There are many ways to gain exposure to cryptocurrencies. We’ve talked about several of them before but today, we are going to focus on some of the top crypto Exchange Traded Funds (ETFs).

ETFs are excellent ways for passive investors to gain exposure to emerging industries. They also happen to be the simplest way to get exposure to cryptocurrencies.

As Canadians, we are quite fortunate to have several Canadian ETFs that cover the industry. While other countries like the United States have dragged their feet, we have many opportunities that other investors do not.

Should I buy a cryptocurrency ETF or simply the cryptocurrency itself?

Many experienced investors and those learning how to buy stocks who are looking to buy cryptocurrency often already have an investment account set up. Whether it be a TFSA, RRSP, or cash account, you have the ability to buy crypto ETFs in the single click of a button.

There is certainly a convenience factor when it comes to cryptocurrency ETFs. And, another large benefit to purchasing the ETF, especially in a tax-sheltered account, is that your gains will be tax free.

The same cannot be said if you buy cryptocurrency on a platform like Bitbuy. Although you will be able to claim capital losses in the event your crypto investment goes south, you will also be forced to pay capital gains in the event you sell for profit.

Simply put, you need to weigh the pros and cons of purchasing cryptocurrency in a taxable account, or taking advantage of the tax opportunity and buying these crypto ETFs in a tax-sheltered account.

This list will contain what we feel are the best in class cryptocurrency ETFs

We see plenty of articles highlighting the dozens of cryptocurrency ETFs you can buy here in Canada. The reality of it is, these lists get a bit convoluted. In our opinion, most all of these funds provide the exact same purpose, so why not simply list the one we feel is best in class?

All of these ETFs trade on the Toronto Stock Exchange, and if you do want alternate funds, we’ll list them in point form below.

