Check here for news on how the conflict is affecting markets, businesses and the economy

Article content

Russia’s invasion of Ukraine has sparked unprecedented economic and financial retaliation from western nations which are piling on sanctions in what France has called “all-out economic and financial war.”

Advertisement 2

Article content

But the conflict will have consequences for the whole world as it cuts off crucial energy and crop supplies, disrupts businesses and upsets financial markets, already under stress as central banks tighten policy.

There is a lot going on out there so check here for the latest news on how the conflict is affecting markets, businesses and the economy.

4:10 p.m.

They opened higher, but closed in the red.

According to preliminary data, the S&P 500 lost 55.08 points, or 1.29 per cent, to end at 4,204.44 points, while the Nasdaq Composite lost 294.44 points, or 2.19 per cent, to 12,835.53. The Dow Jones Industrial Average fell 239.03 points, or 0.72 per cent, to 32,935.04. The TSX was down 119 to 21,461.

Indexes had opened higher after Russian President Vladimir Putin said there were “certain positive shifts” in talks with Ukraine, but a lot changed during the day.

Advertisement 3

Article content

Scan down to learn more.

3:43 p.m.

Deutsche Bank to wind down Russia business

Deutsche Bank said today that it would wind down its business in Russia.

Deutsche had faced stinging criticism from some investors and politicians for its ongoing ties to Russia after saying that leaving would go against its values, as other banks cut off ties.

“Like some international peers and in line with our legal and regulatory obligations, we are in the process of winding down our remaining business in Russia while we help our non-Russian multinational clients in reducing their operations,” the bank said today.

“There won’t be any new business in Russia.”

— Reuters

3:38 p.m.

What a wild week oil has had. It started out spiking to the US$130s, the highest since 2008, and ended posting the steepest weekly decline since November.

Advertisement 4

Article content

Brent crude futures rose $3.34, or 3.1 per cent, today, settling at US$112.67 a barrel, after hitting a session low of $107.13. U.S. West Texas Intermediate (WTI) crude futures rose $3.31, or 3.1 per cent, to settle at US$109.33 a barrel, off the session low of US$104.48.

2:45 p.m.

War could bring number of undernourished populations to 13 million people next year: FAO

The United Nations is warning the Russian invasion of Ukraine could cause the global tally of undernourished populations to spike by as many as 13 million people next year.

The war has destabilized a key region for production of grain, oilseeds and fertilizer, where Ukraine and Russia make up a third of the world’s cereal exports. As the invasion drags into its third week, the UN’s Food and Agriculture Organization (FAO) expressed concern that Ukrainian farmers won’t be able to plant seeds this spring or harvest a strong winter wheat crop expected in June. Even if they could, port closures in the Black Sea have choked off the main global access point to the country’s exports.

Advertisement 5

Article content

FAO Director-General Qu Dongyu said production disruptions are “likely” in the region. And any steep drop-off in exports will threaten to “seriously escalate food insecurity globally” at a time when the price of grain, oilseeds, fuel and fertilizer are already surging. Global prices for wheat and barley already jumped 31 per cent in 2021, he said in a statement on Friday, urging grain-growing nations to resist the urge to protect domestic supply by banning exports. Such measures would only continue to “drive up prices on global markets,” he said. “Before enacting any measures to secure food supply, governments must consider their potential effects on international markets.”

Losing exports from Ukraine and Russia would seriously constrict the global grain supply, Qu said, noting that Canada’s grain stores from last year’s harvest are running abnormally low due to a severe drought across the Prairies in 2021.

Advertisement 6

Article content

“It is still unclear whether other exporters would be able to fill this gap,” he said. “Wheat inventories are already running low in Canada, and exports from the United States, Argentina and other countries are likely to be limited as government will try to ensure domestic supply.”

The world’s top wheat importers — including Egypt, Turkey and Iran — would be forced to look elsewhere to replace Russian and Ukrainian products, driving up the price and making it even harder for developing countries to secure shipments. Some of the countries most dependent on Ukrainian and Russian grains are already facing food insecurity, including Yemen and Libya, according to the FAO.

FAO simulations suggest that a prolonged disruption to the region’s food production would increase the number of undernourished people by 8 to 13 million in 2022/23, “with the most pronounced increases taking place in Asia-Pacific, followed by sub-Saharan Africa, and the Near East and North Africa,” according to [http://Before enacting any measures to secure food supply, governments must consider their potential effects on international markets]an extensive report released by the FAO on Friday.

Advertisement 7

Article content

—Jake Edmiston

1:46 p.m.

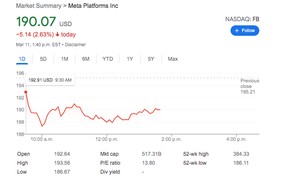

Meta Platforms shares fell 2.6 per cent as Russia opened a criminal case against Facebook’s parent after the social network changed its hate speech rules to allow users to call for “death to the Russian invaders” in the context of the war with Ukraine. Russia is seeking to have it designated an “extremist organization.”

1:30 p.m.

