In an interview with Kevin Carmichael, Macklem says the economy needs, and can handle, higher interest rates

Article content

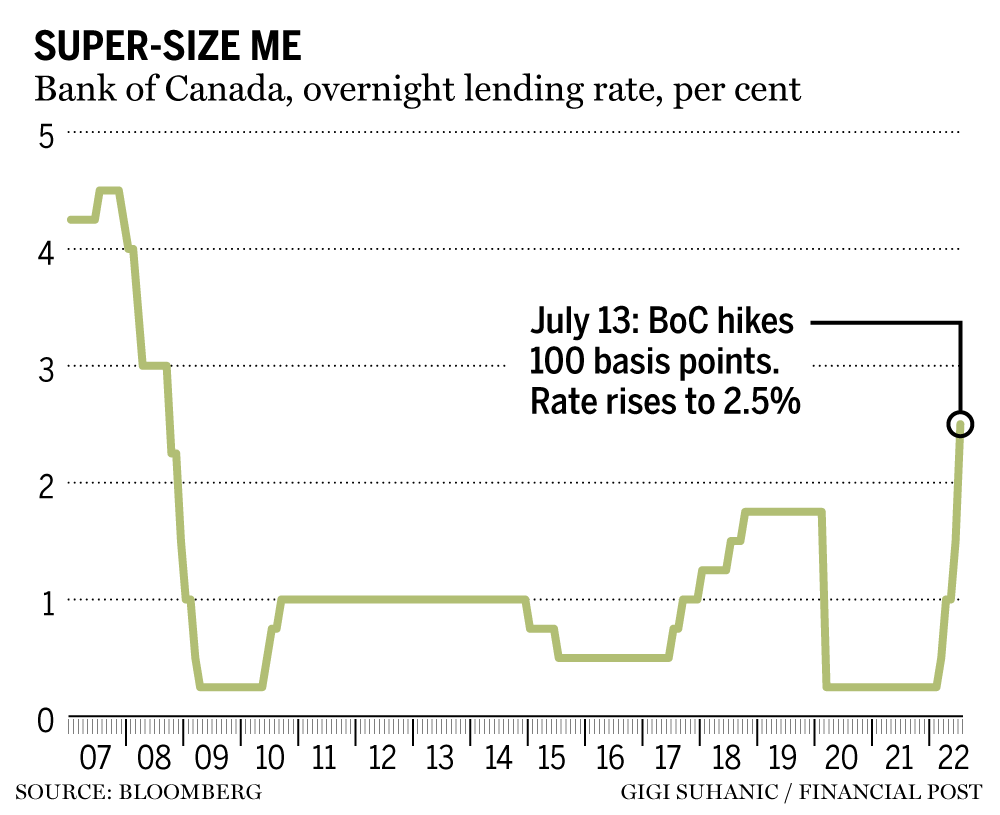

Financial Post editor-in-chief Kevin Carmichael sat down with Bank of Canada governor Tiff Macklem on Wednesday, hours after the central bank announced its decision to raise interest rates 100 basis points, bringing the benchmark borrowing rate to 2.5 per cent. What follows is an edited transcript of their conversation.

Advertisement 2

Article content

Kevin Carmichael: Is it fair to say that the primary mission today was shock and awe, to reset expectations around inflation?

Tiff Macklem: I’ll let you pick your favourite expression. I think it is fair to say that today’s decision expressed concern. I didn’t like your word, “panic.” (The decision) expressed concern that inflation is too high; it’s affecting all Canadians. And it expressed concern that the longer inflation stays too high, the bigger the risk that this high inflation becomes entrenched in people’s expectations.

So, yes, we did want to send a clear message to Canadian businesses and Canadian households that they should expect inflation to come down and they should build that into their expectations.

Advertisement 3

Article content

KC: What’s the best way to think about how inflation expectations work? That is, won’t people need to see inflation start to come down? Or are you convinced that a surprisingly aggressive move is enough to rest those expectations?

TM: Ultimately, Canadians will definitely need to see inflation coming down. They’re going to believe that inflation is coming down when they see it’s coming down.

