[ad_1]

MCCAIG/iStock via Getty Images

Volcker Rate Hike

Following last week’s FOMC meeting, where the Fed reneged on its May 4th 50-basis point declaration that rates would not go up 75-basis point, the markets went from positive to negative. In a bold effort to tame inflation, the Fed’s 75-basis point hike will be the biggest since 1994 – perhaps a ‘Volcker Moment’ – adding fuel to the already intense recession fears in the markets. This 75-basis point hike is likely just the first abnormal increase, which makes it hard to trust Powell, when just in May, with sound conviction, Powell took the 75-basis point hike off the table.

As the case may be even worse than a ‘Volcker Moment’, it could be the beginning of a ‘Volcker Era’ if the Fed cannot get its house in order. In fairness to the Fed and Powell, it is a complicated global environment with a lot of complicated data points.

What is most interesting is that retail sales unexpectedly dropped by 0.3%, indicating that inflation could be fixing itself. Raising rates is unlikely to fix inflation. Yet the Fed’s hubris pride, moderate tapering to end 2021, late reaction, and now aggressive tightening may cause a recession given inflation was not transitory. In a recent statement, Jerome Powell himself said that higher interest rates could cause a recession.

According to the below dot plot, policymakers are forecasting additional hikes to 3.4% by year-end and 3.8% by the end of 2023, a stark difference from their predicted 1.9% and 2.8% for March projections.

Fed Dot Plot (Bloomberg)

Coined the Volcker Moment, former Federal Reserve Chairman Paul Volcker made a drastic decision in the late 1970s to significantly raise interest rates to curb inflation, which was rampant at the time, pushing them to 20%, subsequently causing a recession from 1980-1982. With the current struggle to get inflation under control, fuel and food prices are a nagging reality, most affecting lower to middle-income households. And while the Fed may be committed to returning inflation to 2%, the supply chain issues caused by China and the war in Ukraine cannot be fixed by Fed hikes and monetary policy. As I wrote in a recent FOMC article,

“These are all exogenous events causing inflation in the U.S. that monetary policy can’t fix. However, the Fed feels it needs to continue tightening when perhaps it may not and has tightened enough. And while the need to control inflation or ramp down inflation is ever-present, the future tightening of monetary policy, in addition to the fiscal cliff that we just went off of in terms of government spending, could lead to a recession.”

Part of the Fed’s responsibility is to aid economic growth, adjust the money supply and interest rates, and promote maximum employment and stable prices in pursuing economic goals. Signs of inflation are increasing across the board, and while the labor market is currently robust, it’s beginning to cool.

“The Federal Reserve wants the labor market to moderate, and it thinks it can achieve this without much of a rise in the unemployment rate, according to official comments and the Summary of Economic Projections. Despite what appears to be widespread criticism of this view, the median forecast in Bloomberg’s survey seems to concur; 3.5% unemployment forecast for next year and CPI and the PCE deflator at 3%, and the Fed funds rate at 3.1%” -Marc Chandler, Seeking Alpha Contributor.

Despite the Fed’s indication of a moderating labor market, the question is: are they living in a “fantasy land,” where the risk of growing unemployment and significant slowing of the economy over the next two years is a reality? The May 4th 50-basis point announcement experienced a 24-hour rally, followed by plummeting indexes that brought the Nasdaq’s 30-year bull run to a screeching halt. In times past, right after the FOMC meetings, the markets have experienced rallies, followed by declines after the release of FOMC Minutes, as showcased in the below FOMC Cycle Chart.

FOMC Cycle April 2021 to May 2022

FOMC Cycle April 2021 to May 2022 (TradingView)

While we’ve already seen a substantial decline after this most recent meeting, we believe a similar trend will happen unless there is some unforeseen circumstance.

The markets are experiencing some oversold stocks, bouncing heavily amid selling pressure but have the potential to recover. We are seeing a bit of a rally to begin the week, but this may be short-lived, as we are still in bear market territory, with people buying the dips with no sustained conviction. While we usually focus on stocks, given the market environment, we are mixing things up and concentrating on quality, inflation-proof ETFs for this article.

