As stocks continue to flirt with bear market territory, many investors are understandably concerned about a possible recession. It is not a foregone conclusion that we are going to enter a recession anytime soon. And, although we cannot know for sure what to expect, we can at least use the history of bear markets and recessions as a guide.

The challenges facing the underlying economy, driven by the resurgence of inflation, are historic in nature and won’t be resolved overnight. The resulting swings in the stock market have been difficult for some to stomach, especially those who took on more and more risk over the past two years. For less seasoned investors, navigating a market that doesn’t simply rise day-after-day may be a new experience. What does history tell us about market and economic downturns?

The U.S. stock market has already pulled back more than the run-of-the-mill downturn. The Nasdaq has been in bear market territory since late April after notching significant gains throughout the pandemic recovery. The S&P 500 briefly entered bear market territory last week during intra-day trading, but closed back above these levels. From its all-time high at the start of the year to its lowest point in recent days, the S&P 500 has fallen as much as 19%.

It’s an industry convention to consider a 20% peak-to-trough decline a bear market based on end-of-day prices. Whether we officially refer to the current environment as a “bear market” is a semantic argument that will be settled in hindsight. At the moment, the difference in a percentage point here or there doesn’t fundamentally change the situation or how investors should behave. In this environment, there are three facts worth remembering.

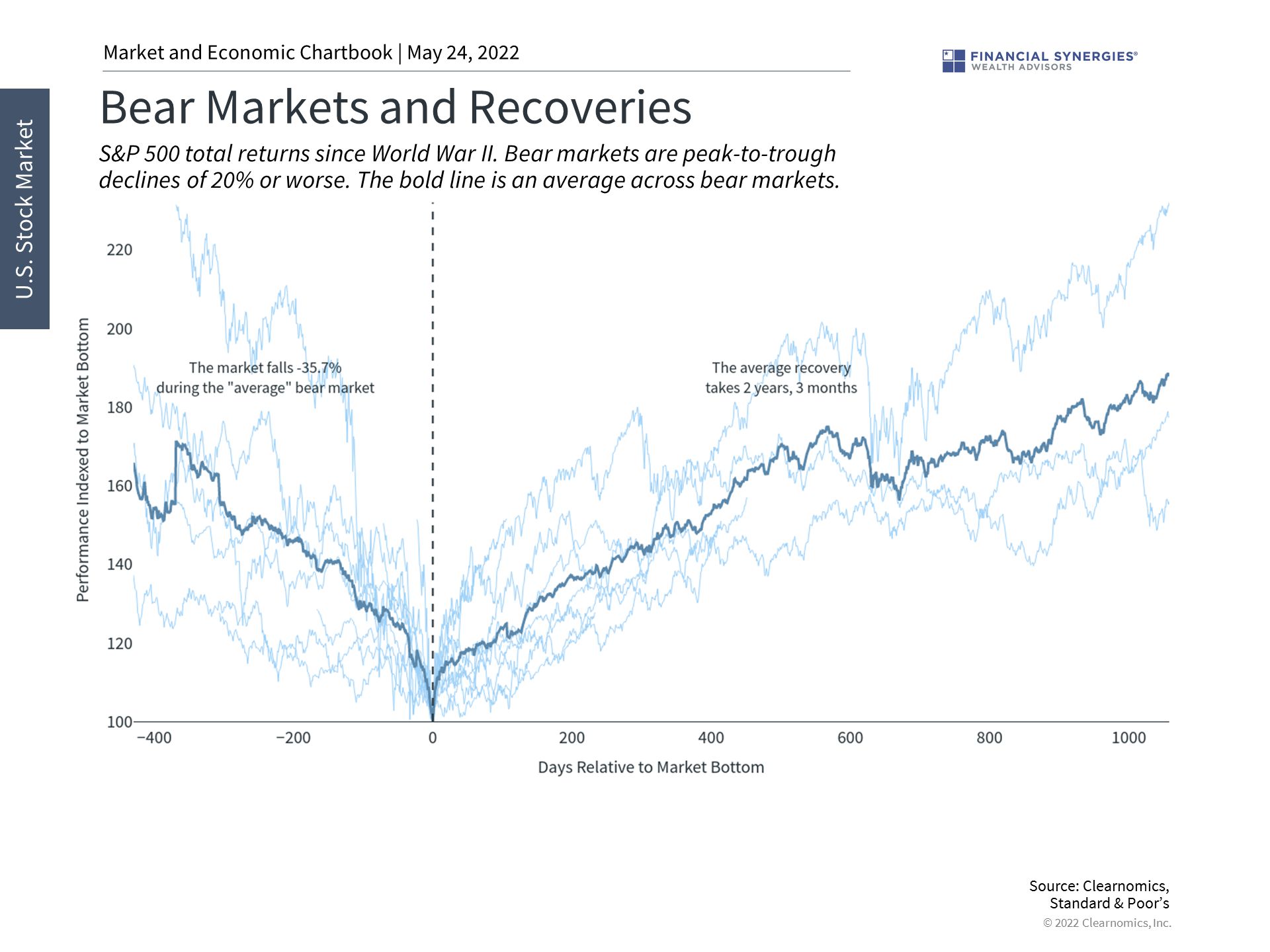

First, historical bear markets have been much worse than 20%. The average since World War II has been a decline of nearly 36% for the S&P 500. During the dot-com bust, the S&P 500 fell 49% over two and a half years. The 2008 global financial crisis led the market to a 57% loss over a year and four months. In 2020, the market fell as much as 34% in just a single month.

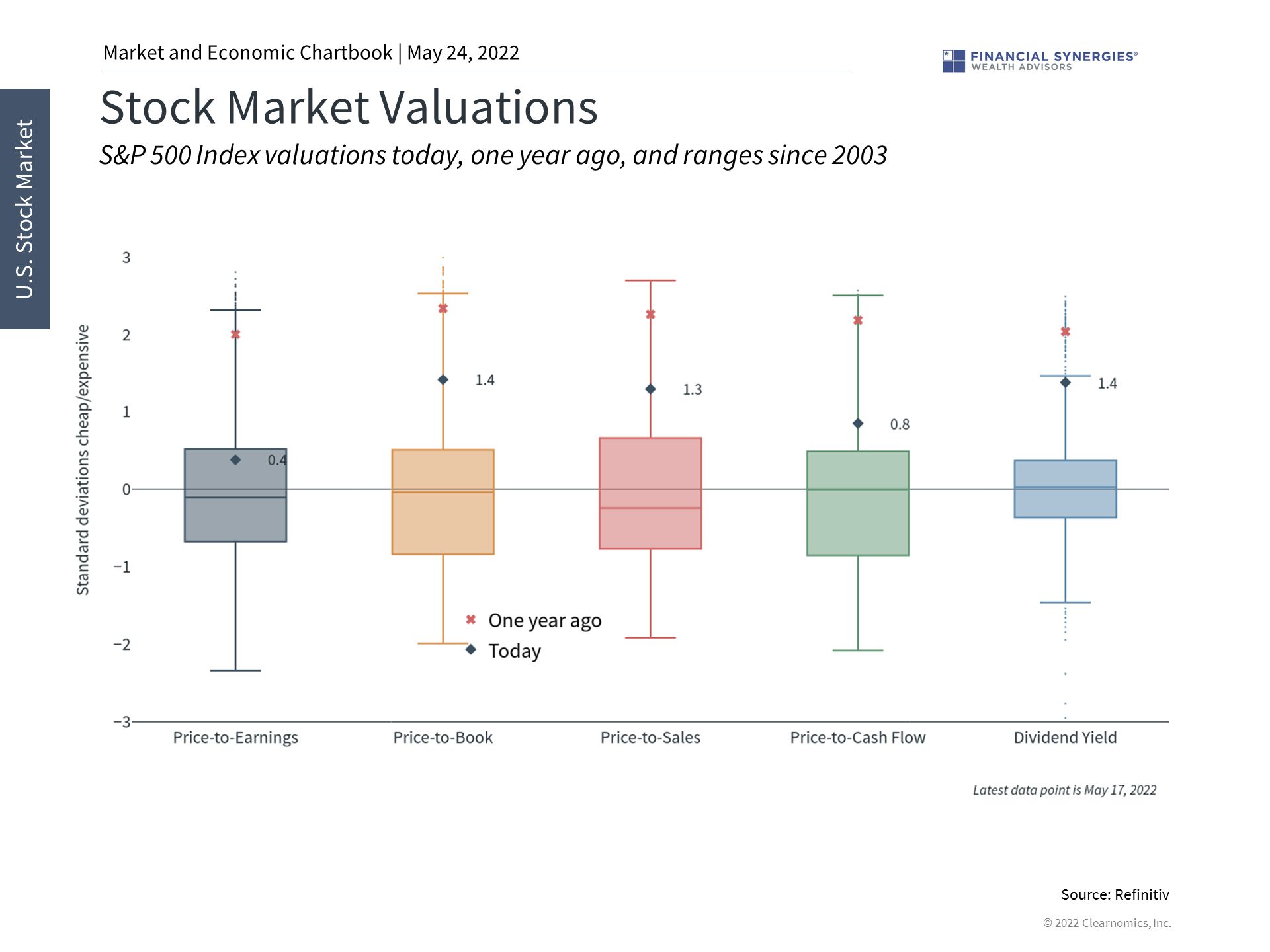

These bear markets weren’t just isolated to financial markets but occurred alongside recessions. This makes them different from standard market corrections which can occur at any time. When the economy remains strong as markets pull back, corporate earnings and economic growth can serve as a “floor” to falling market prices. In these situations, valuations become more and more attractive until investor sentiment turns around.

