[ad_1]

bjdlzx

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 26th.

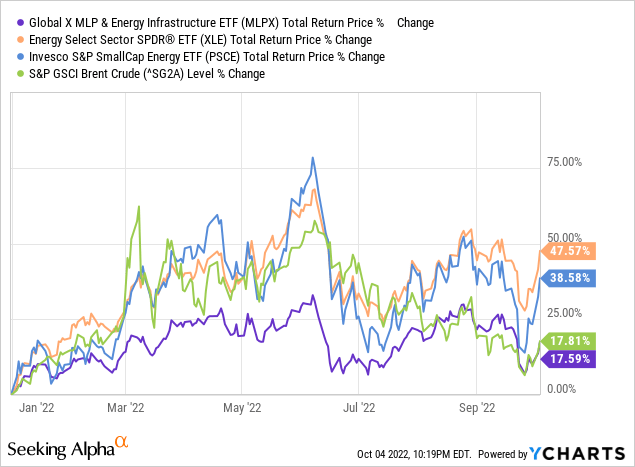

Energy has been the best-performing equity industry YTD, due to rapidly increasing energy prices, boosted by extremely cheap valuations. Energy remains undervalued relative to other industries, which could result in strong capital gains and market-beating returns moving forward. Due to this, thought to do an article summarizing some strong, popular index ETFs. These have different characteristics and might be more or less appropriate for different types of investors.

The Global X MLP & Energy Infrastructure ETF (MLPX) is the safest and highest-yielding of the bunch. MLPX invests in midstream energy companies, offers investors a fully-covered, growing 5.3% yield, and fares comparatively well during downturns, recessions, and energy price crunches. Ideal choice for income investors and less aggressive energy bulls, in my opinion at least.

On the opposite side of the spectrum, we have the Invesco S&P SmallCap Energy ETF (PSCE). PSCE invests in small-cap energy stocks, which are incredibly volatile, sensitive, and cheap securities. Gains are sky-high during bull markets, losses disastrous during bear markets. PSCE offers the greatest potential returns of the bunch but is the riskiest fund as well.

In the middle, we have the Energy Select Sector SPDR ETF (XLE). XLE invests in U.S. energy stocks, focusing on the integrated energy giants, but including midstream energy corporations, refineries, and smaller companies as well. XLE offers diversified exposure to the U.S. energy equity industry and is appropriate for more vanilla energy investors.

Under current conditions, I believe that PSCE is best, due to the fund’s comparatively cheap valuation and strong potential returns. PSCE remains the riskiest fund, and only appropriate for more aggressive investors.

Let’s now have a quick look at each of the funds above.

MLPX – Lower-Risk Higher-Yield Energy Fund

Overview

MLPX is a simple energy midstream ETF.

MLPX’s midstream holdings generate most of their revenue from the transportation and distribution of assorted energy products. The typical holding transports oil and/or natural gas through pipelines. MLPX does not invest in non-midstream energy companies, including integrated oil majors and refineries.

MLPX invests in 25 different midstream companies, including traditional corporations and MLPs (no K-1 for MLPX’s investors though). Largest holdings are as follows.

MLPX

Benefits and Positives

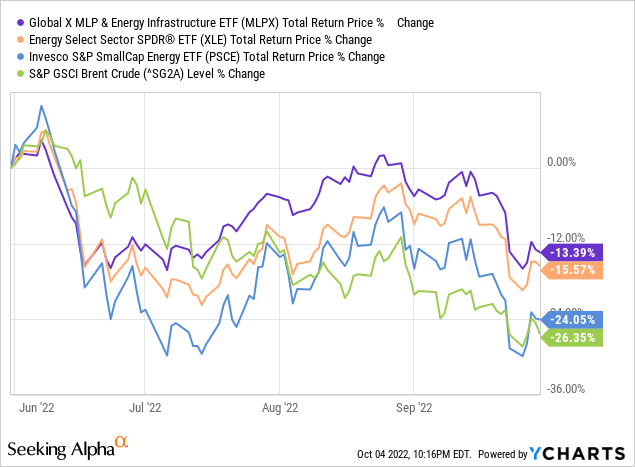

MLPX’s underlying holdings have significantly less exposure to energy prices than the average energy company, as their contracts are generally specifically structured to ensure that this is the case. As such, the revenues, earnings, and share prices of the fund’s underlying holdings tend to fare relatively well when oil prices decline, as has been the case since May.

