Reflecting weaknesses in new orders for manufacturing, housing permits, and unemployment insurance claims, the Conference Board released a report on Thursday showing an unexpected decrease by its index of leading U.S. economic indicators in the month of June.

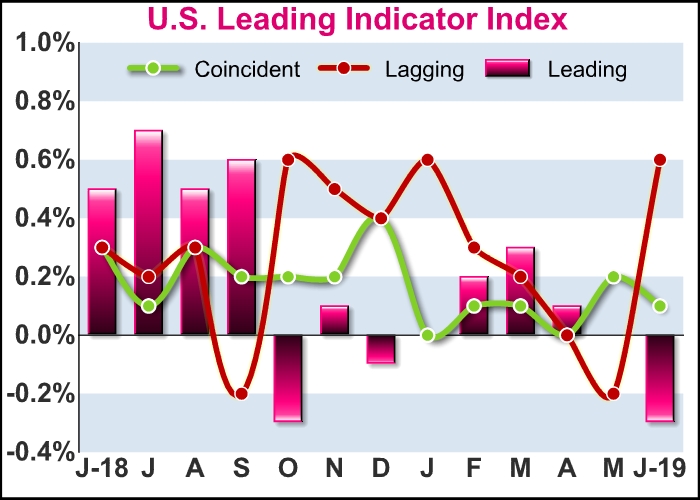

The Conference Board said its leading economic index fell by 0.3 percent in June after coming in unchanged in May. The drop surprised economists, who had expected the index to inch up by 0.1 percent.

“As the US economy enters its eleventh year of expansion, the longest in US history, the LEI suggests growth is likely to remain slow in the second half of the year,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board.

The unexpected drop by the leading economic index reflected negative contributions from building permits, the ISM New Orders Index, and average weekly initial jobless claims.

Ozyildirim the interest rate spread also made a small negative contribution for the first time since late 2007.

Meanwhile, the report said positive contributions from the Leading Credit Index, average weekly manufacturing hours, and stock prices helped limit the downside for the index.

The Conference Board also said its coincident economic index crept up by 0.1 percent in June after rising by 0.2 percent in May.

The uptick came as positive contributions from employees on non-farm payrolls, personal income less transfer payments and manufacturing and trade sales more than offset a negative contribution from industrial production.

Reflecting positive contributions from four of its seven components, the lagging economic index also climbed by 0.6 percent in June after dipping by 0.2 percent in May.

The rebound by the index came amid positive contributions from the average duration of unemployment, commercial and industrial loans outstanding, the ratio of manufacturing and trade inventories to sales, and the ratio of consumer installment credit outstanding to personal income.

For comments and feedback contact: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.