Why ETFs Are Good Investments

Not all ETFs are created equal, so it is important to analyze the construction and methodology when selecting an ETF, particularly index ETFs. For example, SPDR S&P 500 Trust ETF (SPY) is a market-cap-weighted index that seeks to mirror the performance of the S&P 500. So, underlying constituents are allocated by size relative to the other indexes, which is why when you look at the S&P 500, you’re not getting true exposure to all 500 companies. Instead, you’re getting a skewed allocation that comprises roughly the 10 largest weighted stocks like Apple, Microsoft, Amazon, and Tesla representing 27% of the index.

When you compare SPY to the Invesco S&P 500 Equal Weight ETF (RSP), every company that comprises RSP has an equal weight. Every ETF has pros and cons, and often it depends on the market cycle. We like to focus on quality and screening criteria that put a premium on forward P/E, earnings growth, dividend growth, free cash flow, etc., in locating the most high-quality ETFs.

Given market volatility, the difference between gains and losses may be gravitating towards high quality versus baby in the bathwater investments. As we’ve seen with tech and even staying in market cap indexes whose largest companies are selling off, quality tends to rise to the top and stand the test of time in downside pressure.

U.S. gas prices are breaking records, with consumers feeling the pain at the pump. Energy stocks remain top-performers, but energy ETFs provide diversified exposure to the energy sector and are thus lower risk and less volatile than individual stocks. Some incorporate multiple stocks, sometimes across multiple industries. Because energy has been one of my favorite sectors that has gained tremendously over the last year, I have two top energy ETFs to consider.

Top 2 ETFs

ETFs can provide several advantages compared to single stocks, including portfolio diversification, tax benefits, risk management, and lower costs. Given the high demand for commodities – energy, fuel, and particularly natural gas – our top two ETFs make for great portfolio considerations and serve as inflation, and recession-resilient picks, given everyone’s need for fuel and companies being able to pass off costs to the consumers.

1. United States Natural Gasoline ETF (NYSEARCA:UNG)

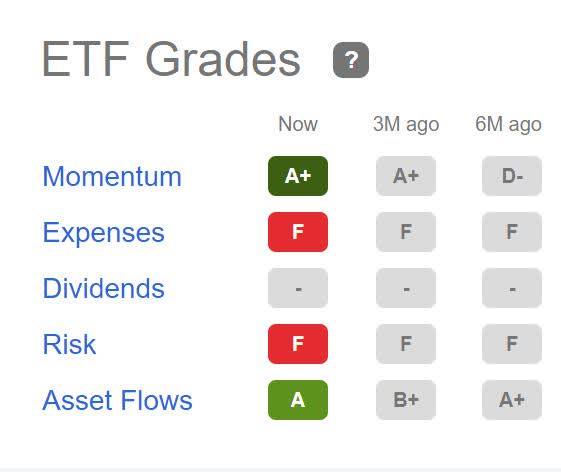

United States Natural Gasoline ETF, which invests in U.S. commodity markets focused on futures natural gas contracts, has been on a longer-term bullish trend. As you look at UNG’s ETF Grades which rates its investment characteristics to the same metrics for other ETFs in its asset class, while UNG’s Expenses and Risk grades are not ideal, they are offset by the stellar Return and Momentum grades, indicating that this ETF has great potential and is fundamentally sound.

UNG ETF Grades (Seeking Alpha Premium)

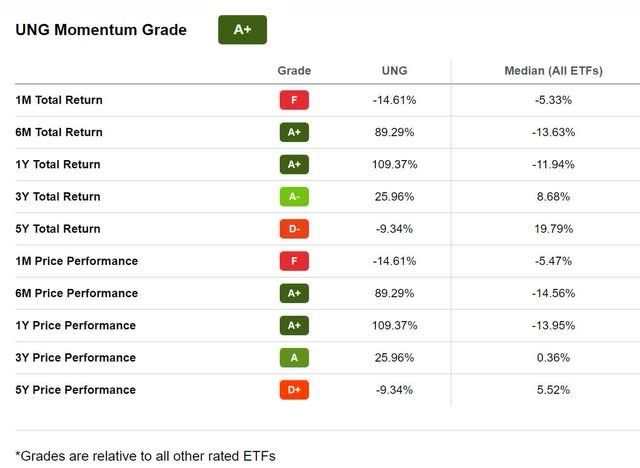

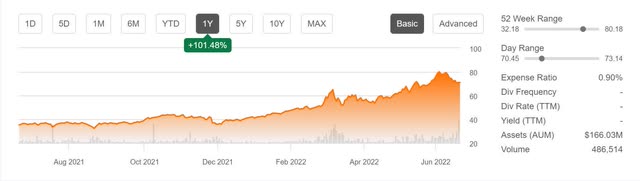

As evidenced by the below chart, UNG’s one-year price performance is +106%, benefiting from high demand, limited supply, and tailwinds caused by geopolitical issues abroad, namely in Europe.

