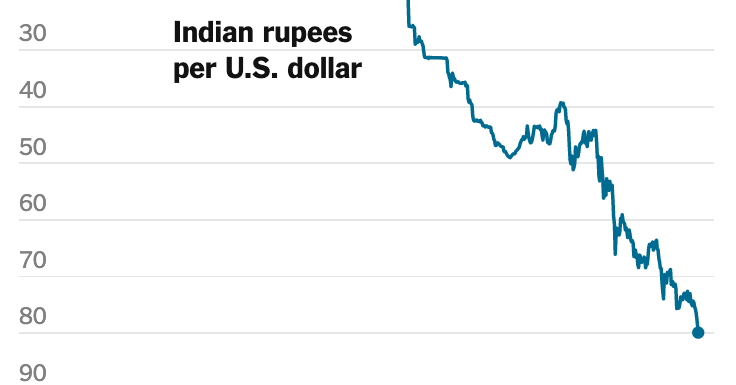

The Indian rupee touched the weakest level on record against the dollar on Tuesday, another victim of higher energy prices and a stronger greenback.

The rupee has lost about 7 percent of its value against the dollar this year as India has spent more to import sources of energy like crude oil, natural gas and coal. Prices of those commodities have climbed after Russia invaded Ukraine.

Another factor behind the decline of the rupee is uncertainty about the global economy that has, in turn, propelled the dollar to a 20-year high against the currencies of its major trading partners. Investors have pulled money out of India and other developing countries and poured it into the United States, where the Federal Reserve is raising interest rates aggressively to tame inflation.

“A lot of it is dollar strength rather than rupee weakness,” said Rahul Bajoria, the chief economist for India at Barclays. “It still feels like on a relative basis the rupee has done a lot better,” he said, pointing to the steeper declines in the value of the euro and the British pound against the dollar.

On Tuesday, the rupee briefly crossed 80 to the dollar for the first time. The Reserve Bank of India intervened in the market, as it had in recent months, to bid up the currency, according to local media reports.

As it has in much of the world, inflation has slowed economic growth this year in India. Reserve Bank officials responded by unexpectedly raising rates in May, and then again in June to 4.9 percent. But inflation remains around 7 percent, putting pressure on household budgets.

Prime Minister Narendra Modi’s government has cut taxes on fuel and restricted exports of wheat and sugar. And it has bought more Russian oil, which has become cheaper after sanctions imposed by the United States and Europe.