As larger players come round to the idea of cryptocurrency, or crypto, they are typically introducing crypto exchange-traded funds (ETFs). However, HNW investors remain keen to go direct into the asset class.

Cryptocurrency is highly volatile, with Bitcoin yet to return to its high of around GBP48,000 ($53,868.46) achieved in November 2021. Bitcoin is hovering around the GBP17,000 ($19,076.44) mark as of September 2022.

Unsurprisingly, GlobalData’s 2022 Global Wealth Managers Survey found that the average global HNW portfolio holds just 1.4% in crypto. Demand is expected to grow going forward; investors are keen, but they are also unwilling to let cryptocurrency take up a sizable chunk of their portfolio.

There are approximately 21,000 cryptocurrencies in circulation according to CoinMarketCap, so investors are not short of options. However, similarly to other securities, going direct comes with the most risk (and thus the most reward). As a result, players both old and new are providing clients with a cushion via crypto funds or ETFs, with Charles Schwab the newest entrant in this space. ETFs also offer an added layer of security as investors are less likely to be hacked or lose their assets due to forgotten passwords.

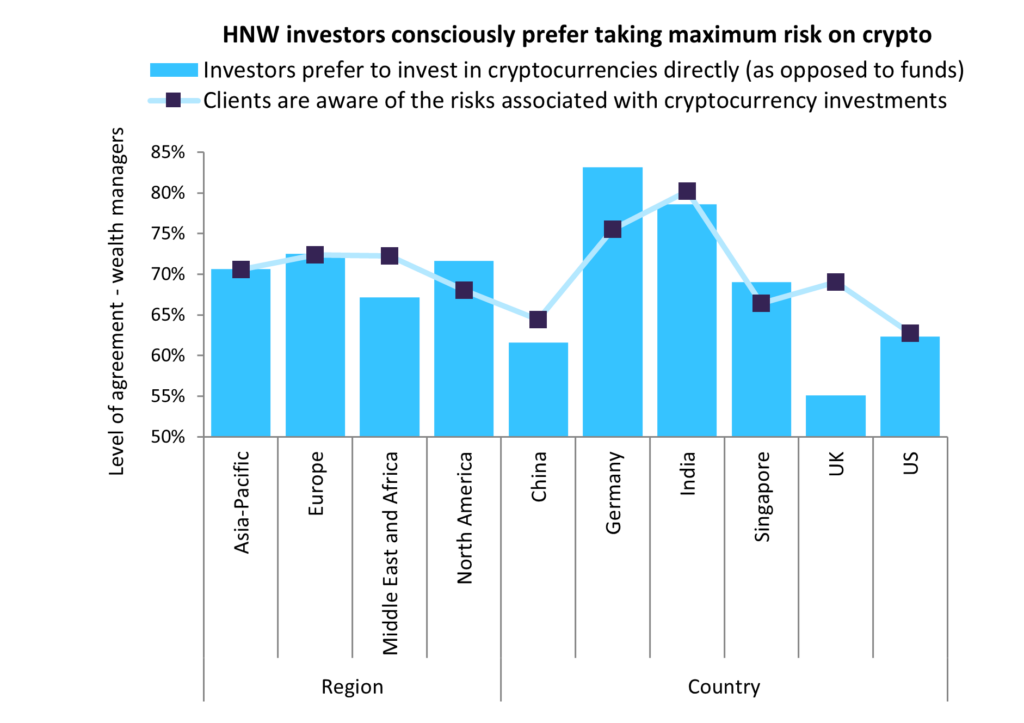

Nevertheless, players focusing solely on crypto ETFs are missing out on the significant chunk of HNW crypto investors who prefer to go direct. GlobalData’s 2022 Global Wealth Managers Survey found that the lion’s share of HNW investors across all regions are conscious and aware of the risk that comes with investing in crypto, and are happy to go direct as opposed to the safer option via funds. The potential of heightened returns is what pulls investors to the asset class; as it only takes up a small proportion of their portfolio, they are happy to take maximum risk.

Providing clients with a wide investment range and choice is key for retention. Although some wealth managers still question cryptocurrency and its longevity, customer demand has forced the hand of global players. For those that want to hold on to as much client wealth as possible, offering both a direct route into crypto investing as well as a fund option is essential.