By Bob Smith, Sage Advisory President

During the last six months the U.S. investment markets have been put through the proverbial ringer with equities recording declines of between 21% to 30% across the major indices. Coincidentally, the U.S. fixed income markets also suffered historic declines across the yield curve and most market sectors. Long-term Treasuries declined by over 20%, while short-term Treasuries recorded negative returns of -0.15%. The sharp decline across all asset classes thus far this year could be regarded as a Black Swan event as such occurrences, according to market history, are very rare. In looking at the largest U.S. equity drawdowns over the last 60 years and the concurrent performance of long duration Treasuries, one can find only three periods in which bonds lost value during large equity drawdowns. They were:

Black Swan events are characterized by their extreme rarity, severe impact, and the widespread insistence among market practitioners that they were obvious in hindsight. The magnitude of these results suggest that the first half of 2022 could best be regarded as a Black Swan because of the coincidental nature and magnitude of the drawdowns as well as the unpredictability of such an outcome that went well beyond what would have normally been expected. Moreover, it is difficult to identify any major financial institutions or governmental entities that correctly predicted these outcomes at any time early this year.

As we have learned from the past, these severe market dislocations or anomalies do not last for long, but it is difficult to identify when and how they may begin to dissipate and change course. Our sense is that by the fourth quarter of this year the bond markets will have found firm ground and that risk assets will begin to stabilize as we reach a possible end to the current interest rate tightening cycle.

While most sectors of the fixed income markets suffered negative performance outcomes, we noticed that the ESG-optimized investment sector performed well compared to its conventional counterparts. Throughout most of this year, ESG-related investment strategies have come under heavy public scrutiny because of their association with the notion of energy transition, the reduction of fossil fuel dependency, and increased corporate climate impact reporting. Indeed, many market pundits have suggested the rise in energy prices that have resulted from current U.S. domestic energy policies and the Russian hostilities in central Europe would cause ESG-focused funds to suffer relative underperformance compared to their conventional fund counterparts.

Content continues below advertisement

Competitive in the Worst of Times

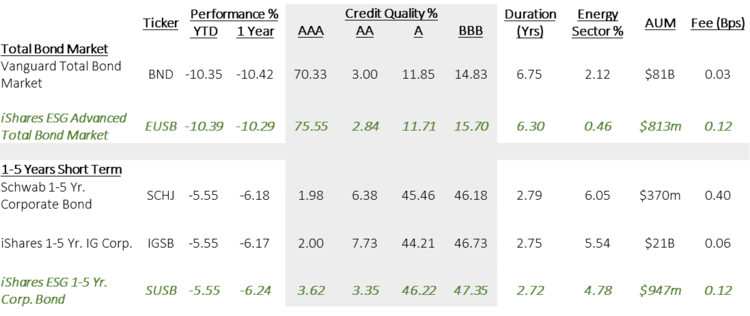

Our research suggests that based on their relative year-to-date and one-year performance results, ESG-focused fixed income ETFs have done as well and, in some areas, slightly better than their conventional counterparts during the recent historic market drawdown. These favorable results clearly suggest that in periods of extreme market stress, ESG funds tend to do a bit better because they have maintained comparatively higher credit profiles and conservative portfolio durations. Moreover, most of the ESG funds had lower exposures to the energy sector compared to their conventional counterparts.

These factors were clear when one compared the Vanguard Total Bond Fund (BND) performance and composition to the iShares ESG Advanced Total Bond Fund (EUSB) performance and composition as shown in the table below. While BND slightly outperformed EUSB year-to-date by 4 basis points, the last one-year relative performance was a difference of 13 basis points in favor of the ESG-optimized strategy. The higher-quality orientation, slightly shorter duration, and almost zero exposure to the energy sector were all factors that differentiated EUSB over the last year.