In contrast, these fundamentals tend to deteriorate during recessions so that profits and growth are called into question, worsening and prolonging these downturns. Today, there are certainly many challenges due to the surge in inflation. Financial conditions are tightening as the Fed raises interest rates. Rising prices are eating into consumer pocketbooks, especially from higher energy prices due to the war in Ukraine. Some companies are experiencing greater input costs and ongoing supply chain problems as they try to meet demand. It will take time for these headwinds to work themselves out, especially when they involve the prices of global goods.

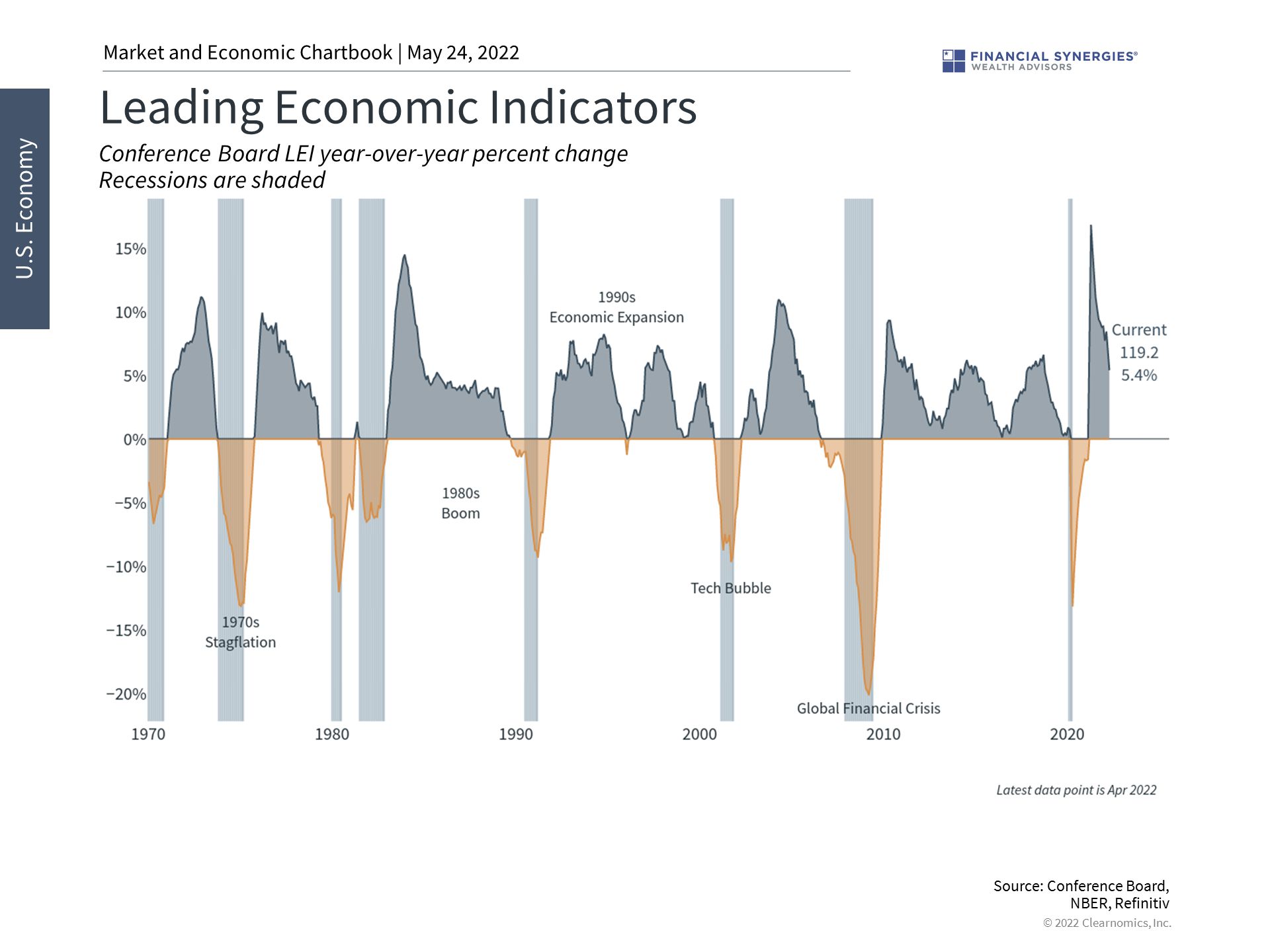

At the same time, many parts of the economy continue to be robust. Hiring is very strong, wages are improving for the first time in years, industrial activity is growing, and consumers are still spending. The leading economic indicators tracked by economists tend to be negative leading into a recession, since by definition a recession represents a contraction in these activities. Currently, the leading economic indicators are still positive and suggest overall economic stability. This can change quickly, especially if inflation continues to be worse for longer, but there are also reasons to believe the situation can improve if inflation slowly begins to fade.

Second, in all of these historical cases, markets more than recovered. The challenge for investors is that identifying the bottom of a downturn is impossible. The investing world is littered with those who counterproductively sold low and bought high at the wrong moments, especially when sentiment was at its worst as it is today. This is because there is a natural human tendency to wait until it’s comfortable to invest.

Unfortunately, markets simply don’t wait for conditions to be perfect. Instead, markets can turn around at any moment, especially when investors least expect it, since they are forward-looking even when investors are not.

One factor that determines the severity of bear markets and recessions is whether they are “systemic” in nature. This was the case for the housing bubble which was not just about the housing market, which would already affect most Americans, but that it spread across the entire global financial system via mortgage-backed securities, collateralized debt obligations, and more. This was not the case during the dot-com bust which, although a tough period for financial markets, resulted in only a shallow recession. In hindsight, this was also not the case during the pandemic which was what allowed the market to rebound so quickly once the economy reopened.

It’s hard to perfectly characterize today’s market situation while in the eye of the storm. During these previous crises, there were always those market observers who said things would never return to normal. This was true during the pandemic when some expected another Great Depression.

