‘Canadians now face heightened economic anxiety because rates are going up by leaps and bounds’

Article content

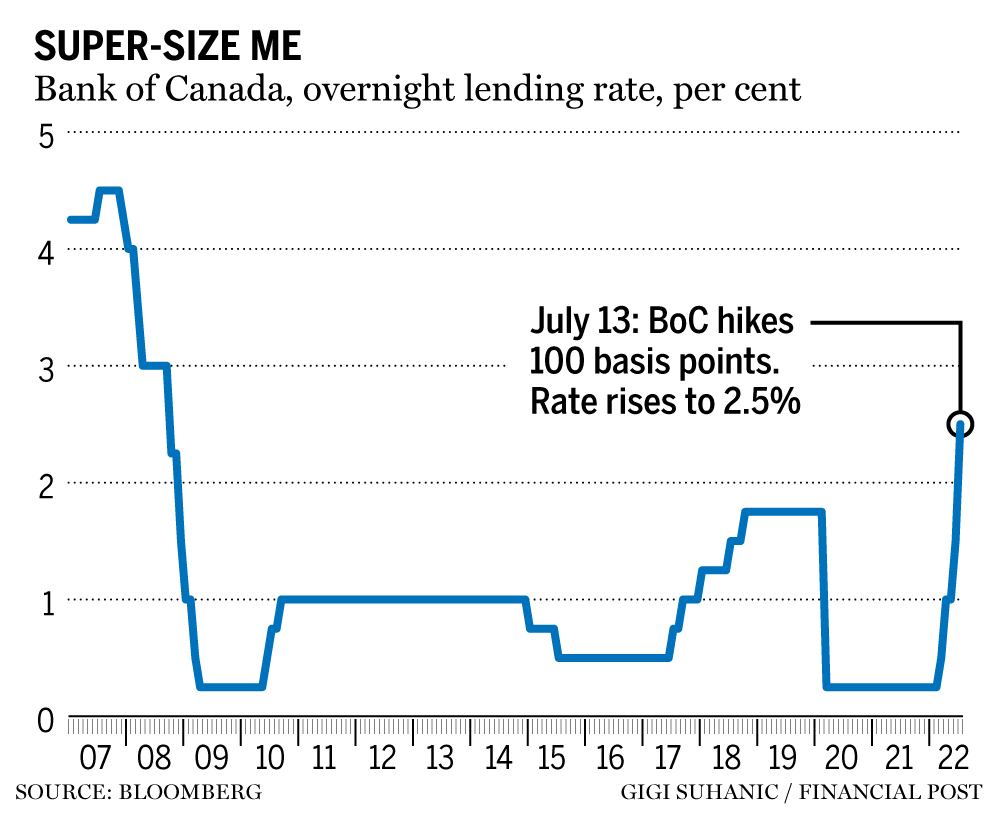

The Bank of Canada delivered a steep hike of the overnight interest rate on July 13 as it wrestles to get decades-high inflation under control.

Advertisement 2

Article content

Governor Tiff Macklem and his deputies raised the policy rate by a full percentage point, bringing the interest rate up from 1.5 per cent to 2.5 per cent. It’s an aggressive move by the central bank, and the largest since 1998, but the governing council likely felt assured in their decision after the United States Federal Reserve Bank made a similarly vigorous hike of 75 basis points last month.

Inflation has hit records not seen in four decades, climbing to 7.7 per cent in May, thanks to higher prices in almost every category Statistics Canada tracks. Many economists predicted price pressures could be peaking, however the central bank’s rate increase landed just after the U.S. released inflation data for June, showing its consumer price index surged 9.1 per cent over the year.

Advertisement 3

Article content

Prices in Canada tend to follow what happens south of the border, and with inflation showing few signs of cooling, more hikes are likely to come.

Read on for expert reaction to what this outsized increase means.

Derek Holt, head of capital markets economics at Bank of Nova Scotia

“What I’d emphasize in this regard is that I just can’t accept their depiction of today’s move as being about how ‘the Governing Council decided to front-load the path to higher interest rates by raising the policy rate by 100 basis points today.’ That implies they think they are getting ahead of inflation risk when in reality they are far behind in the fight against inflation. All they have done today is to tiptoe into the neutral policy setting when what Canada needs to counter inflation is something more deeply into restrictive territory. Front-loading would have been like the (Reserve Bank of New Zealand) and (Bank of Korea) did when they began hiking last summer.

Advertisement 4

Article content

“We’re so past any relevant point at which today’s actions can be described as front-loading the response, when a more accurate depiction portrays the BoC in perpetual catch-up mode to inflationary pressures. As a consequence to having misread inflationary impulses last year, Canadians now face heightened economic anxiety because rates are going up by leaps and bounds when earlier and more gradual rate hikes could have nipped some of the inflation risk in the bud and avoided today’s big changes.”

