Check here to find out how the crisis is impacting markets, Canadian businesses and the financial world

Article content

World stocks are tumbling this morning and oil prices are soaring as the West ramped up sanctions against Russia over the Ukraine invasion.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

Check here for live updates on how the crisis is impacting markets, Canadian businesses and the financial world.

11:36 a.m.

More than $20 million in crypto donations pour into Ukraine

Cryptoassets have been emerging as an important funding tool in the Russia-Ukraine crisis as Ukraine raised as much as US$20.9 million in digital assets since the beginning of the Russian invasion, according to data from U.S.-based crypto analytics firm Elliptic.

The figures, updated on Monday morning, represent over 23,000 cryptoasset donations raised by the Ukrainian government and other non-governmental organizations (NGO) supporting Ukraine’s military donations. One such NGO was Come Back Alive, which raised several million dollars.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

The official Twitter account of the Ukraine posted a Tweet over the weekend asking for crypto donations with an address linked within. The posted addresses have since seen 18,037 transactions and raised US$13.6 million. Elliptic added that one NGO saw a single US$3 million bitcoin donation.

Bitcoin represents the majority of cryptocurrencies being donated (56 per cent) with Ethereum in second place (32 per cent). Stablecoins and other cryptoassets like non-fungible tokens (NFTs) have also been sent to the Ukrainian government’s Ethereum account.

Crypto payments have been a faster way to process cross-border donations and side-step financial institutions that may be attempting to block payments to these Ukrainian groups.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

— Stephanie Hughes

11:23 a.m.

It’s extremely likely Russia will default on its external debts and its economy will suffer a double-digit contraction this year after the West launched sanctions unprecedented in their scale and coordination, the Institute of International Finance said today.

The IIF estimates that half of the foreign reserves of Russia’s central bank are held in countries which have imposed asset freezes, severely shrinking the firepower policymakers have to support the Russian economy.

— Reuters

10:38 a.m.

Dream of G20 going up in smoke

When Canada’s Paul Martin and America’s Lawrence Summers decided in the spring of 1999 that the world’s legacy powers and emerging economies such as China and Brazil needed a place to talk, they drew up a roster for what would become the G20.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

The G20 was supposed to bring stability, but five days into Russia’s invasion of Ukraine, it feels naive to think that a group that includes the United States, China, Russia, the United Kingdom, Saudi Arabia, and Turkey ever would have been able to accomplish much, writes the Financial Post editor-in-chief Kevin Carmichael.

Over the weekend, the United States, the European members of the G20, and Canada imposed “restrictive measures” that they said would stop Russia’s central bank from “deploying its international reserves in ways that undermine the impacts of our sanctions.” European Commission Ursula von der Leyen emphasized the point on Feb. 27, stating that the commission will “ban the transactions of Russia’s central bank and freeze all its assets, to prevent it from financing (Vladimir) Putin’s war.”

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

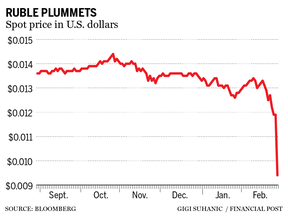

The founders of a group created in the aftermath of a rouble crisis has now triggered one. The Russian currency collapsed by some 40 per cent, more than during the country’s financial crisis in 1998.

Canada is a small player in this scene. “The Bank of Canada does not hold any of the Russian central bank’s reserves, nor does it transact with any Russian banks,” spokesman Paul Badertsher said in an email. “The Bank of Canada has also notified the Russian central bank that we will not facilitate any transactions for them.”

But what looks like the death of the G20 as a serious global body must be a disappointment to the globalists in Ottawa who thought they had helped to create something special. It looked that way for a little while. Then history got in the way, forcing the group to choose sides. Now they are fanning flames rather than dousing them.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

— Kevin Carmichael

10:16 a.m.

President Joe Biden’s administration on Monday banned American people and companies from doing business with the Bank of Russia, the Russian National Wealth Fund and the Ministry of Finance.

This is just the latest in sanctions aimed at cutting off Russia financially.

“Our objective is to make sure that the Russian economy goes backwards if President Putin decides to continue to go forward with an invasion in Ukraine, and we have the tools to continue to do that,” a senior U.S. administration official said on Monday.

This weekend Canada, the European Commission, France, Germany, Italy, the United Kingdom, and the United States issued a joint statement condemning Putin’s “war of choice” and attacks on Ukraine, and committed to ensuring the removal of “selected Russian banks” from the SWIFT system.

Advertisement

This advertisement has not loaded yet, but your article continues below.

Article content

The Financial Post’s Barbara Shecter explains why SWIFT is the financial “nuclear option” when it comes to punishing Putin. Read more here

9:55 a.m.

Whoa, Russia’s central bank hiked its interest rate from 9.5 per cent to 20 per cent this morning before the ruble started trading.

The biggest rate increase in almost 20 years did little to save the currency which plunged nearly 30 per cent as traders struggled to price the currency amid an initial lack of liquidity.

9:33 a.m.

Stocks are falling off the bell this morning as investors assess the fallout from a new set of sanctions imposed by the Western countries on Russia over its invasion of Ukraine.

The Dow Jones Industrial Average fell 188.13 points, or 0.55 per cent, at the open to 33,870.62 and is now down more 400 points.

The S&P 500 opened lower by 30.48 points, or 0.70%, at 4,354.17, while the Nasdaq Composite dropped 123.80 points, or 0.90%, to 13,570.83 at the opening bell.

The TSX is down 121 points at 20,984.

Gold is up US$23 at US$1,911.

Additional reporting by Reuters, Bloomberg.

Advertisement

This advertisement has not loaded yet, but your article continues below.