These are the best cryptocurrency ETFs in Canada today

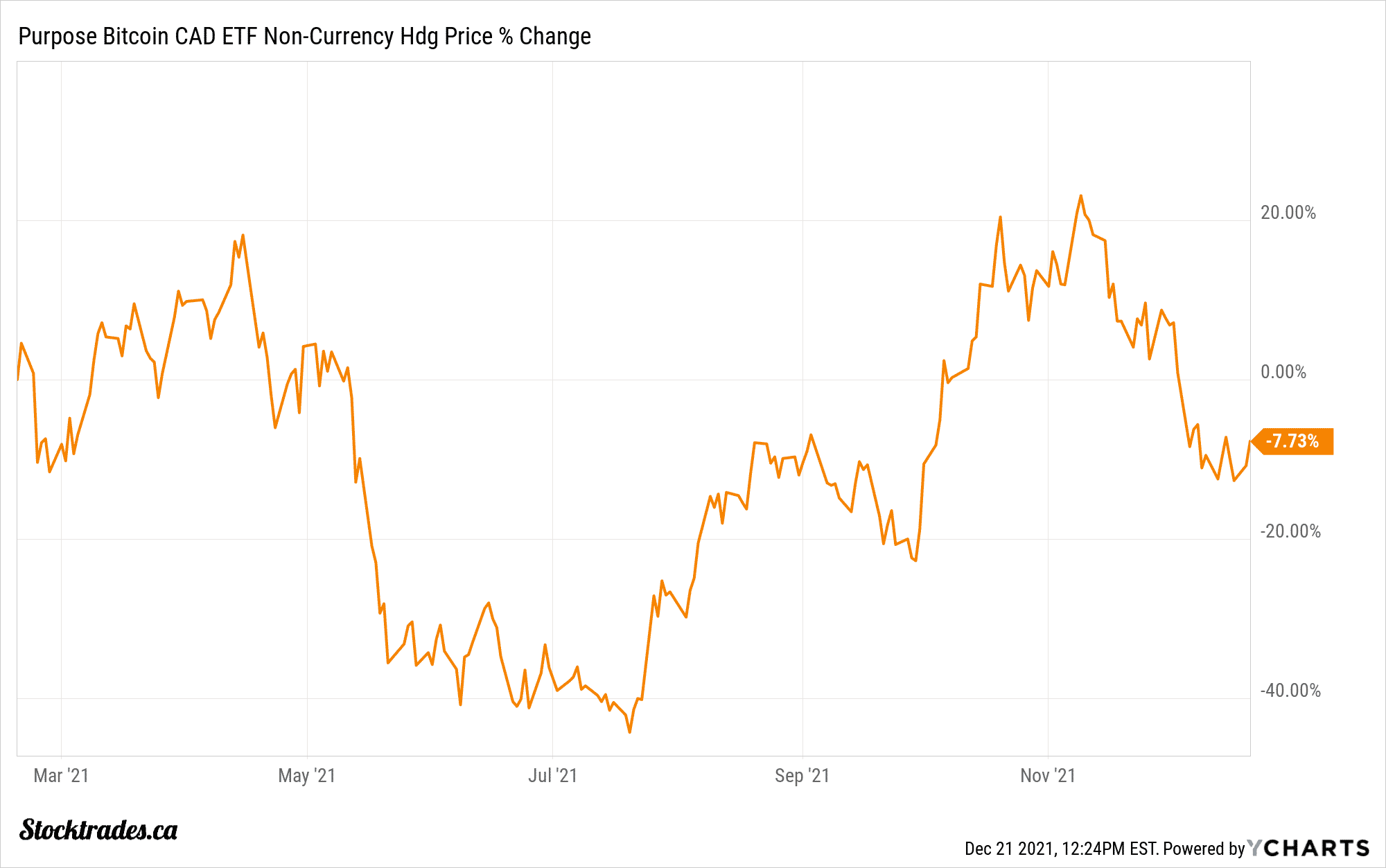

Purpose Bitcoin ETF (BTCC)

Let’s start with the mother of all cryptos – Bitcoin. Canada beat the US to the market with one of the world’s first Bitcoin ETFs, and that distinction belongs to the Purpose Bitcoin ETF (BTCC). While Purpose has one of the higher fee structures (capped at a MER of 1.5%), it makes the list as our top choice as it is the largest fund in its class with $1.8B in assets under management.

It was first to market and remains the most popular among investors, which is why we are willing to overlook high expenses.

The fund is backed by actual bitcoin held in cold storage and aims to replicate the daily price movements of Bitcoin. What also makes Purpose’s product unique is that there are several options for investors:

BTCC.B: CAD non-hedged product. The most popular of all the options available.

BTCC.U: USD product.

BTCC: CAD Hedged to the US Dollar.

BTCC.J: Carbon Offset non-hedged product. A new product, this one is aimed at those who want to ensure that the Bitcoin sourced is not having a negative impact on the planet. Purpose utilizes a portion of the MER fees to purchase carbon credits which are used to cancel out the carbon footprint of the fund. It is estimated that offsetting fees are roughly 0.10-0.20% for BTCC.J

Overall, if you’re looking for exposure to Bitcoin we see Purpose’s fund as being the best. However, if you’re looking for alternatives, here is a quick list:

- Evolve Bitcoin ETF (EBIT)

- CI Galaxy Bitcoin ETF (BTCX)

- 3iQCoinShares Bitcoin ETF (BTCQ)

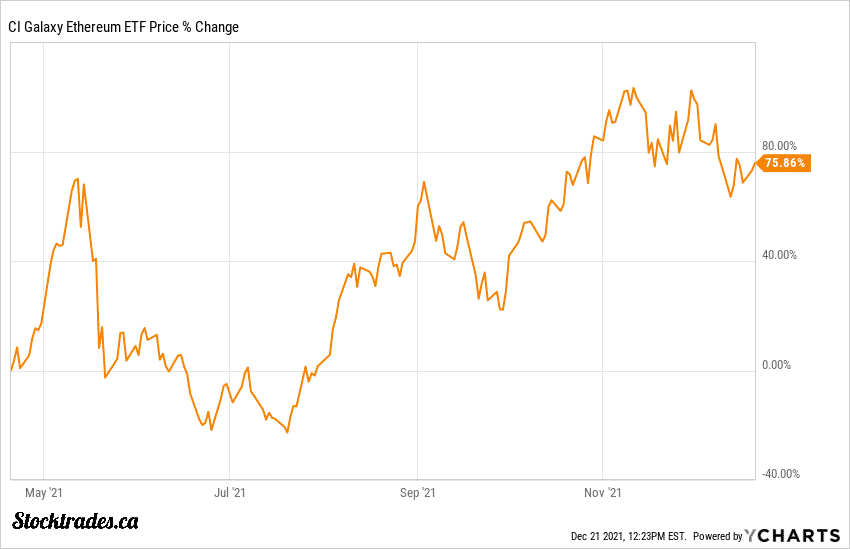

CI Galaxy Ethereum ETF (ETHX)

The only other crypto-tracking-related ETFs in Canada center around Ethereum. This isn’t surprising, as Bitcoin and Ether are largely considered the top cryptocurrencies in the world. There are two products: the Canadian Unhedged Series (ETHX.B) or USD Series (ETHX.U)

Along the same lines as above, CI Galaxy Ethereum ETF (ETHX) is the largest Ether ETF in the country. The ETF’s investment objective is to provide holders of units exposure to Ether through an institutional-quality fund platform. It aims to track the daily price movements of Ether (ETH).