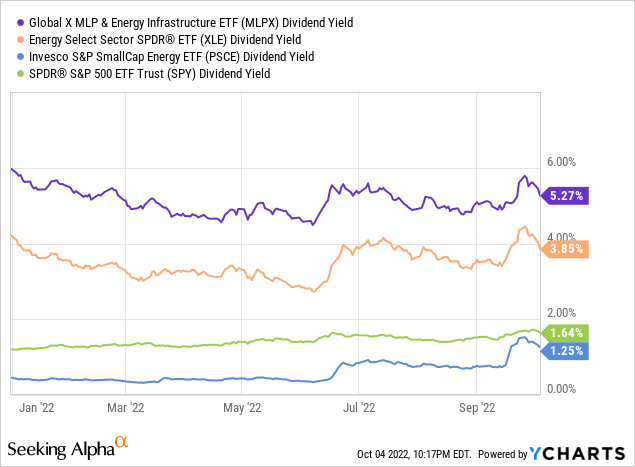

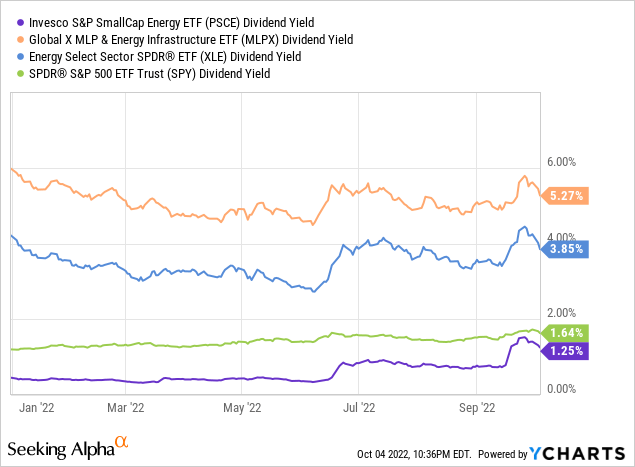

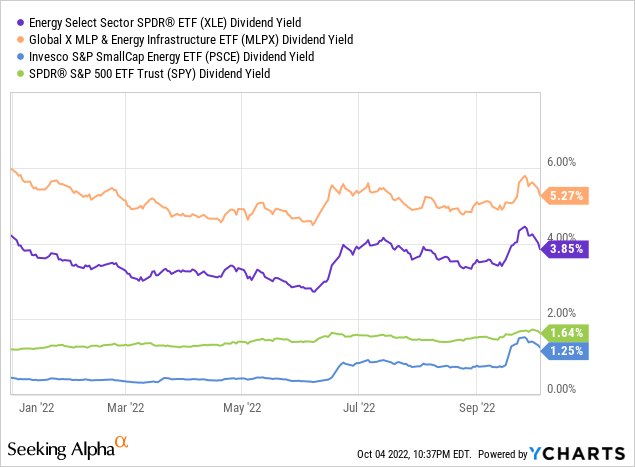

Midstream energy companies tend to distribute significant cash-flow to investors, in the form of dividends and distributions. MLPX itself sports a 5.3% dividend yield, significantly higher than the equity market average, and that its peers.

