Tight conditions loosen a little but employers still struggling to find workers

Article content

Canada’s unusually tight labour market loosened a little in November, but employers were still struggling to find enough workers to keep up with demand, new data showed.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

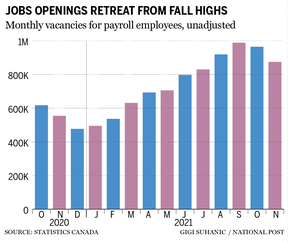

Employers had 874,000 unfilled positions, a decline of 9.3 per cent from October and the second consecutive monthly drop from a peak of about 988,000 vacancies in September, Statistics Canada reported on Jan. 27.

The report is positive, because a rebalancing of the labour market will be necessary to calm worries about rampant inflation, which spiked to 4.8 per cent in December from a year earlier, according to Statistics Canada’s consumer price index. Understaffed businesses can’t keep up with orders, and that’s putting upward pressure on the price of goods by constraining supply. An outsized number of unfilled positions also could push wages higher, a mixed blessing for the economy because companies might raise their prices to offset larger salary commitments.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

To be sure, vacancies remain unusually high even after November’s decline. The total was 72 per cent higher than the fourth quarter of 2019, and the vacancy rate, which measures vacant positions as a share of all positions, was 5.1 per cent, compared with three per cent before the pandemic, Statistics Canada said.

“We’ve definitely shifted to a job-seeker’s market,” said Brendon Bernard, an economist at Indeed, the hiring website.

Statistics Canada tallies job vacancies along with its monthly sweep of company payrolls, a supplementary measure of employment that complements the agency’s more timely Labour Force Survey (LFS). The payroll survey showed employers added 37,200 positions in November, pushing overall employment to within 0.4 per cent of where it was in February 2020.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

The LFS suggests hiring returned to pre-pandemic levels in the autumn, and more recent readings suggest employment is where it would have been if the recession hadn’t interrupted the trend.

Bank of Canada Governor Tiff Macklem said this week that the strength of the labour market as one of the factors that convinced him and his deputies that it was almost time to start raising interest rates. The Bank of Canada stopped short of doing so in its latest policy decision on Jan. 26, but the central bank was clear that an increase was likely at its next interest-rate meeting in early March.

“With strong employment growth, the labour market has tightened significantly,” Macklem said at a press conference. “Job vacancies are elevated, hiring intentions are strong, and wage gains are picking up.”

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

-

Bank of Canada puts credibility on line with hold on rates: economist

-

Will rate hikes dampen Canada’s already lacklustre business investment?

-

The Bank of Canada is holding, but make no mistake, rate hikes are coming

The latest Statistics Canada data show that firms involved in transportation and warehousing are having the hardest time finding workers. Vacancies in that industry climbed to a record 51,000 in November, and the vacancy rate rose to 6.2 per cent, the highest since the agency began producing comparable data in October 2020.

Hotels, bars and restaurants led the hiring in November as most restrictions on high-contact businesses had been eased. The number of vacancies dropped 11.7 per cent to 130,000, but the sector’s job vacancy rate — 9.9 per cent — was the highest of all major industries for a seventh consecutive month.

The Omicron wave of COVID-19 infections will likely reverse some of that hiring, as provinces once again ordered restaurants and other high-touch businesses to close to slow the virus’s spread. Macklem cited Omicron in explaining his decision to leave the benchmark interest rate unchanged this week, despite his growing unease over inflation. The Bank of Canada’s updated economic outlook sees economic growth slowing to an annual rate of two per cent in the first quarter from almost six per cent at the end of 2021.

• Email: bbharti@postmedia.com | Twitter: biancabharti

Advertisement

This advertisement has not loaded yet, but your article continues below.