Contraction expected to be moderate and short-lived

Article content

Economists with the Royal Bank of Canada are predicting the country will head into a moderate and short-lived recession in 2023 as inflation, historic labour shortages and rising interest rates drag on the economy.

Advertisement 2

Article content

In a report released Thursday, the bank said Canada’s unemployment rate is now almost a full percentage point below RBC’s assumption of the longer-run, non-inflationary level.

“(Recession) has become, in our view, the most likely outcome,” Nathan Janzen, one of the report’s authors, said.

Bloomberg reported Thursday that RBC was the first of Canada’s big banks to make such a prediction.

The significant increase in interest rates, continuous inflation and central banks “sounding much, much more hawkish near term” have shifted the odds in the past months, Janzen said.

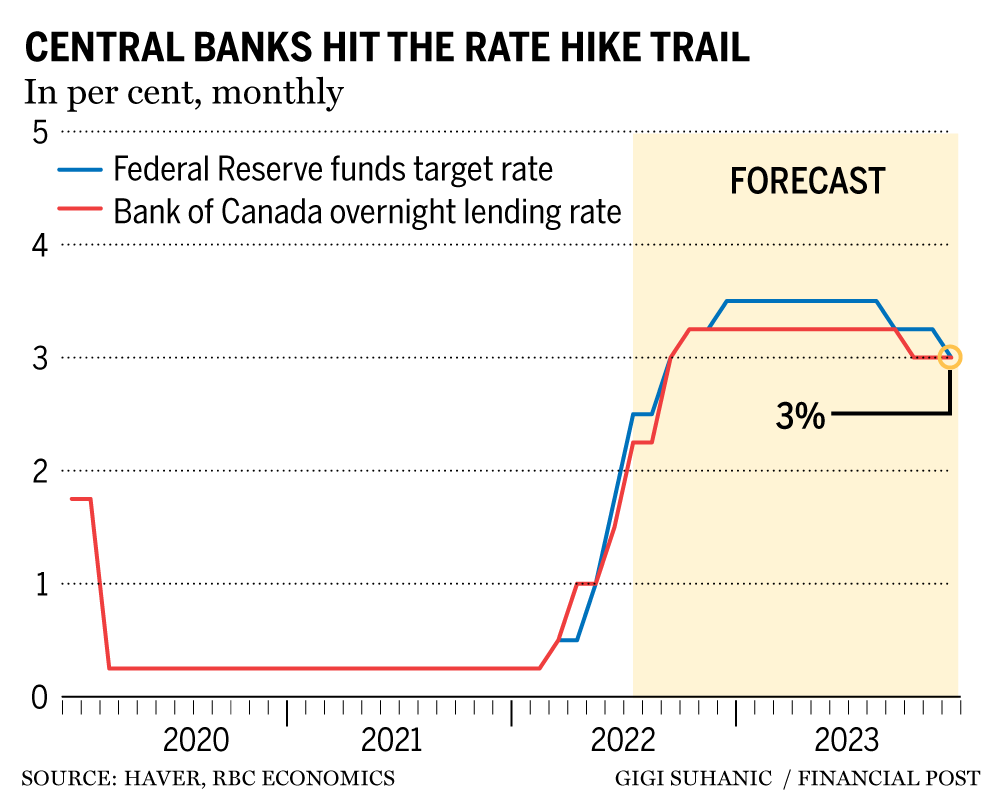

The report predicts the Bank of Canada will follow the lead of the U.S. Federal Reserve, which hiked rates by 75 basis points in June, during its meeting next week.

Advertisement 3

Article content

It isn’t the only hike the economists are expecting. They said they expect the Bank of Canada to lift rates to 3.25 per cent by the end of 2022, which they noted is high enough to significantly restrict growth, particularly in Canada, where household debt is very high.

Recession has become, in our view, the most likely outcome

Nathan Janzen

“It doesn’t take a whole lot at that point to push you into negative GDP growth rates at some point next year, which is how a recession is defined,” Janzen said.

Their report said that while the travel and hospitality sectors continue to recover, businesses are struggling to find the workers they need to expand production and soaring prices are cutting into Canadians’ purchasing power.

“Strong domestic demand for housing and services has intensified these pressures and the labour crunch is driving wages higher,” Janzen and fellow economist Claire Fan wrote.

Advertisement 4

Article content

The forecast expects the unemployment rate will jump another 1.5 percentage points to 6.6 per cent as the economic contraction plays out next year — when Canadians are already grappling with higher prices and debt servicing costs.

Nearly 70 per cent more jobs opened in June than before the pandemic and those hunting for staff were forced to compete for almost nine per cent fewer unemployed workers, it said.

“When you see unemployment starting to jump more significantly, that’ll probably be the first sign that … we’re in a recessionary backdrop,” Janzen said.

However, the economists said the slowdown will be modest and not as severe as prior downturns.

They pointed out that much of the pressure the country faces stems from outside its borders, and central banks both in Canada and abroad are aggressively hiking rates to slow household demand and fight inflation.

Advertisement 5

Article content

“Canadian households have socked away over $300 billion in savings since the end of 2019. That’s boosting spending — and adding more inflation pressure,” they wrote, noting that this leaves lower income groups more vulnerable to rising rates and prices.

A similar forecast by U.K.-based Oxford Economics on Wednesday predicts a “soft landing” for Canada’s economy, estimating a 40 per cent probability of a recession over the next 12 months.

“We’re increasingly concerned that a conjunction of headwinds along with imbalances in the household sector could push the Canadian economy into recession,” wrote Tony Stillo, the firm’s Canada economics director.

His report forecasts economic growth to slow sharply later this year and to stall in 2023.

Advertisement 6

Article content

-

Rising recession fears strip some of the lift from loonie’s outlook

-

‘Massive wealth’ Canadians stockpiled during pandemic being chipped away, study says

-

Soaring inflation expectations raise odds of super-sized Bank of Canada hike

Oxford is forecasting a soft landing for now, but “we’re concerned that the (Bank of Canada’s) fixation on dampening domestic demand to realign with supply will mean excessively high rates that could provoke a recession with still high inflation,” Stillo wrote.

The RBC report said this potential recession can be reversed once inflation settles enough for central banks to lower rates.

“Global inflation pressures may soon peak,” economists wrote, but added that prices are still rising too fast and inflation won’t slow sustainably until demand falls. Only then will central banks ease interest rates again.

They said a slowdown both in Canada and abroad will help temper inflation.

“We don’t think it’ll take long to unwind that weakness in 2024 and beyond.”

• Email: dpaglinawan@postmedia.com | Twitter: denisepglnwn