But Canadians understand what’s going on. They understand that there are shortages in the economy. We’re all seeing shortages of workers. We’re all seeing shortages of goods and services. You buy something and it takes longer (to arrive). You want to go to a restaurant, it’s harder to get a reservation. You want to fly somewhere and the airports are clogged. We’re all seeing evidence. Canadians understand that the economy is overheated and it needs to cool. We’ve got to slow down spending, give supply the opportunity to catch up to take some steam out of inflation. If Canadians thought that we (at the Bank of Canada) didn’t see, and we didn’t understand that, that would be unnerving; that would start to unmoor inflation expectations.

Advertisement 4

Article content

So I do think central banks have a lot of influence over inflation expectations and I think by showing that we’re on top of this, we’re getting ahead of this, we’re being proactive, I think that does give Canadians confidence that they can expect inflation to come back down.

But yes, we do have to realize those expectations. Canadians do need to see inflation coming back down, and it is going to take some time. In fact, inflation is probably going to go up a little further before it starts coming down, and even when it starts coming down, in the beginning, it’s going to come down pretty slowly.

It takes time for monetary policy to work its way through the economy and bring inflation down. That’s partly why it’s important to get out in front of it. Monetary policy works in the lag. The sooner you get started, the sooner it’s going to work and the sooner that Canadians will see that it’s working and that will validate those expectations.

Advertisement 5

Article content

So I do think central banks have a lot of influence on expectations, and ultimately it is the job of the central bank to provide that anchor in the economy, that nominal anchor, to keep inflation expectations well anchored. You do that by hitting your inflation target.

Soft landings and front-loading interest rates

KC: We’re going to need to hit the brakes on economic growth to counter inflation. All you’ve really done today is take the foot off the gas. Does that mean that we’re ultimately going to have to get rates above neutral before you’re finished?

TM: We took a big step today. We raised rates 100 basis points. That puts us in the middle of what we call the long-run neutral range that we estimate to be between two and three per cent. We also indicated that we do expect that interest rates will need to rise further to cool demand and let supply catch up and see some easing in inflationary pressures. We stressed repeatedly that by front-loading the interest-rate increases, what we’re doing is we’re trying to avoid the need for interest rates to be even higher further down the road.

Advertisement 6

Article content

Front-loading tightening cycles do tend to be associated with softer landings. If you want good empirical evidence, and a good summary of that evidence, the (Bank of International Settlements) annual report that came out about three weeks ago has a very good chapter looking at the evidence of tightening cycles in all range of countries over a broad swath of time.

So, what that argues for is getting our policy rate quickly up to at least the top, or somewhat above the top, of this two-to-three per cent neutral range. Where interest rates ultimately need to go, is going to depend on the evolution of the economy and importantly, on the evolution of inflation.

So, what that argues for is getting our policy rate quickly up to at least the top, or somewhat above the top, of this two-to-three per cent neutral range. Where interest rates ultimately need to go, is going to depend on the evolution of the economy and importantly, on the evolution of inflation.

We have an inflation target. We don’t have an interest-rate target. Getting inflation back to target is paramount. As we move forward, we’re going to take each of those decisions, based on our best judgments at the time, reflecting our assessment of the economy and importantly, our outlook for inflation.

Advertisement 7

Article content

Loonie’s lost link to oil

KC: What’s your latest thinking on why the dollar seems to have lost its link with oil prices? And to what extent was today’s move about trying to get some upward pressure on the dollar, given how that influences inflation?

TM: Yes, historically, when oil prices have gone up, the Canadian dollar has acted as a bit of an automatic stabilizer in the economy. It’s been one of the benefits of the flexible exchange rate. When the price of oil in U.S. dollars goes up, the Canadian dollar tends to appreciate. What does that do? One, it dampens the inflationary shock for households at the gas pump, because it means the price in Canadian dollars doesn’t go up as much because the Canadian dollar absorbs some of that.

Advertisement 8

Article content

The other thing it does is that it spreads the benefits to Canada of a higher oil price because we’re an oil exporter, it spreads it more across the economy.