Ukraine’s top diplomat pushed back on the suggestion of “positive movement” in talks with Russia cited earlier by President Vladimir Putin, saying there’s been “zero progress.”

Ukrainian Foreign Minister Dmytro Kuleba said high-level talks Thursday with his Russian counterpart yielded no progress.

“There was zero progress in talks, so it’s hard for me to understand what kind of progress president Putin is referring to,” Kuleba said on Bloomberg Television.

Advertisement 8

Article content

Stock futures spiked on Putin’s comment early this morning, but have since slipped back.

12:53 p.m.

YouTube is immediately blocking access around the world to channels associated with Russian state-funded media, the company said today, citing a policy barring content that denies or trivializes well-documented violent events.

12:08 p.m.

Bay Street is stepping up its efforts to provide aid in the humanitarian crisis unfolding in Ukraine. The Bay Street Toronto for Ukraine fund launched yesterday and donations it collects will be sent to the Canadian Red Cross. The initiative is headed by Purpose Investments, Horizons ETFs, and the Faculty of Change.

“I think Bay Street has a huge opportunity to actually be a leading business voice in this country and to actually help on the fundraising side,” Vlad Tasevski, chief operating officer at Purpose Investments, told the Financial Post.

Advertisement 9

Article content

Tasevski added that he has been encouraged by the overwhelming response from Bay Street professionals, financial institutions and corporations in providing initial donations.

The fund aims to raise $500,000 and as of Friday morning, had reached just shy of $10,000. Donations are matched on a 1x basis by the Canadian government. The campaign will run until May 31.

— Stephanie Hughes

10:41 a.m.

Biden bans Russian-made vodka and caviar

U.S. President Joe Biden on Friday just called for an end to normal trade relations with Russia, clearing the way for increased import tariffs, and announced a ban on Russian-made vodka and caviar.

Revoking the trading status “is going to make it harder for Russia to do business with the United States,” Biden said in remarks at the White House, adding that it would “be another crushing blow to the Russian economy.”

Advertisement 10

Article content

The president can’t unilaterally change Russia’s trade status because that authority lies with Congress. House Speaker Nancy Pelosi said the House would consider legislation next week revoking Russia’s trade status, a move that has support from both Democratic and Republican lawmakers.

If Congress passes the legislation, Russia would join Cuba and North Korea as the only countries without the status.

The U.S. effort is happening in concert with European Union and Group of Seven nations, Biden said. Canada has already revoked Russia’s status.

— Bloomberg

9:44 a.m.

The relief rally seen in futures this morning is continuing after the opening bell.

U.S. stocks gained as risk sentiment got a boost after Russian President Vladimir Putin said he saw positive shifts in his country’s talks with Ukraine. The TSX was up 16.84 points at 21,598.

Advertisement 11

Article content

The news added a risk-on impulse to a session that had been volatile in early European hours. Gold and Treasuries fell.

Oil is on track for its biggest weekly loss since November.

— Bloomberg

9:25 a.m.

BREAKING!

The White House will revoke Russia’s “most favored nation status” over its invasion of Ukraine, U.S. House Speaker Nancy Pelosi said at a news conference on Friday.

9:20 a.m.

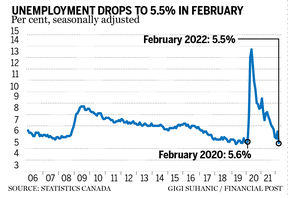

For all the uncertainty in the world right now, Canada’s economy appears to be chugging along nicely.

Statistics Canada data out this morning showed Canada gained a net 336,600 jobs in February almost double what was expected and the jobless rate fell a full percentage point to 5.5%.

“Obviously, economists were expecting a rebound but clearly not of this magnitude,” said BMO chief economist Doug Porter, after the data release.

Read Kevin Carmichael’s take here

8:50 a.m.

Advertisement 12

Article content

7:34 a.m.

BlackRock takes $17 billion in losses on Russian exposure

Ouch! The Financial Times is reporting this morning that BlackRock, the world’s largest asset manager, has taken about US$17 billion in losses on its Russian securities holdings because of the attack on Ukraine.

BlackRock said clients held more than US$18.2 billion in Russian assets at the end of the January, but sanctions and shuttered markets made most of it unsaleable, so they had to be marked down sharply.

The firm suspended all purchases of Russian assets on Feb. 28 and said at the time that its holdings related to the country had fallen to less than 0.01 per cent of assets under management.

Other large asset managers have also had to write down billions in exposure, said the FT. Pimco held at least $1.5 billion of sovereign debt and about $1.1 billion of bets on Russia via the credit-default swap market before the war.

— Financial Times

7:24 a.m.

The latest on markets

7 a.m.

U.S. stock index futures moved sharply higher this morning after Russian President Vladimir Putin said there were certain “positive shifts” in talks with Ukraine.

At 6:32 a.m. ET, Dow e-minis were up 424 points, or 1.28 per cent, S&P 500 e-minis were up 60.75 points, or 1.43 per cent, and Nasdaq 100 e-minis were up 223 points, or 1.64 per cent.

— Reuters

Additional reporting by Reuters and Bloomberg