source: St. Louis Fed

Source: St. Louis Fed

My takeaway here is positive for the sector overall. While this increase simply shows new construction starting, and not finished products, these houses will likely be built in the short-term. This is because home prices continue to rise and home affordability has been on the decline. With potential buyers clamoring for more supply, there is a lot of incentive for homebuilders to get houses on the market quickly. And this should impact VPU because an increase in development of single family homes should push up demand for residential electricity, as there will now be more units available to serve. This should directly benefit the bulk of the companies that make up VPU’s portfolio.

Micro Look – Top Holdings Performing Well

Now that I have discussed the broader outlook for the Utilities sector, I want to scrutinize the performance of VPU’s top holdings. The top three companies in the portfolio are NextEra Energy Inc. (NEE), Duke Energy Corp. (DUK), and Dominion Energy Inc. (D), respectively. To gain a little perspective on how these companies have been performing of late, I reviewed their annual 10-K filings, and compared 2018 against 2017 to gauge revenue and income growth. The chart below lists out the relevant figures for each company:

| Company | Revenue Growth (YOY) | Net Income Growth (YOY) | Current Yield | Forward P/E |

| NEE | (1%) | 23.4% | 2.66% | 22 |

| DUK | 4.1% | 4.4%* | 4.14% | 18 |

| D | 6.2% | 13.9%** | 4.82% | 18 |

Source: Seeking Alpha Disclosures (calculations made by author)

*Based on adjusted earnings per share. DUK had $610 million additional one-time charges due to regulatory and legislative matters, impairment charges, and other costs that were not occurred in 2017 and are not expected to occur in 2019. Including those charges would result in a 12.8% drop in net income.

**Fourth quarter results from 2017 included a $851 million tax benefit resulting from the re-measurement of deferred income taxes as a result of the 2017 Tax Reform Act. The 13.9% figure excludes this one-time benefit in order to draw a more accurate year-over-year comparison.

These are the types of results I would expect to see out of the Utilities sector. These major firms are showing steady growth, with a clear focus on cost efficiency given the net income figures are rising faster than revenue growth.

Furthermore, the Utility space, while seen as a safe, and often boring, sector, is actually undergoing some fundamental changes that make a play on this sector much more exciting. For instance, NEE specifically is becoming a big player in the renewable energy field. The company produces multiple forms of the desired “clean energy”, in the form of wind, solar, and nuclear power. And they are quickly becoming a leader in this space, with their renewable division growing faster than the electric utility business in 2018, currently accounting for almost 40% of the total net income for the year.

My takeaway here is that the underlying performance of these firms is stable, the outlook is moderately bullish, and they are on the forefront of providing a service that Americans, and the world, will be soon be demanding more of. For these reasons, I see VPU as both a short-term and a long-term play, which is an attribute that always piques my interest.

Bottom line

The Utilities sector has been a strong performer, and that often means the market is struggling. While 2019 has started off well overall, the major indices are down roughly 3-4% from their recent highs, which may have investors considering defensive positions. VPU could be an option to gain this exposure, as it is comprised entirely of utility companies that are traditionally thought of as more defensive and as a stable investment theme. With dividend yields well above what is offered in the S&P 500, stable revenue growth, and improving earnings, the top companies within VPU help make a compelling case to buy the fund. Furthermore, the Fed has seemingly shifted entirely dovish, with officials projecting a cautious and “wait and see” approach before suggesting more rate hikes. With growth slowing around the globe, this has investors predicting zero rate increases in the U.S. this year, and that is a positive catalyst for income-oriented stocks. Therefore, I believe VPU is a good option to consider going forward, as multiple market conditions exist that seemingly favor the Utilities sector, and would recommend investors give this fund a serious look at this time.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in VPU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News