As you indicated, the Canadian dollar, while it’s been strong relative to most other country currencies, it has not appreciated against the U.S. dollar. It has been very stable against the U.S. dollar. So, what is going on? Explaining exchange rates is never easy, but I think there’s probably two things going on. One is we are not getting the historical investment boom in oil and gas that we’ve had when oil prices go up sharply like they have. We are seeing some increase in investment, but it’s more enhanced extraction, it’s not big projects. The obvious reason for that is that we’re moving to lower-carbon growth and a lot of our oil and gap, particularly oil, these are 25-year investments, so you’re not seeing a big investment boom; so, you’re not seeing a big influx of foreign investment; you’re not seeing as much of an increase in demand for Canadian dollars; and so you’re not seeing as much of a boost of the Canadian dollar.

Advertisement 9

Article content

The other thing is, you have to look at (Canada) as relative to the U.S. The U.S. Federal Reserve has done a rapid monetary-policy pivot and so interest rates have gone up very quickly. That’s strengthened the U.S. dollar a lot, and the exchange rate for us that matters the most is the U.S. dollar exchange rate because 75 per cent of our trade (goes to the United States). Our exchange rate is appreciating against most other countries, it’s just not appreciating against the U.S. dollar. So, those two things, I think, provide some explanation for why we haven’t seen, really, an appreciation of the Canadian dollar.

In terms of this decision, the fact that we haven’t seen as much appreciation of the Canadian dollar means we’ve got to do more through interest rates. That is something we’re taking into account.

Advertisement 10

Article content

‘Economy needs higher interest rates’

KC: Could you address the critique that you, the Fed, the big central banks are now overdoing it when it comes to inflation? That you’re now pushing forward too aggressively and the economy is going to suffer more than it needs to as a result?

TM: Front-loaded tightening cycles, typically, lead to softer landings. The other way to put that is, more gradual tightening cycles that end up having to take rates even higher end in bigger slowdowns. So, we are deliberately front-loading our policy response. Our objective is to get inflation back to target with a soft landing, and a front-loaded policy response gives us the best chance of achieving that.

Our objective is to get inflation back to target with a soft landing

Are we over doing it? We raised rates by a very big step, 100 basis points, but the level is 2.5 per cent. It’s not a high interest rate. You have to look at where we started. We started effectively at zero. Yes, we’ve raised rates quickly since March, in four steps, and it’s an unusually rapid increase, and that reflects the fact that the economy has moved rapidly into excess demand, and what started as international inflation coming largely from higher oil and higher prices for globally traded goods because of gummed up supply chains, what we’re seeing is that is broadening in Canada, and with that broadening, it’s persisting.

