By Kevin Flanagan

Head of Fixed Income Strategy

It’s 8:30 in the morning, and I’m trying to stay awake at my desk for my Econ 101 class. We take out our pens (yes, writing instruments from the 20th century) and are taught that two consecutive quarters of negative real GDP is the definition of a recession. Fast forward a few years later—okay, more than a “few”—and all of a sudden, the definition of an economic downturn is undergoing some sort of revision. Hence the question: when is a recession actually a recession?

The Bureau of Economic Analysis (BEA) weighed in on the discussion yet again last week with the release of the Third Estimate for Q2 2022 real GDP. Typically, the third release of this economic report doesn’t garner much attention, but for this report, the BEA incorporated their annual revisions to data dating from Q1 2017 through Q1 2022. Remember, in the original releases, the BEA reported that real GDP for both Q1 and Q2 of this year fell in the negative column, a development that gave rise to recession talk. In other words, one could say the U.S. economy entered into a “technical recession” during the first half of the year. For the record, that conclusion didn’t change one bit, as the negative readings for Q1 and Q2 went unrevised at -1.6% and -0.6%, respectively.

This is where the debate began as some Fed members and outside economists pushed back on this narrative, especially given the ongoing solid nature of the labor market. As a result, another gauge, gross domestic income (GDI), came into focus.

Average of Real GDP and GDI

According to the BEA, GDI is defined as a measure of the incomes earned and the costs incurred in the production of gross domestic product and is another way of measuring economic activity. For the record, GDP measures the value of the final goods and services produced in the U.S. To sum up, GDP calculates economic activity by expenditures, while GDI focuses on the incomes generated during the process. Interestingly, the BEA states that both are “conceptually equal.” While each series can produce different short-term results, they tend to come together over the longer haul.

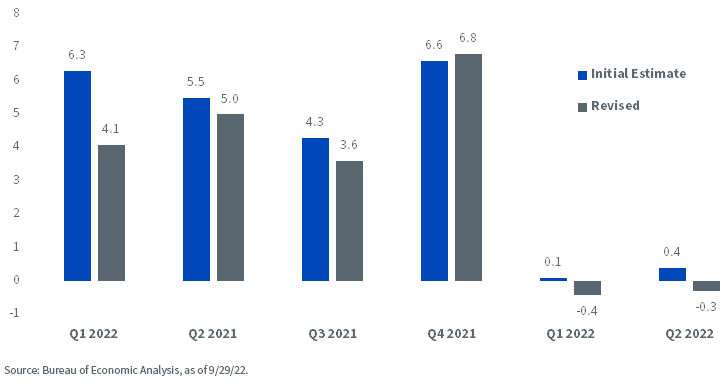

Another way of looking at economic activity is to average real GDP and GDI together, a component the BEA produces as well. As the bar chart reveals, this “average” did post positive readings in the BEA’s initial estimates, but after the annual revision process, it now resides in negative territory for both Q1 and Q2. So that begs the question: has the recession riddle finally been answered? Probably not, but the evidence for how the first half of this year played out certainly points in the “technical recession” direction.

Conclusion

I would agree that the real GDP data provided thus far is “yesterday’s news,” but knowing the starting point as the Fed continues to ramp up its rate hikes can be valuable information for where the U.S. economy may be headed. For the record, most forecasts for Q3 2022 seem to be leaning toward a return to slightly positive growth, with the Atlanta Fed GDPNOW forecast, as of this writing, looking for a +2.3% increase.

Originally published by WisdomTree on October 5, 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.