Sources: Sage, Bloomberg

In the corporate-only sectors of the market, we saw some variance in the performance outcomes between conventional and ESG-optimized funds, but almost all the ESG funds were able to outperform their conventional counterparts on a year-to-date and one-year basis. Here again, the more conservative durations of the ESG funds contributed to their modest outperformance. Their results were aided by their higher credit quality tilts and lower energy sector allocations. We noted that the energy exposure between this group of ESG funds varied quite a bit but were less than the level featured in the iShares iBoxx Investment Grade Fund (LQD). Indeed, the Vanguard ESG Corporate Bond Fund (VCEB), with no allocation to the energy sector, managed to outperform the iShares and Wisdom Tree conventional corporate bond alternatives by significant margins of well over 100 basis points for both the year-to-date and one-year periods. These results should clearly dispel the notion that ESG-focused investing, in and of itself, does not lead to relative investment underperformance.

Fixed Income ETF Comparison

Sources: Sage, Bloomberg

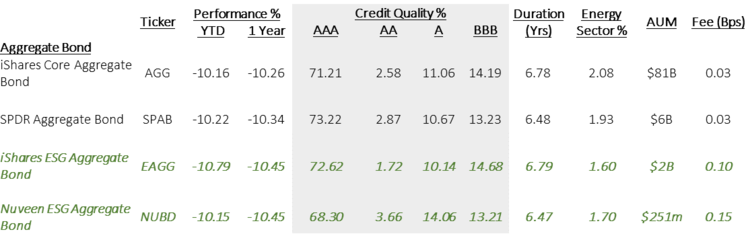

In the Aggregate Bond Index funds, our research found some mixed outcomes. The relative performance of the conventional funds was slightly better for the one-year period, but the ESG-focused funds were more competitive for the year-to-date period. Here it is worth noting the relative performance of the iShares Aggregate Bond Fund (AGG) compared to its ESG counterpart (EAGG). While the two funds had similar duration and credit risk profiles, AGG outperformed EAGG by roughly 20 basis points or more for the year-to-date and one-year periods. While EAGG had a slightly lower allocation to the energy sector, it is difficult to attribute the relative minor underperformance to this factor. Rather, we believe that the 3% higher cash position and having 2% less government and securitized exposure compared to AGG were the more likely reasons for the slight underperformance of EAGG.

Fixed Income ETF Comparison

Sources: Sage, Bloomberg

The high yield sector of the market has seen significant levels of volatility. Interest rate spreads on the ICE Bank of America US High Yield Index moved from a low of 305 basis points in early January to a high of 587 basis points by the end of June. With this backup in yields, high yield ETFs suffered significant drawdowns but oddly their relative performance was a bit better or similar to their investment grade counterparts. What we noted in the high yield sector was that the ESG funds that had similar duration characteristics tended to offer better performance outcomes. For example, the iShares Advanced ESG High Yield Fund (HYXF) with a duration of 4.23 years, no energy sector exposure, and a higher credit quality tilt generated attractive relative performance outcomes of over 70 basis points for the year-to-date and one-year periods versus the conventional SPDR High Yield Fund (JNK) with a duration of 4.15 years and a 12.14% allocation to the energy sector. The same results were apparent when one compares the conventional iShares iBoxx High Yield Corporate Fund (HYG) with a duration of 3.93 years versus the Xtrackers J.P. Morgan ESG High Yield Fund (ESHY) with a duration of 3.00 years. Here again, the ESG-focused fund offers slightly better relative performance for the year-to-date and one-year periods.

Fixed Income ETF Comparison

Sources: Sage, Bloomberg

Our research of 14 different ESG-focused fixed income ETFs representing a cross section of different issuers, market sectors, and energy industry exposures clearly illustrates that when it comes to surviving the most difficult of market downturns, sustainably focused investing proves its defensive mettle.

Investors ought to take note that this year, despite the worst U.S. bond market environment on record and unparalleled levels of market volatility, ESG-focused ETFs, as in the past, provided comparatively superior relative performance versus their conventional counterparts. Our findings prove once again that ESG-focused ETFs do not cost investors performance but instead enhance the defensive strength of one’s overall investment portfolio during periods of extreme adversity.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.