Advertisement 11

Article content

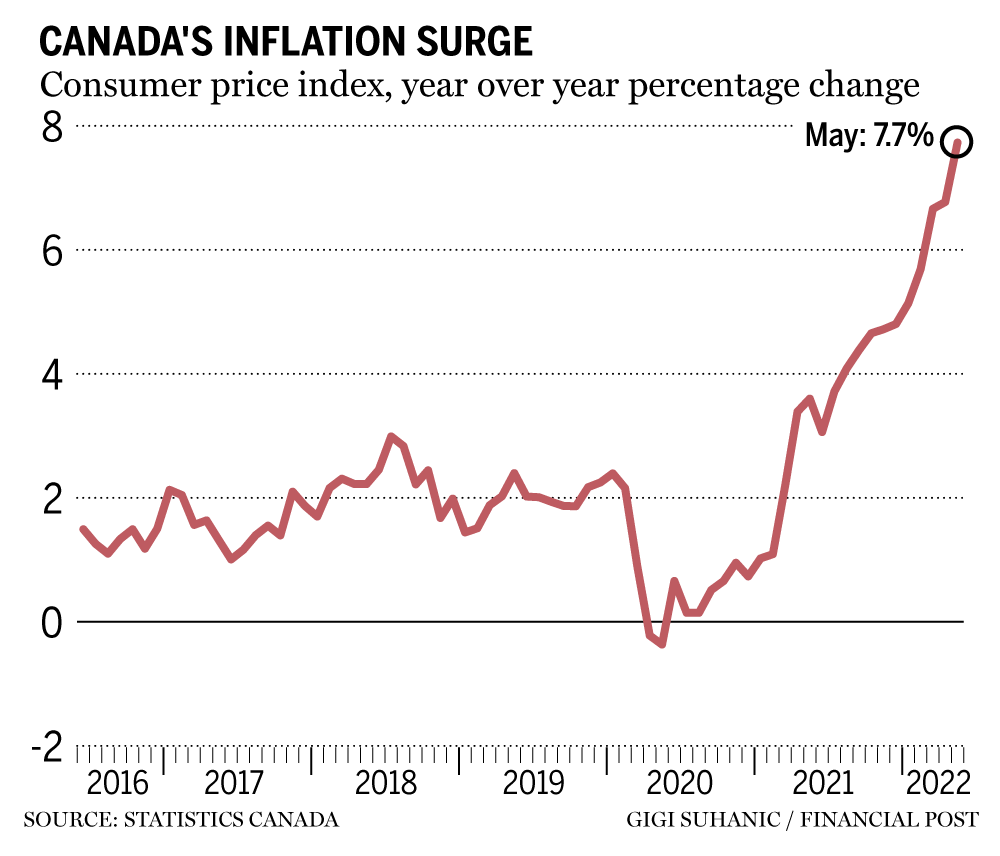

If you look at CPI-common, which is mostly services, it’s gone up from two per cent to almost four per cent. If you look at the CPI in total, almost three quarters, a little over 70 per cent, 72 per cent to be precise, of CPI components are now rising more than three per cent, more than half are rising more than five per cent.

These higher goods prices, these higher energy prices, particularly energy, has been passed through to a broad range of goods. Higher food prices are showing up in restaurant meals, labour shortages are showing up in services prices more generally. That’s a clear signal the economy is in excess demand. It needs higher interest rates. It can handle higher interest rates. We do need to moderate spending to take the steam out of inflation.

Advertisement 12

Article content

Money supply

KC: Monetarists are arguing forcefully that if central banks had kept a closer eye on money supply that we wouldn’t be in this mess. To what extent does Governing Council consider money supply when it’s making its decisions? And what’s your response to the broader notion that money aggregates had something to tell us all along?

TM: We do look at everything. We look at money growth. We look at credit growth. The thing about money growth, though, is that it’s a good predictor, some of the times, and then it’s not such a good predictor at other times. Money growth, it can be an indicator of spending, people need money to spend, but the inflationary impact of that spending, depends a lot on the state of the economy. If the economy is weak, and it needs extra spending because it’s like filling in a hole, that’s not inflationary. That’s filling in a hole. That’s preventing inflation from going down.

Advertisement 13

Article content

On the other hand, if your economy moves into excess demand, yes too much spending causes demand to run ahead of supply, supply can’t keep up, and inflation goes up. So, yeah, sometimes money is a good predictor of future inflation, but sometimes it’s not. Yes, you can draw a graph and you can see that money growth went up a lot in Canada, in the depth of depths of the pandemic and now inflation is high. On the other hand, if you go back, the Bank of England, for example, after 08-09 had very large quantitative easing programs, big surges in money growth and we did not see big surges in inflation after the global financial crisis.

So, I think the lesson is, you definitely want to keep an eye on money, but ultimately what you have to look at is, where is demand in the economy, relative to the economy’s ability to produce the goods and services that people want. And if supply can’t keep up with demand, you’re going to get inflation.

Advertisement 14

Article content

In the last several months, there’s no question demand has moved ahead of supply. If you look at the labour market, almost every indicator suggests the labour market is very tight and that’s why we’re seeing this broadening of inflationary pressures.

Just to go back to money, you know, I spent the first year of my career at the Bank of Canada, so in 1984, I was in a research group with a number of other economists. (Former Bank of Canada governor) Steve Poloz was one of them. It was just a few years after the bank had dropped money targeting, or as Gerald Bouey (the Bank of Canada governor between 1973 and 1987) famously said, ‘We didn’t abandon M1, M1 abandoned us.’ And at that time, there was a lot of focus in the Bank of Canada on finding a new monetary aggregate. It was like the new Holy Grail. What’s the new monetary aggregate where we can find the stable relationship between money growth, spending, and inflation so we could re-anchor policy on a new monetary aggregate.

Advertisement 15

Article content

I spent a year running a lot of regressions, and so did the other members of the team, and really at the end of that year, the conclusion was, ‘Yeah, if you overfitted these regressions, you could find what looked like a stable relationship.’ But as soon as you started to do out a sample of predictions, we could not find a stable relationship between money and income. That laid the groundwork for what became inflation targeting. Rather than using money as an intermediate target to try to control inflation, the idea was, ‘Well, if the relationship’s not stable, we’re just going to get ourselves in more trouble. We’re going to make more mistakes.’ So, let’s focus directly on our objective. Let’s focus directly on targeting inflation.

