For the past 12-plus years, I’ve been tracking something called “The World’s Cheapest ETF Portfolio.” It’s a diversified portfolio holding the cheapest ETF in each of six asset classes at the following weights:

- International Equities: 30%

- Emerging Market Equities: 5%

(The portfolio’s weights were set when I was … ahem … a bit younger).

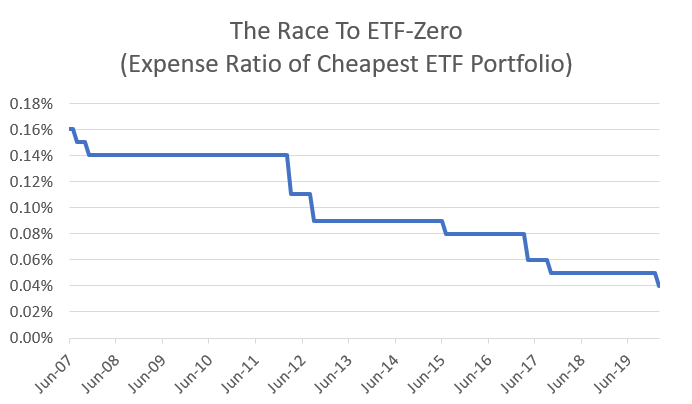

When I first wrote about this portfolio, the blended expense ratio was 0.16% … which I thought was amazing.

At the time, the ETF fee wars were in their infancy; the term “robo-advisor” hadn’t even been invented. The idea that you could buy effectively all the stocks in the world, a complete portfolio of bonds, and 20+ different commodities for a fee of 0.16% blew my mind.

Little did I know.

Ever since, the fee on my portfolio has fallen lower and lower, shedding about 1 basis point per year on its relentless push towards zero.

Content continues below advertisement

As Dave Nadig and I explained at our keynote address to the 2020 Inside ETFs conference, the price recently fell to a new all-time low: Just 0.04%.

| Asset Class | Weight | Fund | Ticker | Expense |

|---|---|---|---|---|

| U.S. Equity | 40% | Sofi Select 500 | (SFY) | 0.00% |

| Developed Market Equity | 30% | SPDR Developed World Ex-US ETF | (SPDW) | 0.04% |

| Emerging Market Equity | 5% | Vanguard FTSE Emerging Markets ETF | (VWO ) | 0.10% |

| REITs | 5% | Schwab U.S. REIT ETF | (SCHH ) | 0.07% |

| Fixed Income | 15% | Schwab U.S. Aggregate Bond | (SCHZ ) | 0.04% |

| Commodities | 5% | GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF | (COMB) | 0.25% |

| Total | 0.04% |

The drop was driven primarily by the 2019 introduction of the Sofi Select 500 ETF (SFY), with its expense ratio of 0.00%.

Critics may argue that SFY’s fee is based on a waiver, which expires on March 27. My gut tells me, however, that the waiver will be extended … perhaps permanently. Sofi is committed to offering the lowest cost ETF in the space, which means keeping prices below that of the next-cheapest US equity ETF, the JP Morgan BetaBuilders US Equity ETF (BBUS), which charges a whopping 0.02%.

With $83 million in assets, even if it matched BBUS’ expense ratio, you’d be talking about a $16,600 revenue stream for SFY — hardly worth the PR hit for abandoning zero fees.

Fingers crossed SFY sticks to its knitting.

Where Do We Go From Here?

A lot of people ask me how low I think the portfolio’s expense ratio can go. The answer is simple: Much lower. In fact, I suspect we’ll be at a 0.02% all-in fee by the end of 2021.

How will we get there?

Someone will introduce zero fee ETFs for International Equities and Fixed Income, and commodity ETF fees will go lower.

I know that sounds too good to be true, but ETFs are a commodity where the marginal cost of production is zero. Simple economics tells us where the prices will go.

(Don’t believe me? Ask the firms that used to charge commissions for trading.)

What a wonderful time to be an investor.

Note: Our keynote slide erred in listing the blended expense ratio at 0.03%. This is the correct number.

This article was originally published on ETF Trends.