Largely reflecting a rebound in energy prices, the Labor Department released a report on Friday showing a modest increase in U.S. producer prices in the month of July.

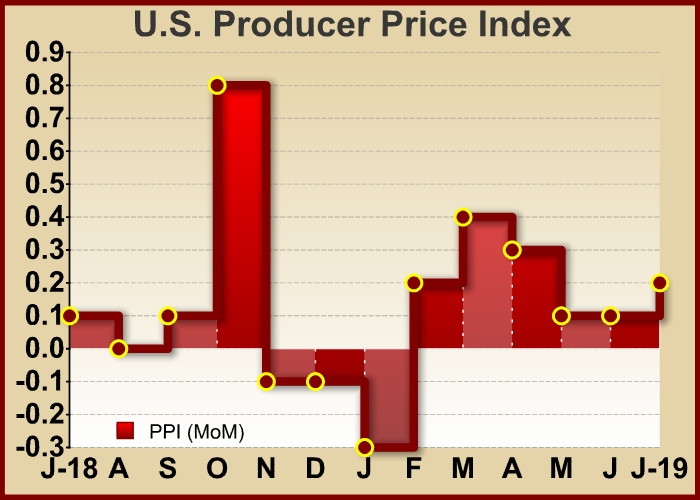

The Labor Department said its producer price index for final demand rose by 0.2 percent in July after inching up by 0.1 percent in both May and June. The uptick in prices matched economist estimates.

The modest increase in producer prices was largely due to a spike in energy prices, which surged up by 2.3 percent in July after plunging by 3.1 percent in June.

Meanwhile, the report said core producer prices, which exclude food and energy prices, edged down by 0.1 percent in July after rising by 0.3 percent in June.

The modest pullback in core producer prices came as a surprise to economists, who had expected core prices to rise by 0.2 percent.

“The decline in core producer prices in July confirms that underlying price pressures remain subdued,” said Andrew Hunter, Senior U.S. Economist at Capital Economics.

He added, “At the margin, that makes it a little more likely that Fed officials will react to any further signs of weakness in the real economy by cutting interest rates again.”

The unexpected dip in core prices came as prices for final demand services also slipped by 0.1 percent in July after climbing by 0.4 percent in June.

A 0.3 percent drop in prices for services less trade, transportation, and warehousing more than offset modest increases in prices for trade, transportation, and warehousing services.

Compared to the same month a year ago, producer prices in July were up by 1.7 percent, unchanged from the annual rate of growth seen in the previous month.

On the other hand, the report said the annual rate of growth in core consumer prices slowed to 2.1 percent in July from 2.3 percent in June.

The Labor Department is scheduled to release its more closely watched report on consumer price inflation in the month of July next Tuesday.

For comments and feedback contact: editorial@rttnews.com

Forex News