As of writing, the fund has $1.464 billion in assets under management and has a low management fee of 0.4% – one of the lowest among all Ethereum-listed ETFs. So with this ETF, you truly do get the largest and one of the cheapest options out there.

Each unit is equal to 0.003684 ETH and it requires ~271.5 units to equal 1 ETH. Overall, ETHX has become the go-to for those interested in exposure to ETH. The ETF is more than 3 times the size of its closest competitor.

And speaking of competitors, if you’re looking to do some digging into other Ethereum ETFs, here’s a quick list of CI’s competitors:

- Purpose Ether ETF (ETHH)

- Evolve Ether ETF (ETHR)

- 3iQCoinSharesEther ETF (ETHQ)

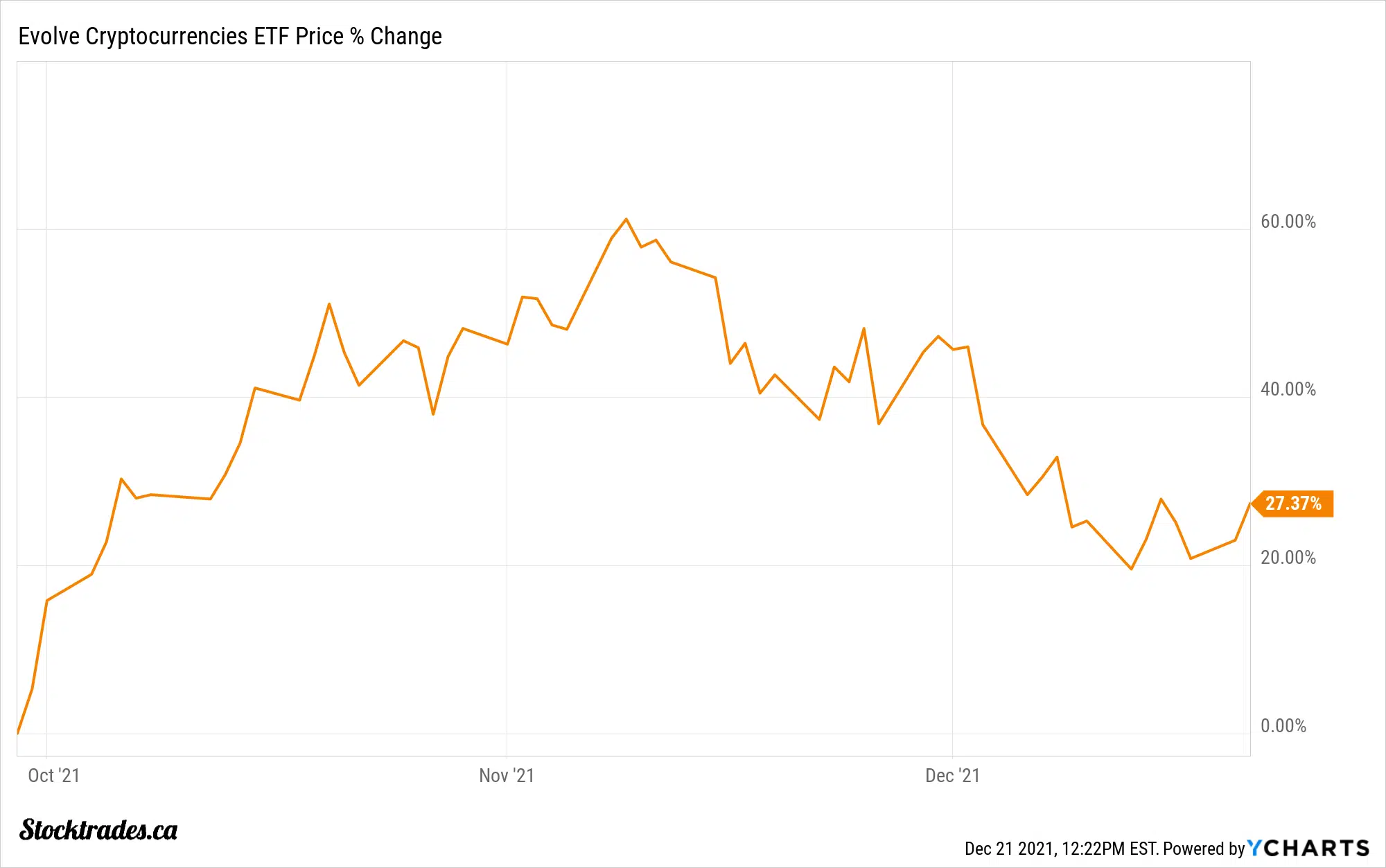

Evolve Cryptocurrencies ETF (TSE:ETC)

Can’t decide between Bitcoin and Ethereum? Why not go with the first multi-coin ETF in Canada. Evolve’s Cryptocurrency ETF (ETC) provides investors with one convenient way to obtain exposure to cryptocurrencies, and gain exposure to both Bitcoin and Ethereum.