UNG 1-year Price Performance

UNG 1yr Price Performance (Seeking Alpha Premium)

Despite a recent fire at Freeport LNG that halted the US’s largest export facility of liquid natural gas (LNG), causing an ~15% fall in natural gas prices (NG1:COM) last week, and trade halting of UNG, which fell 12.5%, this week is almost business as usual for UNG. According to some reports, the outage is expected to affect other natural gas companies through the end of the year. Still, we see no slowing in demand for natural gas, which has surged post-COVID, and now more than ever since Putin invaded Ukraine.

Foreign demand is in full effect, and despite the few headwinds experienced over the last month, it’s evident in the UNG’s Momentum Grade that this ETF is still on an upward trajectory.

UNG Momentum Grade (Seeking Alpha Premium)

As nations fuel the need for efficient, clean energy, liquid natural gas has grown in popularity as the fuel for the future, prompting an increase in production levels. Domestic natural gas approached $10/MMBtu, its height since its $14 price in 2008. Record high temperatures are creating higher demand for natural gas, and as Seeking Alpha Contributor Mike Zaccardi, CFA, CMT writes:

“Having been a professional energy trader and risk analyst for many years here in Jacksonville, I keep a close watch on energy markets – both from a fundamental perspective and from the charts. Right now, I see support at $6.50. That level is key because it was the 2014 Polar Vortex-spike high and was the zenith during late 2021. It’s an important test underway…”

Natural Gas Continuous Contract: $6.50 Support

Natural Gas Continuous Contract: $6.50 Support (StockCharts.com)

“Retail traders can play it through the United States Natural Gas Fund, LP. The exchange-traded product offers exposure to near-dated natural gas futures contracts. With that, though, comes significant roll risk when the futures market is in contango. Right now, however, the market is in slight backwardation, so there is much less risk of losing out when the fund transitions its holdings to later-dated contracts…I’d be a buyer of NG right here.” -Zaccardi

Despite some changes abroad, UNG down from its year-to-date high of $32.72, and the potential effects of the Freeport LNG facility halting production, we agree with Zaccardi that now may be a great time to get in on the action, because we still see substantial upside in the natural gas market, especially given the supply chain constraints taking place abroad.

2. The United States Gasoline ETF (NYSEARCA:UGA)

The markets have been shaken following the Fed’s decision to increase rates by 75 basis points. With the first decline in nearly ten weeks, oil and gas prices on the heels of the Fed decision may be signaling dampening in demand, or perhaps recession. Consumers are hoping that the pain at the pump nationwide gas prices exceeding $5 per gallon, now under $4.99 per gallon this past weekend, according to AAA, may offer some relief. The United States Gasoline ETF invests in futures contracts of gasoline, crude oil, natural gas, and other fuels and tracks the spot price of gas traded on the New York Mercantile Exchange.

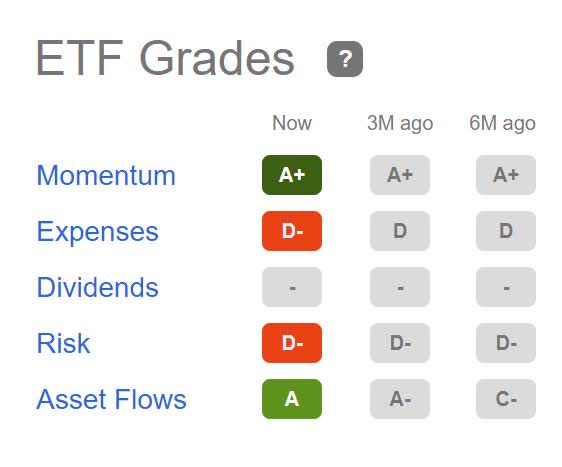

UGA ETF Grades (Seeking Alpha Premium)