Royce Mendes, managing director and head of macro strategy at Desjardins

“The Bank of Canada is committing to further rate hikes. Despite the fact that there are some signs that the economy is slowing and certain components of inflation are cooling, central bankers are again tying their hands with forward guidance. There’s not a lot of data between now and the September meeting. So expect further policy tightening is on a pre-set course.”

Advertisement 5

Article content

Stephen Brown, senior economist at Capital Economics

“The statement noted that the decision to hike the policy rate by 100 bp 2.5 per cent — the first 100 bp move since August 1998 — was intended to ‘front-load the path to higher interest rates,’ rather than to reach a higher final destination. While the Bank said that it ‘continues to judge that interest rates will need to rise further,’ it provided no update on where it expects the policy rate to end up, having hinted last month that it intends to raise it to either the top end of its neutral rate estimate — of between two per cent and three per cent — or a bit further.”

Simon Harvey, head of analysis at Monex Canada

“With the Fed expected to conduct two further 75 bp hikes at their next two meetings, it is likely the BoC will follow up today’s decision with a 75 bp hike in September. From thereon in, with rates considered to be above neutral, adjustments are likely to take a more fine-tuning approach.”

Advertisement 6

Article content

James Orlando, senior economist at TD

“This big step up in rates is uncommon, so too is the economic backdrop. With the unemployment rate at 4.9 per cent, wages running at 5.2 per cent, and inflation at 7.7 per cent, the pressure on the BoC has not let up. …The hit to consumers from high inflation and rising rates will weigh on growth over the remainder of this year and into 2023. Though this raises the risk that the economy tips into recession…. the Bank has to accept this risk (and possible outcomes) in order to prevent high inflation expectations from becoming even more entrenched.”

Karl Schamotta, chief market strategist at Cambridge Mercantile Corp

“Fear of an unmooring in inflation expectations was evident throughout the release, with officials noting ‘surveys indicate more consumers and businesses are expecting inflation to be higher for longer, raising the risk that elevated inflation becomes entrenched in price- and wage-setting,’ implying that ‘the economic cost of restoring price stability will be higher.’”

Advertisement 7

Article content

Tu Nguyen, economist at RSM Canada

“As unsettling as this news is for consumers and businesses alike, an economy-wide recession is still unlikely in 2022. Certain industries, such as the housing market which has already slowed, will likely go into decline, but overall, the economic indicators of the job market, businesses, and consumers point to a still rather healthy economy. However, a slowdown is certain and a necessary tradeoff to restore price stability.”

-

Bank of Canada delivers jolt with 100 basis point interest rate hike to crush inflation

-

What the Bank of Canada’s full percentage point hike means for the housing market and your mortgage

-

Bank of Canada raises interest rate: Read the official statement

Advertisement 8

Article content

Josh Nye, senior economist at Royal Bank of Canada

“The BoC revised its GDP growth forecasts significantly lower, trimming 0.75 percentage ppts from its 2022 projection and 1.5 ppts from 2023. It attributed the downward revisions to higher inflation, tighter financial conditions, ongoing supply chain disruptions and weaker foreign demand (global GDP growth seen slowing to 2 per cent next year with the U.S. at 1.1 per cent). …

“The BoC thinks the easing of temporary supply disruptions (assumed to be worth 2.5 per cent of GDP currently) will support growth over the next two years, allowing for decent GDP gains while still absorbing excess demand (currently thought to be around one per cent of GDP). That allows inflation to ease from eight per cent in the near-term to three per cent by the end of next year and two per cent in 2024. But the BoC admitted the path to such a soft landing has narrowed. Indeed, we think the BoC’s forecasts are optimistic, with growth likely needing to slow more materially next year if domestic inflationary pressure is to be brought under control in any reasonable timeframe.

Advertisement 9

Article content

“In our view, a soft landing will be difficult to achieve and our forecast now assumes a mild recession next year.”

Charles St-Arnaud, chief economist at Alberta Central

“The key message in today’s decision is that the central bank is fully committed to controlling inflation. The decision to front-load the increase in policy rate is an effort to nip in the bud any upside pressure on inflation expectations and prevent the high inflation rate from becoming entrenched. It also suggests that when deciding between bringing down inflation or avoiding a recession, the BoC will prioritize inflation. This means that the BoC will likely remain unfazed by the current pullback in the housing market unless it threatens financial stability.”

Advertisement 10

Article content

“It is important to stress that the BoC has little control over global inflationary pressures coming from higher commodity prices or global supply chain disruptions. As such, increasing interest rates will not lower food or gasoline prices or make the computer chip shortage disappear. The only way for the BoC to lower inflation is by slowing the domestic economy, creating excess capacity and reducing domestic inflationary pressures. This is a balancing act that will lead to a period of economic underperformance, notably in the labour market and consumer spending. Whether it will be a soft-landing or a recession remains to be determined.”

• Email: bbharti@postmedia.com | Twitter: biancabharti