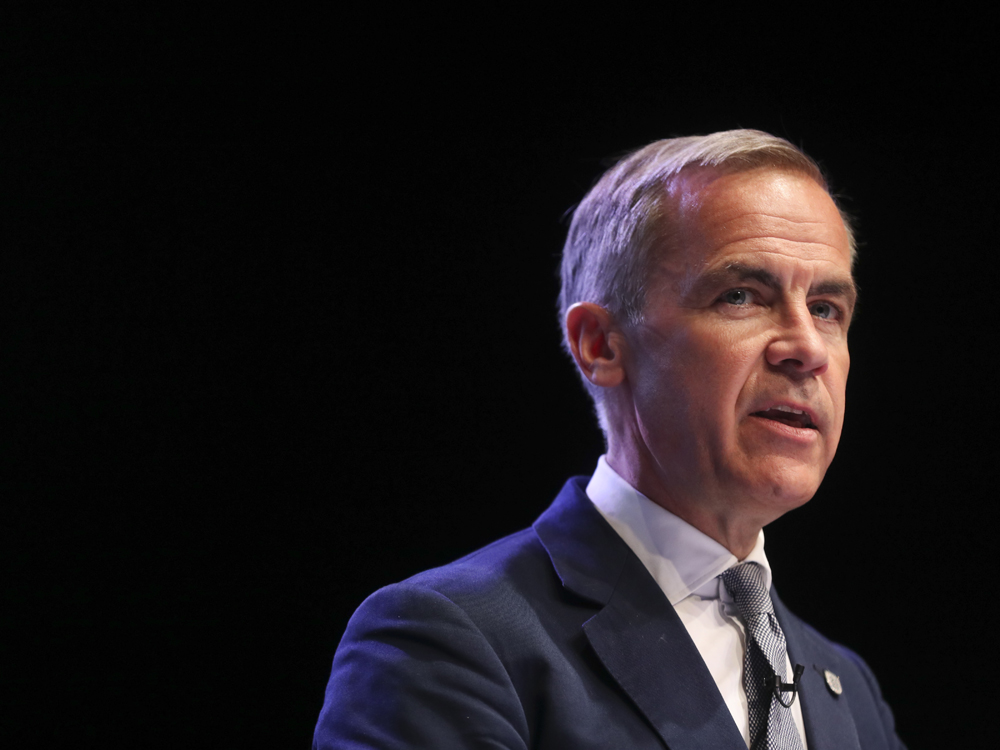

LONDON — Mark Carney, the Governor of the Bank of England, believes that international trade tensions have conjured a storm that could “shipwreck” the world economy.

Carney said that the rise of protectionism could trigger a new Cold War with high economic costs, in a speech laden with disturbing seafaring metaphors.

The central bank chief said that negative market developments represented a “sea change” caused by increased fears about how a trade war might damage businesses.

“Certainly the portents are worrying,” he said. “The storm that the modern Prospero has conjured is having an impact.”

The longer current tensions persist, the greater the risk that protectionism becomes the norm

Carney also warned that a new Cold War in trade would have a deep effect on the world economy. At the height of the historical Cold War, U.S.-USSR trade was worth US$2 billion, he said, compared to U.S.-Chinese trade now, which “clocks US$2 billion a day”.

“The latest actions raise the possibility that trade tensions could be far more pervasive, persistent and damaging than previously expected. The rationales for action are broadening. Initially motivated by concerns over bilateral trade imbalances, trade measures are now being taken in response to issues ranging from immigration to intellectual property protection to control of the technologies underpinning the fourth industrial revolution,” he said.

“The longer current tensions persist, the greater the risk that protectionism becomes the norm. Once raised, tariffs are usually slow to be lowered. Consider that half a century ago the U.S. imposed tariffs on light trucks due to a dispute over chicken exports to Europe. While the chickens were soon forgotten, the truck tariffs remain in place.”

It is too soon to say whether current trade tensions could “shipwreck the global economy or prove to be a tempest in a teacup”.

How the situation plays out will have significant ramifications for prosperity and price stability in the UK, Carney warned, suggesting a dovish near-term response might be needed from central banks, in a worst-case scenario.

The negative tone pushed sterling close to a six-month low against the dollar and the euro.

The potential for a deepening of international trade conflict was underlined Tuesday, when the White House threatened the European Union with tariffs worth US$4 billion on a range of politically sensitive goods from olives to Scotch whisky amid a long-running spat over aircraft subsidies.

A temporary hiatus in the tit-for-tat trade war between the U.S. and China is also unlikely to last long, analysts have warned.

As fears about the global economy mount, oil had its worst reaction to an OPEC meeting in more than four years, with prices sliding just after the cartel agreed to prolong production curb.

Futures closed down 4.8 per cent in New York, the steepest decline since May 31 and the biggest drop after an OPEC gathering since November 2014.

Carney’s warning added to worries following weak manufacturing reports from the U.S., China and Europe. The anxieties blotted out optimism despite Tuesday’s agreement by major oil exporters to extend production cuts for nine months. Divisions remained over Saudi Arabia’s push to target even deeper reductions, with Russia expressing doubts at the end of a summit in Vienna.

“There are concerns that demand might slow to where it overpowers supply,” Bart Melek, head of commodity strategy at Toronto’s TD Securities, said in an interview. The “gloomy” data, especially from China, “is very much part and parcel of what we’re seeing.”

Trade tensions could be far more pervasive, persistent and damaging than previously expected

In another worrying sign, backwardation for Brent, a pattern in which the front-month contract is valued more than future months because of strong demand, was halved between Monday and Tuesday for near-term prices.

West Texas Intermediate crude for August delivery slipped US$2.84 to settle at US$56.25 a barrel on the New York Mercantile Exchange. The slide accelerated as the contract crashed through several key technical trading levels, with WTI crossing below its 50-, 100- and 200-day moving averages.

Brent for September settlement declined US$2.66 to US$62.40 a barrel on the ICE Futures Europe Exchange.

The drop in crude prices on Tuesday was an “anomaly,” OPEC Secretary-General Mohammad Barkindo told reporters in Vienna.

Saudi Arabia said it would keep its output below 10 million barrels a day, even lower than required under the so-called OPEC+ deal. Saudi Energy Minister Khalid Al-Falih said he was “enthusiastic“ about the outlook for oil demand.

Yet Russia, the other de facto leader of the group, questioned a Saudi proposal to use the average of 2010 to 2014 global oil inventories to set future production targets. That move, a change to current policy, would require deeper cuts but achieve the higher prices the Saudis need to balance their budget.

The OPEC pact leaves the door open for U.S. shale producers to grab more market share, as the group will have to cut deeper to achieve inventory targets, according to Goldman Sachs Group Inc. The decision creates a clearer downside risk to the bank’s forecast for Brent to average US$60 a barrel next year, even though it could result in some shorter-term price spikes.

— With files from Bloomberg News