In many ways, the current environment represents a reversal of “the everything bubble,” as some have dubbed it, in which all assets rose – including stocks, bonds, housing, commodities, private assets, startup valuations, crypto, and more. For this reason, today’s market perhaps feels worse than the usual downturn because there has been nowhere to hide.

Thus, the third point is that throughout these periods, focusing on what you can and cannot control is the most important lesson. We’re unable to control the direction of the stock market or identify the market bottom with accuracy. Neither we nor the government and the Fed can directly control the global supply chain. We also can’t control the behavior of other investors, especially when their goals differ from ours. This is the case not just today, but across a full investment lifetime.

What we can do is react to market swings appropriately. We can keep a close eye on the economic data to assess whether this is a short-lived event or whether there are larger implications. We can focus on valuation levels which are much more attractive than they were just a few months ago. And, most importantly, we can maintain discipline in our investment portfolios by staying diversified, maintaining a long time horizon, and not overreacting. Being reminded of this when the situation seems dire is perhaps the greatest value of financial guidance.

Try and focus on the bigger picture. While they do feel terrible, recessions and bear markets are a natural part of investing. In many cases, they allow the economy to shake off excesses and re-allocate resources, paving the way for future growth. Once a crisis subsides, subsequent economic expansions and bull markets not only last significantly longer, but are the reason investors are able to achieve their financial goals. This is especially true for investors that can take advantage of attractive valuations today.

Below are three charts that shed light on the current bear market discussion.

1. The economy is slowing but still strong

Leading Economic Indicators

Many leading economic indicators tend to turn negative ahead of recessions. This is not the case today. Although growth is certainly slowing from the breakneck speeds of the initial pandemic recovery, many parts of the economy are still positive. This includes hiring activity, consumer spending, and more.

2. Stock market valuations are significantly cheaper today

Stock Market Valuations

The market is significantly cheaper (and less risky) than it was just a few months earlier. This is true regardless of the measure, including those that take into account forward expectations of earnings and growth.

3. Bear market bottoms are difficult to predict

Bear Markets and Recoveries

It is difficult if not impossible to predict the exact bottom of a correction or bear market. In fact, the typical bear market is much worse than what we are experiencing today. Trying to time the market, especially by moving to cash, means that investors run the risk of missing the rebound.

We wouldn’t be human if we didn’t worry (at least a little) about bear markets and recessions. But lessons from history tell us that the market and economy always recover, given a bit of time.

Source: Clearnomics