Advertisement 16

Article content

Money is something we’re going to watch, but it’s not always that reliable an indicator and you want to look at it in the context of a lot of other indicators. I think the success of inflation targeting has indicated that decision.

Lessons from inflation-forecast miss

KC: I’m going to try to squeeze in one more question. I’d like to hear your take on the exercise the central bank went through on why your inflation forecasts were so off. The box (in the Monetary Policy Report) is self-explanatory. The accounting is all there. But what are the one or the two takeaways that might change your thinking going forward?

TM: Well, let me start by just reflecting a little bit on my two years as governor.

Two years ago was my first press conference as governor. Very little has been normal in these last two years. We’ve been through the sharpest, deepest recession in history. We’ve had the fastest recovery we’ve ever had. We’ve seen the vaccines developed faster than they’ve ever been developed before. Oil prices went from virtually zero to $120 a barrel. Global supply chains have been impaired in ways that we have never seen before. And of course, Russia has invaded Ukraine.

Advertisement 17

Article content

I guess what I would stress is that our decisions have always been based on our best judgments, based on the best available information we had at the time. And they’ve always been grounded in our mandate, in our inflation-targeting objective.

Everybody has experienced this. The economy has been very unusually volatile and with that, we’ve had some usually large forecast errors. A couple of things come out of this exercise, which I think was important, and I think it’s important for two reasons. One, yes, we made unusually large forecast errors. We do need to be accountable for that. We do need to explain that to Canadians. And it’s also important that we understand our own inflation forecast errors because inflation is too high. We’ve got to get it back down and we need to understand where we missed to calibrate our response and how to get it back down.

Advertisement 18

Article content

-

Bank of Canada issues shock rate hike in effort to crush inflation

-

What the Bank of Canada’s full percentage point hike means for the housing market and your mortgage

-

What economists are saying about Bank of Canada’s steep rate increase

-

Bank of Canada’s jumbo rate hike set to slow banks’ earnings growth

What comes out of that to me, if you do the accounting, as you saw, roughly two-thirds of the miss comes from international factors, the biggest one being a sharp rise in the price of oil. A year ago, oil was about 50 bucks. As we normally do, we assumed that it would stay roughly at 50 bucks. That stable assumption, a “random walk assumption” if you want, has been about the best available predictor (of oil prices). So that’s what we do, typically. Of course, it’s more than doubled from that.

Advertisement 19

Article content

There have been also big increases in other commodity prices. And as I’ve already mentioned, global supply chains got seriously impaired and that really boosted the prices of many globally traded goods. So, all those things together account for about two-thirds of the inflation-forecast miss.

The part that is more under our influence, is the recovery, and the excess demand and the faster-than-expected recovery, that accounts for about a quarter of the miss. That’s where, if we had known everything a year ago that we know today, yes, we probably would have started raising interest rates a little bit earlier. But we didn’t know. A year ago, there was still a lot of excess supply in the economy. The unemployment rate was about seven and a half per cent last summer. We were still in the midst of waves of the virus. We were still experiencing on-again-and-off-again public health restrictions and you’ll remember as recently as January, when Omicron first hit us with a lot of force, there was a new round of public health restrictions. And of course, we didn’t expect Russia to invade Ukraine. And based on history, we did think that these global supply chain issues would work themselves out more. And some of them have worked themselves out more, but then new ones arrived. So, these supply chain disruptions have been much more systemic and persistent than they have been historically. And those things all surprised us.

Advertisement 20

Article content

As the economy got traction last year, we did taper our QE, we actually ended QE in October, nine months ago. We removed our exceptional forward guidance in January. We signalled very clearly to Canadians that they should expect a rising path for interest rates and since March, we’ve raised rates now 225 basis points. We’ve done that really to try to get ahead of this, front-load our response, keep inflation expectations well anchored and cool demand.

So, what did we learn from this? We learned what can start as international inflation, if you’re in excess demand, those domestic inflationary pressures will become more prominent. And that’s what we’re addressing.

• Email: kcarmichael@postmedia.com | Twitter: CarmichaelKevin