Economists weigh in on the first rate hike since 2018

Article content

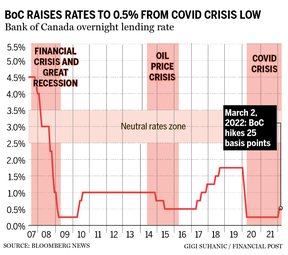

The Bank of Canada raised the key policy rate to 0.5 per cent from 0.25 per cent, the first increase since October 2018 and the kick-off of a hiking cycle intended to quell elevated inflation.

Advertisement 2

Article content

Below is a round-up of economists’ takes on the latest decision by Governor Tiff Macklem and his deputies:

Royce Mendes, head of macro strategy at Desjardins

“Today’s rate hike is the first step in the most consequential tightening cycle in decades. Monetary policymakers are trying to slow down already-red hot inflation instead of their typical tact of heading off price pressures before they fully emerge.”

“The Bank of Canada did acknowledge the additional tailwinds to inflation from the conflict in Ukraine and headwinds to global growth, neither of which were incorporated in its January Monetary Policy Report.”

James Orlando, senior economist at Toronto-Dominion Bank

“The Bank of Canada’s policy path isn’t set in stone. The Russia/Ukraine conflict is causing financial conditions to tighten. Should the spillover become more entrenched, further tightening may need to be reassessed.”

Advertisement 3

Article content

Stephen Brown, senior economist at Capital Economics

“While the Bank noted that the war in Ukraine will have ‘negative impacts on confidence’ and that ‘new supply disruptions could weigh on global growth’, it also highlighted that, due to the impact on energy and food prices, Canadian ‘inflation is now expected to be higher in the near term than projected in January’ and that this ‘persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards’.”

Josh Nye, senior economist at Royal Bank of Canada

“The BoC will have to weigh additional inflationary pressure brought on by that conflict against two-way domestic impacts (increased revenue for commodity producers, higher prices for consumers) and concerns about the global economic outlook. Central banks would normally look through geopolitically-driven commodity price pressures, but with inflation already so far above target the BoC has said it is more concerned about upside risks to inflation than downside. Indeed, it said “persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards.” In addition to inflation expectations, the bank will be keeping an eye on financial conditions. Government bond yields have fallen amid growth concerns and rising risk aversion, but corporate credit spreads have widened. Other financial channels have been fairly steady—the Canadian dollar has been in a tight range over the past month and the TSX has held up well relative to other equity markets. At this early stage, we don’t think geopolitical developments preclude a follow-up hike in April, nor do they argue for the more aggressive tightening path that markets continue to price.”

Advertisement 4

Article content

Stephen Tapp, chief economist at Canadian Chamber of Commerce

“Inflation pressures are broadening, medium-term inflation expectations are creeping up, and tight labour markets are causing wage pressures to build. Across a range of sectors, Canadian businesses are struggling with rising costs, and many say they’ll eventually have to raise prices. Thankfully, the economic recovery now looks sufficiently entrenched that it should be able to withstand the steady tightening of financial conditions that’s needed over the next few years to control inflation.”

Tu Nguyen, economist at RSM Canada

“What the rate hike can do is help anchor long-run inflation expectations, which have begun drifting from the 2 per cent target. The Bank’s actions can also play a role in cooling overheated housing market which has been breaking one record after another. As borrowing becomes expensive, households would think twice and hold off on buying.”

Advertisement 5

Article content

Kelli Bissett-Tom, director at Fitch Ratings

“While the Canadian economy is humming – with 4.9 per cent GDP growth in 2021 according to StatCan’s preliminary estimates, robust consumption, high household savings – and the labor market firms with 6.5 per cent unemployment in January, the risks to wage pressure and long-term price expectations are quite material. The start of the higher interest rate path and the investable balance-sheet reduction that we expect to commence during 2022 will remove fuel from the heated Canadian housing market, although supply constraints and skilled-immigration demand remain long-term structural features.”

Benjamin Reitzes, rates strategist at Bank of Montreal

“Assuming the economy maintains its forward trajectory and inflation stays hot (little doubt there near-term), the BoC ‘expects interest rates will need to rise further.’ That’s consistent with the rate hike path narrative and our expectation for another 25 bp rate hike at the April meeting. Meantime, there were no changes on the balance sheet front, though policy-makers are looking at ending reinvestment and QT. An April announcement on that front is possible, and we could get more colour from governor Macklem’s speech and press conference tomorrow.”

Advertisement 6

Article content

Charles St-Arnaud, chief economist at Alberta Centra

“Overall, today’s BoC decision supports our view that we should see further rate increases at the April and June meeting, bringing the policy rate level to 1.00 per cent by the summer and ending the year at 1.25 per cent. As for the balance sheet, the BoC has expressed a preference for using rate hikes rather than reducing the balance sheet size (QT) to remove the policy stimulus. With this in mind, we wouldn’t be surprised if a decision regarding the end of the reinvestment phase of QE only comes after another round or two of rate hikes.”

Taylor Schleich, Warren Lovely, Jocelyn Paquet, strategists at National Bank of Canada

“Despite the uncertainty created by the Russian invasion of Ukraine, there was never really a doubt that we’d get the Bank of Canada’s first rate hike since 2018 today. Moreover, this was not the ‘dovish hike’ that some had expected. With the Bank citing higher than expected growth and upside risks to inflation, it appears that a steady dose of normalization continues to be in the cards. While the Ukrainian crisis remains fluid and presents clear risks to the outlook, it looks like we’re on track for a second consecutive hike in April. Where the outlook becomes a little murkier is later in the year, if the crisis in Europe were to rage on and financial conditions continued to deteriorate. In this context, the risks to our forecast for five 2022 rate hikes might be skewed to the downside but we feel that there are still at least a couple of ‘easy’ rate hikes ahead in any event.”

Darcy Briggs, portfolio manager at Franklin Templeton Canada

“You’re going to see a lot more volatility (in the bond market) because there’s a heightened level of uncertainty that has to do with geopolitics and we still have a pandemic underway.”

• Email: bbharti@postmedia.com | Twitter: biancabharti