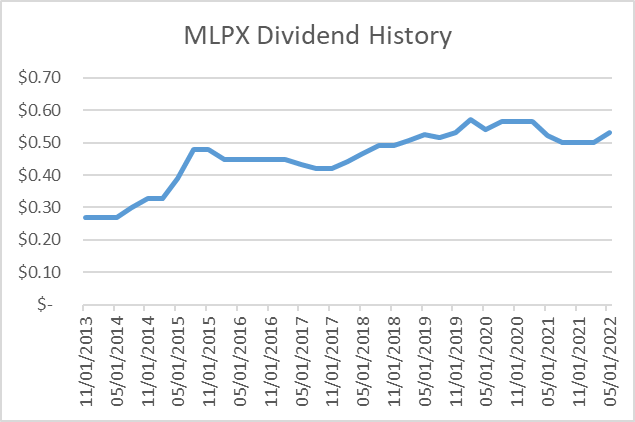

MLPX’s underlying holdings have reasonably stable revenues and earnings, which lead to reasonably stable dividends for the fund and its shareholders. MLPX’s dividends sometimes fluctuate quarter to quarter, sometimes are cut, but growth or stability are the most common scenario.

MLPX – Chart by Author

MLPX offers investors a strong, growing, reasonably stable 5.3% dividend yield, and performs better than most other energy funds when energy prices decline. These are two very significant benefits, and particularly important for more conservative / less aggressive income investors and retirees.

Risks and Drawbacks

MLPX focuses on midstream energy companies, which are relatively safe and stable for energy companies, but are still riskier and more volatile than most corporations. Expect significant volatility and losses during energy price crunches, if somewhat lower than average for an energy fund.

MLPX’s underlying holdings have less exposure to energy prices, which means lower revenue, earnings, and share price growth when energy prices increase. This has been the case YTD, during which oil prices have increased by around 18%.

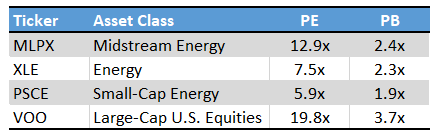

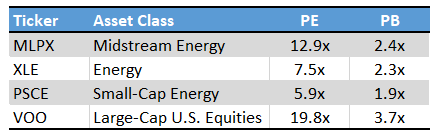

MLPX sports the most expensive valuation in its peer group, with a PE ratio of 12.9x, and a PB ratio of 2.4x. On a more positive note, the fund’s valuation is still cheaper than that of broader equity indexes.

Fund Filings – Chart by author

From what I’ve seen, midstream energy company valuations are at more or less their historically average levels, although the situation is complicated, and in flux (oil prices have been very volatile these past few months).

Midstream energy companies have chosen to retain a greater proportion of their cash-flows in the recent past. This, combined with the above, has resulted in a below-average yield for MLPX. The fund’s yield has averaged 6.1% these past five years, moderately higher than the fund’s current 5.3% yield.

In my opinion, MLPX’s uncompetitive valuation and below-average yield makes it the worst fund of its peers at current prices. Market conditions are in flux, so the situation could change at a moment’s notice. A more opportune buying opportunity could materialize soon, at which time MLPX might make for a stronger fund than its peers.

PSCE – Aggressive Small-Cap Energy Fund

Overview

PSCE is a small-cap energy index ETF.

PSCE’s holdings are all relatively small companies, with a weighted average market-cap of $3.2B. For reference, the average S&P 500 has a market-cap of $562.1B, and the average XLE holding has a market-cap of $193.0B.

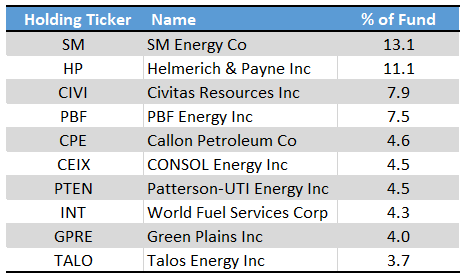

PSCE invests in 29 different companies. Largest of these are as follows.

