[ad_1]

Monthly flows into municipal bond ETFs have been net positive for 20-consecutive months. However, in October, flows slowed and are negative so far in November.

Through Nov. 8, the 44 muni ETFs have pulled in almost $3.4 billion in new assets. Perhaps more interesting, though, is the increase in trading activity.

The daily trading volume has averaged $246 million in these ETFs over the last year, but recently has increased to $392 million over the last month (and $486 million for the five days ending Nov. 8).

But the bulk of trading has been concentrated in a handful of funds: over the last month, the top five most actively traded muni ETFs captured more than 70% of the total trading volume. Those most actively traded muni bond ETFs are:

- iShares National Muni Bond ETF (MUB), $9.7 billion in assets under management

- SPDR Nuveen Bloomberg Barclays Municipal Bond ETF (TFI), $2.7 billion AUM

- Vanguard Tax-Exempt Bond ETF (VTEB), $3.5 billion AUM

- VanEck Vectors High-Yield Municipal Index ETF (HYD), $2.3 billion AUM

- SPDR Nuveen Bloomberg Barclays Short Term Municipal Bond ETF (SHM), $3.6 billion AUM

New Muni Bond ETF Arrivals

While asset growth may have slowed, the number of funds has grown, with four new muni ETFs launched since the beginning of October.

The new entrants are the First Trust Short Duration Managed Municipal ETF (FSMB) and the First Trust Ultra Short Duration Municipal ETF (FUMB) bring First Trust’s suite of muni ETFs to six.

And J.P. Morgan launched its first two muni bond ETFs: the JPMorgan Ultra-Short Municipal ETF (JMST) and the JPMorgan Municipal ETF (JMUB).

We also have the Columbia Multi-Sector Municipal Income ETF (MUST), an intermediate/long-term “smart beta” fund from Columbia Threadneedle.

Both new ETFs from First Trust are low duration, and like its other four funds, are actively managed. The two new funds from J.P. Morgan include an ultra-short-term fund (JMST) and an intermediate/long-term fund (JMUB). MUST will be following an index with fixed weightings in five sectors.

How The Elections Could Impact Munis

Coming out of Election Day, the prospect for congressional restoration of tax-exempt advance refunding as a financing tool for municipal bond issuers is now more promising, although not a sure thing. Restoring advance refunding would likely mean higher new issue volume.

In addition, the threat of new restrictions on tax-exempt private activity bonds (PABs) is greatly diminished by the pending change of leadership in the House of Representatives. (Among other things, PABs are issued for private colleges, universities and not-for-profit hospitals.)

Current Market

Year-to-date, the total return for the ICE BofAML municipal index has been -1.38%, but the high-yield and one- to three-year indices have positive total returns. And year-to-date muni ETF total returns are mostly negative as well, with the exception of the high-yield and low duration funds.

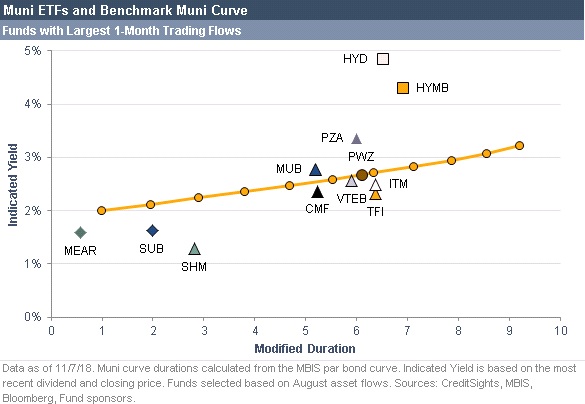

For most taxable investors, municipal bond yields are generally higher than the after-tax yields on U.S. Treasury bonds. In addition, the muni yield curve is steeper than the Treasury curve, so investors may be able to pick up incremental yield by taking on more duration risk.

Tactical investors using muni ETFs as a tool for temporarily implementing a particular view may wish to focus on the largest and most actively traded muni ETFs mentioned above.

Meanwhile, investors seeking core “buy and hold”-type exposure to municipals through ETFs now have more funds from which to choose, including the growing number of actively managed funds.

Muni ETFs can also be used to complement an existing portfolio of individual bonds. For example, adding a very-low- duration ETF can reduce the overall interest rate risk of the portfolio, or by using ETFs to add low-cost and broadly diversified exposure to high yield.

Bond investors considering year-end tax-loss swaps may even wish to consider using muni ETFs for the buy-side of their swaps if they are having difficulty finding suitable bonds sufficiently different from the bonds they are selling.

Patrick Luby is senior municipal strategist with CreditSights Inc. For more information or feedback, please call 212-340-3840 or email [email protected]. This article is not intended as an offer or solicitation with respect to the purchase or sale of any security or as personalized investment advice. No part of this report may be copied, disseminated, reproduced or distributed without CreditSights’ prior written consent. CreditSights, a publisher of investment research, does not give personalized financial or investment advice, and therefore does not recommend the purchase or sale of financial products or securities. Recommendations made in a report may not be suitable for all investors.

[ad_2]

Source link