[ad_1]

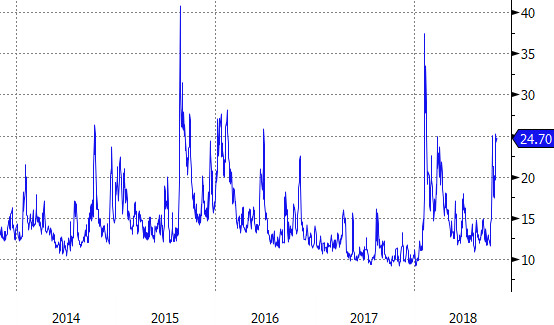

Fear levels are rising on Wall Street, prompting exchange-traded products tied to the Cboe Volatility Index (VIX) to spike in October.

In the month-to-date period ending Oct. 29, the S&P 500 plummeted 9.3%, pushing the VIX to around 25, the loftiest level since April. In turn, the $1.1 billion iPath S&P 500 VIX Short-Term Futures ETN (VXX), the largest volatility ETP on the market, surged more than 50%.

VXX isn’t the only ETP tied to the VIX that is soaring this month. The $817 million VelocityShares Daily 2x VIX Short-Term ETN (TVIX) more than doubled, returning 113.5% in the month-to-date period.

(Note: VXX will expire in January 2019 and will be replaced by the iPath Series B S&P 500 VIX Short Term Futures ETN (VXXB).

What Is The VIX?

The VIX measures implied volatility, a figure based on the price of near-term S&P 500 Index options. When stocks gyrate wildly, options contracts, which allow investors to buy or sell at predetermined prices, tend to cost more.

The VIX usually rises when stocks fall, and vice versa. That’s why it has a reputation as Wall Street’s “fear gauge.”

In addition to being a thermometer of investor sentiment, the VIX is used by investors and traders as a tool for hedging and speculation. There are no products that precisely track movements in the VIX itself (spot VIX) because the portfolio of options that the index tracks is constantly changing.

Cboe Volatility Index (VIX)

VIX Futures

While the VIX itself is uninvestable, VIX futures contracts that allow traders to bet on what value the index will be at some date in the future are readily available.

Cboe Global Markets, parent company of ETF.com, lists a number of weekly and monthly VIX futures contracts whose values fluctuate based on where traders believe the level of the VIX will be at the contract’s expiration date.

The value of VIX futures tends to converge with spot VIX as a contract’s expiration nears, though they can deviate significantly from spot for contracts where expiration is far in the future.

VIX ETPs

The aforementioned VXX and TVIX are both products that have packaged VIX futures into ETPs that can be bought and sold in a standard brokerage account.

These ETPs track VIX futures closely. As of this writing, front-month VIX futures had risen 53.1% month-to-date, compared with the 50.8% return for VXX.

Meanwhile, spot VIX rose 103.8% in the same period, much greater than the jump in VIX futures or VXX—but in line with the 113.5% return for TVIX, which provides two times the return of VIX futures.

MTD Performance Through Oct. 29

Roll Costs

Anyone who delves into the world of VIX ETPs should know that these are short-term tactical tools, not buy-and-hold investments.

That’s largely because of contango, a situation when near-month futures contracts trade at a discount to later-month futures contracts. When VIX ETPs roll their positions from one futures contract to the next, they often have to sell at a lower price and buy at a higher price, resulting in a roll cost that adds up over time.

[ad_2]

Source link