As global bond yields plummeted with some hovering in the negative territory, investors have jumped into precious metals and related ETFs to better safeguard their purchasing power in times of uncertainty.

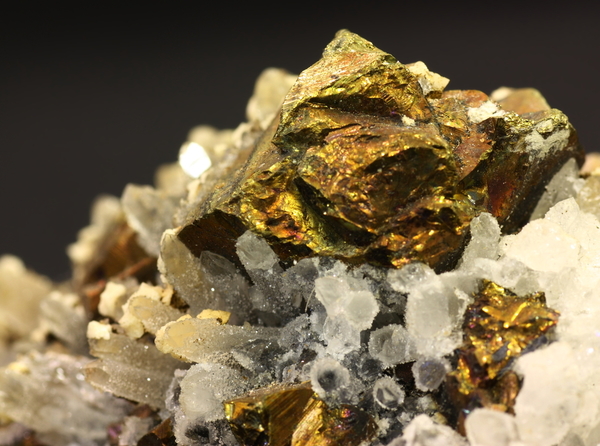

For example, gold has acted as a historical safe-haven play during a low rate environment, with volatile equities and a weak dollar. There are now a number of gold ETFs on the market that investors can choose from, including the SPDR Gold Shares (GLD ), iShares Gold Trust (IAU ), GraniteShares Gold Trust (BAR ), Aberdeen Standard Physical Swiss Gold Shares ETF (SGOL ) and VanEck Merk Gold Trust (OUNZ ). The gold-related ETFs are backed by gold bullion stored in a vault, so investors essentially gain direct exposure to physical gold through these ETFs.

Comex gold futures were trading around $1,516 per ounce on Friday and recently touched their highest levels in six years, breaking out this year after hovering within range for many years.

“There is so much flight to safety right now and metals is where a lot of that money is going,” Bob Haberkorn, senior commodities broker with RJO Futures, told the Wall Street Journal. “Traders that had been out of the metals market are coming back…and there’s been a lot of buying from new accounts. It’s been great, great for business.”

The flight to safety has dragged on global yields, with negative rates proliferating across Europe and Japan. Over $15 trillion in government debt around the world is now showing a negative yield. Global fixed-income investors also expect yields to fall even further as the European Central Bank and Bank of Japan execute additional monetary stimulus measures to further stimulate slowing economic growth.

“Gold yields zero, but zero is still much better than negative,” Bart Melek, head of commodity strategy at TD Securities, told the WSJ.

In the U.S., yields on benchmark 10-year Treasury notes have also dipped to their lowest level in three years in response to disappointing manufacturing data and ongoing trade tensions, and the yield curve even inverted, fueling fears of a potential recession around the corner.

Looking ahead, gold’s place won’t dull any time soon. According to Commodity Futures Trading Commission data, hedge funds and other speculative investors are betting on further gains, with net bullish bets on gold at their highest level since 2006.

This article originally appeared on ETFTrends.com.