A report released by the Conference Board on Thursday showed its reading on U.S. leading economic indicators rose by slightly more than anticipated in the month of March.

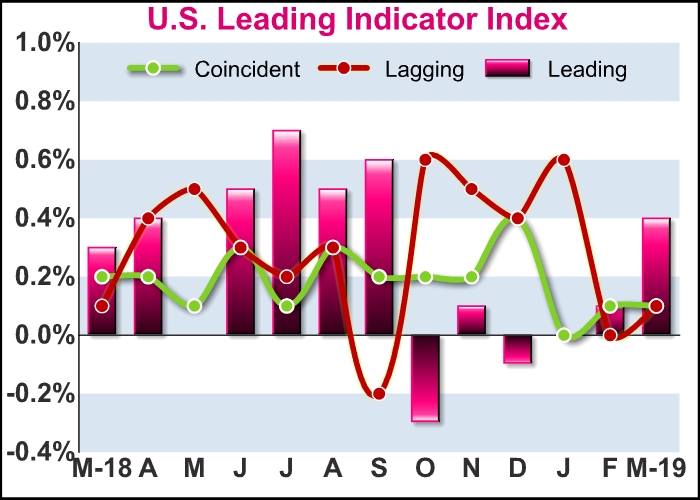

The Conference Board said its leading economic index climbed by 0.4 percent in March after inching up by a revised 0.1 percent in February.

Economists had expected the index to rise by 0.3 percent compared to the 0.2 percent uptick originally reported for the previous month.

“The US LEI picked up in March with labor markets, consumers’ outlook, and financial conditions making the largest contributions,” said Ataman Ozyildirim, Director of Economic Research at the Conference Board.

He added, “Despite the relatively large gain in March, the trend in the US LEI continues to moderate, suggesting that growth in the US economy is likely to decelerate toward its long term potential of about 2 percent by year end.”

The slightly bigger than expected increase by the leading economic index reflected positive contributions from eight of the ten indicators that make up the index.

Average weekly initial jobless claims, average consumer expectations for business conditions, the Leading Credit Index, stock prices, the ISM New Orders Index, and the interest rate spread were among the biggest positive contributors.

Meanwhile, the report said average weekly manufacturing hours and building permits held steady during the month.

The Conference Board also said the coincident economic index crept up by 0.1 percent in March, matching the uptick in February.

The modest increase by the index reflected positive contributions from employees on non-farm payrolls, personal income less transfer payments and manufacturing and trade sales, while industrial production made a negative contribution.

The lagging economic index also inched up by 0.1 percent in March after showing no change in February, with four of its seven components advancing.

Commercial and industrial loans outstanding, the ratio of consumer installment credit outstanding to personal income, the change in consumer prices for services, and the ratio of manufacturing and trade inventories to sales made positive contributions.

Negative contributions from the average duration of unemployment and the change in the index of labor cost per unit of output, manufacturing limited the upside.

For comments and feedback contact: editorial@rttnews.com

Forex News