While the NAV is small at only $38.92M, the fund only launched in September and is not yet well known. It is however, an excellent way to cover both coins in one simple product.

As it is a new fund, the MER is not yet known but we expect it’ll come in around 0.75% to 1.00% based on Evolve’s other products. Much like the other crypto ETFs on this list, it also has both a CAD unhedged (ETC) and USD series (ETC.B).

It is important to note that it is not a perfect 50/50 split. As of writing the fund was ~63% Bitcoin and 37% Ethereum. As you can see, the product is still heavily weighted towards Bitcoin.

In other words, this is a product for those wanting to be overweight BTC but don’t want to miss out on owning Ethereum in their portfolio. Considering this fund is relatively small and recently launched, there really isn’t much competition in the space, so there’s no alternatives at the time of writing.

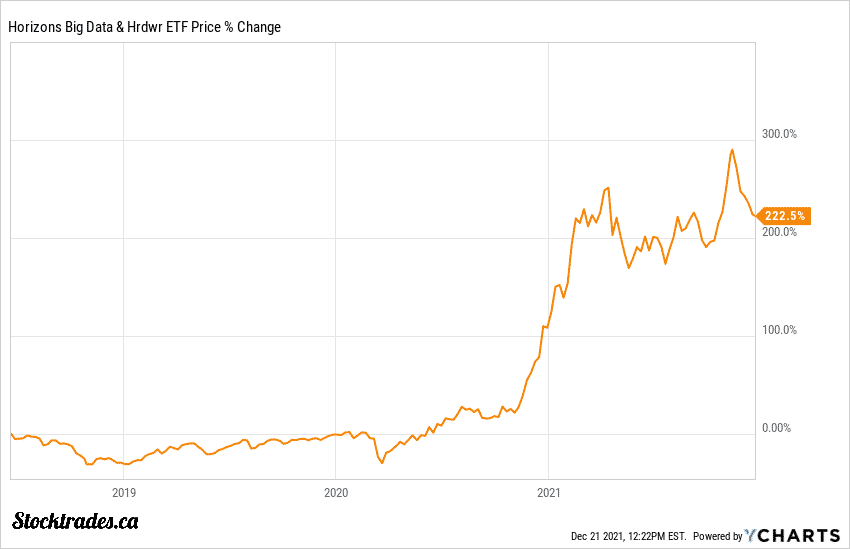

Horizon’s Global Metaverse ETF (TSX:HBGD)

While not tied directly to cryptos, Horizon’s Global Metaverse ETF (TSX:MTAV) seeks to replicate the performance of the Solactive Global Metaverse Index. The Index is focused on global, publicly listed companies that potentially stand to benefit from the adoption and usage of technologies expected to grow and support the functioning of the Metaverse.

Keep in mind, the Metaverse and cryptocurrencies go hand in hand. Several of biggest Metaverse’s in the space are built on the Ethereum network. So while these aren’t crypto companies per-se, there is certainly a strong tie to the crypto space.

The fund was just launched and as a result has only $4.8M in assets under management. So this is a small fund and investors must be cautious. It has reasonable MER fees of 0.55% and the top 10 holdings are some of the more notable tech companies on the planet such as Apple, Nvidia, Amazon, and Meta (formerly Facebook).

This is likely a fund for those who want to dip their toes into the crypto space by investing in an ETF that has a very specific purpose. The good news is that it features many big names and looks like a well-balanced technology ETF. The bad news, it may not meet investors’ needs in terms of crypto exposure.

Our thoughts on The Purpose Bitcoin Yield ETF, Purpose Ether Yield ETF and Purpose Crypto Opportunities ETF

Purpose Investments launched 3 relatively new funds in late November 2021 to give investors some unique opportunities when it comes to crypto via the generation of passive income.

Its Bitcoin Yield ETF (BTCY) and Ether Yield ETF (ETHY) will use a covered call strategy to generate a monthly yield for its unitholders. We’re not huge fans of covered call ETFs here at Stocktrades.

Their strategies do generate more income but tend to cap upside. On slower-growing or declining assets this might be a strategy that could benefit the investor in the long term. However, with an asset that is growing as fast as cryptocurrency is, we’re not sure we would want to cap our potential capital gain by selling call options on it. Yes, there will be volatility, but we can expect that volatility to be present in these funds as well.

In terms of the Purpose Crypto Opportunities ETF, this one is an actively managed ETF that will seek out opportunities in the crypto space in an attempt to provide outsized returns. We can expect this active management to come along with larger fees.

Of note on these as well, there will be mutual funds available for purchase instead of the ETFs.