PSCE – Chart by Author

Benefits and Positives

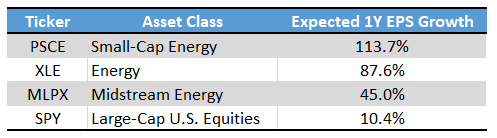

Energy companies tend to be leveraged, both financial and operationally. Leverage means marginally higher revenues and sales lead to significantly greater earnings. For reasons of market structure and history, small-cap energy companies tend to be more leveraged than most, so tend to see above-average growth when revenues increase. For energy companies, revenues are tightly linked to energy prices. Oil prices have increased these past few months, which should mean above-average earnings growth for PSCE’s underlying holdings, as has indeed been the case.

Fund Filings – Chart by author

Assuming oil prices remain elevated, PSCE should (continue to) see strong earnings growth moving forward, a significant benefit for the fund and its shareholders.

Small-cap companies tend to trade with heavily discounted valuations, due to above-average perceived and realized risk. This is the case for small-cap energy companies and PSCE, as expected.

Fund Filings – Chart by author

Cheap valuations could lead to strong capital gains and market-beating returns in the future, a significant benefit for PSCE and its shareholders. Gains are ultimately dependent on market sentiment, which is fickle, and currently bearish.

PSCE offers investors the strongest potential capital gains and total returns in its peer group. This makes for a very compelling investment thesis, but one mostly suited to more aggressive investors.

Risks and Drawbacks

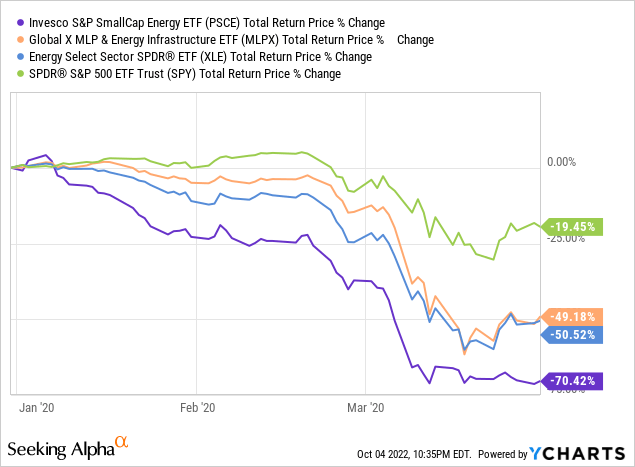

PSCE’s small-cap holdings are riskier than the average energy company, due to greater leverage, less diversified revenue streams, and greater perceptions of risk from investors. Expect the fund to underperform during downturns, recessions, and energy price crunches, as was the case during 1Q2020, the onset of the coronavirus pandemic.

PSCE sports a meager 1.3% dividend yield. It is a very low yield on an absolute basis, significantly lower than that of its peers, and lower than that of broader equity indexes.

PSCE’s low dividend yield is a direct negative for the fund and its shareholders and makes the fund an ineffective income vehicle. PSCE’s low dividend yield also means investors are almost entirely dependent on capital gains for their total returns, and these are quite fickle. Higher oil prices should lead to higher share prices for PSCE, and capital gains for its shareholders, but there is no guarantee that this will, in fact, be the case. Markets are sometimes irrational and can remain irrational for a very long time. Share prices, and hence capital gains, are strongly dependent on investor sentiment too, and sentiment is broadly bearish, due to inflation, higher interest rates, and a cooling economy. Under these conditions, capital gains might fail to materialize, even if oil prices remain elevated, a significant risk for PSCE and its investors.

MLPX’s investors will receive a good 5.3% in dividends while they wait for capital gains to, potentially, materialize. PSCE’s investors will only receive a paltry 1.3% in dividends while doing the same. This is a significant difference between these funds, and important drawback for PSCE.

Due to the above, and as mentioned previously, PSCE is mostly suited to more aggressive investors. In my opinion, at least.

XLE – Diversified Energy Index Fund

Overview

XLE sits between MLPX and PSCE on most relevant metrics.