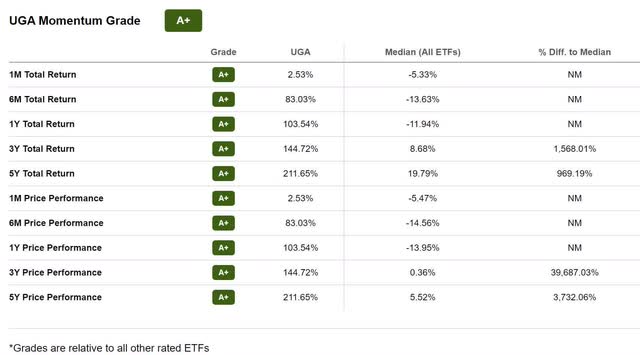

UGA’s ETF Grades also possess stellar Return and Momentum grades, offsetting the less than ideal Expenses and Risk grades. With a one-year price performance of +100%, despite recent falls in gasoline prices, we believe this ETF’s near-perfect momentum will maintain its bullish trajectory as tailwinds continue to push demand and prices.

UGA 1-year Price Performance

UGA 1-Yr Price Performance (Seeking Alpha Premium)

While the recent FOMC decision may have divided analysts and whether recent declines in oil are signaling a broader or if the surge in prices will continue its seven-month streak, the target that the Fed has on the back of commodities could be the trigger for the rate increases thus the subsequent decline in gas prices. Higher fuel prices are creating demand destruction, but fuel needs remain high. As the summer is now in full swing, the travel season is underway. Although supplies may be limited in some areas putting pressure on prices as the pump and suppliers in some parts of the country are jacking up prices, the majority of the supply-side pressures we’re seeing are taking place in Europe because of the war in Ukraine. These geopolitical factors benefit U.S. fuel companies and UGA. Peter F. Way best conveys it in his article, UGA: A Bet On $8 A Gallon Gasoline.

“Other better opportunities for wealth-building may exist now, but this article presents an attention opportunity magnified by the tragic invasion of Ukraine by Russia. We do not take any comfort in the misery which is unleashed by those actions…(But) the US hasn’t even started shipping the promised EU deficit caused by shutting down Germany’s pipeline imports from Russia in response to their invasion of Ukraine.”

There is a strong possibility that demand will continue to increase as European nations like Germany are falling back on retired coal power plants amid their energy crisis. The EIA shows that crude oil price is one of the most crucial components of gas prices, accounting for nearly 60% of the price per gallon. Russia, the second-largest producer of crude and refined oil, has caused the prices of crude oil to surge, trading above $90 per barrel since February 25, 2022. UGA’s A+ momentum continues on a bullish trend, despite rate hikes.

UGA Momentum Grade (Seeking Alpha Premium)

The facts remain. Decreased supply and increased demand are contributing to elevated prices for the foreseeable future. Our two best ETFs to buy now are UNG and UGA, which stand to benefit from increasing prices and the war abroad. Whether the projected rate hikes continue and prices increase, fuel is at the forefront of rising prices, and we believe there is still upside potential for these investments.

Conclusion

The energy sector continues to boom, with fuel prices sky-high around the globe and nations outside of the U.S. and Eurozone capitalizing on the increasing demand. With less risk and volatility than individual energy stocks or energy futures, ETF are great buys, especially if you can identify those with quality characteristics and holdings. Our two energy ETFs are rated Strong Buys, have strong long-term momentum, asset classes that are in demand, positive investor inflows, and rising AUM.

We have dozens of ETF Sectors to choose from. Our two strong buy recommendations, UNG and UGA are essential – and stand to benefit from price increases. UNG and UGA have been on a bullish tear over the last year, with upward momentum given the price of commodities and futures contracts for their holdings, which have done very well. Both ETFs are a great play to diversify a portfolio and ride the energy wave. They possess great outlooks and collective characteristics, with tailwinds for continued momentum. Finding knowledgeable investment resources is a great way to be a successful investor in volatile markets. Consider using Seeking Alpha’s screening criteria link above to help you find an ETF that achieves diversification into desired sectors you like. If you are interested in finding Top Energy Stocks, they can also be found in Seeking Alpha’s screening tool.

[ad_2]

Source links Google News