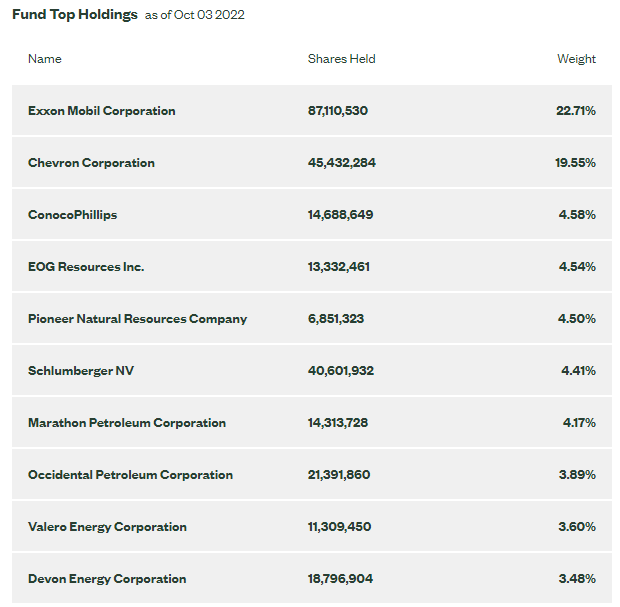

XLE is a diversified energy index fund, investing in all relevant large-cap U.S. energy equities, with few inclusion or exclusion criteria. XLE’s underlying index is much broader than that of PSCE and MLPX, both of which sport relatively narrow indexes. XLE currently invests in 21 different companies, the largest are as follows.

XLE

XLE focuses on the integrated oil majors. Exxon (XOM) and Chevron (CVX) are the two largest holdings, accounting for almost 43% of the value of the fund.

Benefits and Drawbacks

XLE provides investors with broad, diversified exposure to the U.S. energy industry, and is a pure play on the same. MLPX and PSCE track narrower indexes, and focus on more specific industry niches, so their performance is less tied to the U.S. energy industry and could somewhat differ from the same. As an example, PSCE could underperform if small-caps underperform, and this might be the case even if the energy industry as a whole performs well. XLE does not have these issues, and so is a more effective or straightforward play on the U.S. energy industry.

XLE focuses on the large integrated oil majors, which tend to be comparatively high-quality, blue-chip companies, with strong balance sheets and diversified revenue streams. Focusing on these companies reduces risk, especially in comparison to PSCE.

XLE provides a reasonably strong 3.9% dividend yield, and competitive valuation. MLPX yields more but is significantly more expensive. PSCE has a cheaper valuation but yields significantly less. XLE is somewhere in the middle, but, on net, seems to have better fundamentals than both MLPX and PSCE.

XLE provides investors with diversified exposure to U.S. energy equities. The fund is cheaply valued and could post significant capital gains if oil prices remain elevated, unlike MLPX. The fund yields a bit more than average, and focuses on comparatively large, safe oil majors, unlike PSCE. XLE is the moderate, vanilla choice amongst its peers, but a strong fund, nonetheless.

Risks and Drawbacks

XLE’s most important risks and drawbacks are the same as those of the U.S. energy industry.

There is significant energy price exposure, so expect significant losses if said prices decrease.

Energy companies tend to be leveraged, operationally if not financially, so earnings plummet from even small decreases in revenues and sales.

Bearish market sentiment could mean lower share prices and capital losses, even if fundamentals remain strong. Sentiment has been bearish all 2022, so this is an important issue to consider.

In general terms, as XLE is an energy index ETF, it is as risky as the energy industry, which is one of the riskiest industries in the market. Consider said risks before investing in XLE.

Conclusion

Energy ETFs offer investors diversified exposure to a cheap, high-growth industry with strong momentum. Different funds have different characteristics and might be appropriate for different investors.

MLPX is a particularly safe, high-yielding choice, but sports a comparatively expensive valuation.

PSCE offers the highest potential total returns, but is a relatively risky, aggressive choice.

XLE is the most diversified of the three and sits somewhere in the middle between MLPX and PSCE.

PSCE is my top choice, but the riskiest one as well.

[ad_2]

Source links Google News