WASHINGTON — Trade talks between the United States and China resumed on Monday with prospects dimming for a transformative deal, as both sides appeared more focused on preventing tensions from escalating before the 2020 presidential election than on making concessions.

Negotiators from both countries are continuing to press for an agreement, but months of meetings have so failed to yield consensus on the most difficult issues and there is little to suggest that a compromise is within reach. Instead, the United States and China appear to be trying to find a path to keep the talks moving forward and to avoid a breakdown that could rattle stock markets and hurt President Trump’s chances of re-election.

Mr. Trump and his advisers are playing down the likelihood of reaching an agreement in the short term, and the president suggested on Friday that China was trying to drag out the negotiations in the hope that someone else might occupy the Oval Office come January 2021.

“Meeting after meeting,” Mr. Trump told reporters at the White House. “I think that China will probably say: ‘Let’s wait. It’s 14, 15 months till the election. Let’s see if one of these people that give the United States away, let’s see if one of them could possibly get elected.’”

“I don’t know if they’re going to make a deal,” he added, referring to the Chinese government. “Maybe they will, maybe they won’t. I don’t care, because we’re taking in tens of billions of dollars’ worth of tariffs.”

Mr. Trump’s advisers have echoed his stance. Larry Kudlow, the director of the White House National Economic Council, tried to lower expectations that any big announcements would come out of the talks in Shanghai this week between Robert Lighthizer, the United States trade representative, and Steven Mnuchin, the Treasury secretary, and their Chinese counterparts.

“I wouldn’t expect any grand deal,” Mr. Kudlow said on CNBC on Friday. “I think, talking to our negotiators, they are going to kind of reset the stage and, hopefully, go back to where the talks left off last May.”

Negotiators appeared to be on the cusp of making a deal earlier this year. But talks faltered suddenly in May, as Beijing made significant changes to a draft outlining the potential terms of an agreement, and the Americans accused China of reneging on commitments.

Since then, the path toward reaching a trade agreement has been unclear. Talks are highly secretive, but there still appear to be significant differences over how China would enshrine new protections for American intellectual property, how many American products China would agree to buy and how many of Mr. Trump’s tariffs on $250 billion in Chinese goods would remain in place.

The two sides also appear to differ over how explicit the agreement should be. Chinese negotiators previously objected to demands that certain provisions be enshrined in Chinese law, and have pushed for a more vaguely worded text.

Michael Pillsbury, a China expert at the Hudson Institute, said that leaving more uncertainty in the agreement could foster more trade fights between the world’s two largest economies, particularly given a complex enforcement mechanism the two sides previously agreed to establish to ensure both countries lived up the agreement.

“If there are loopholes and gray areas subject to interpretation, then the extensive appeal process the Trump administration has designed will be a recipe for a decade of acrimony,” he said.

Negotiators for the United States insist that China must wind the clock back to where it was before the talks stalled in order for things to progress. Yet the objections to the agreement appear to have come directly from China’s president, Xi Jinping.

“The real question in the next week is, ‘Will they go back to where we were before they changed their mind?’” Wilbur Ross, the commerce secretary, said in an interview on Fox Business Network on Friday. “That’s what’s the important thing, because we were very close to a transaction before.”

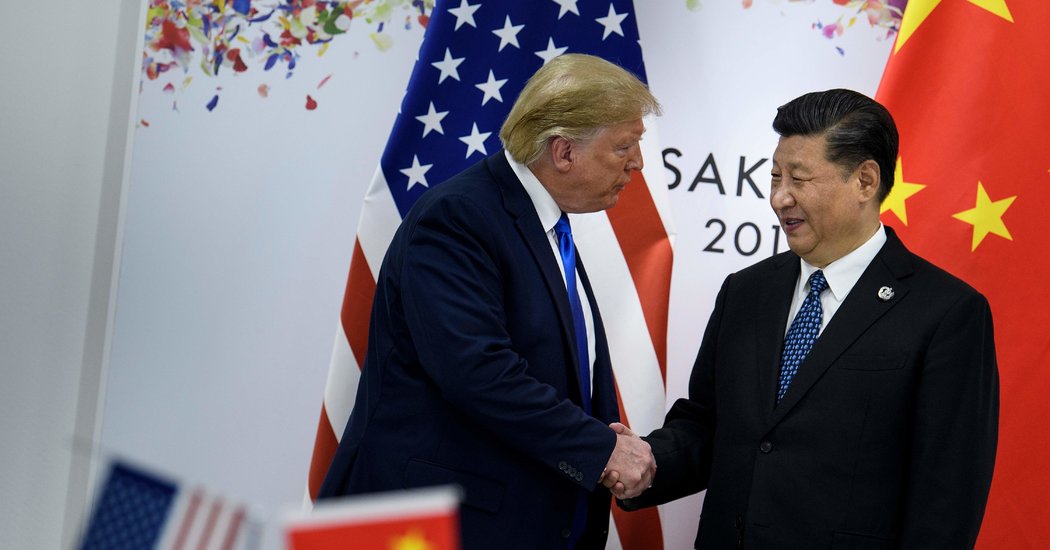

In June, Mr. Trump and Mr. Xi agreed on the sidelines of the Group of 20 gathering in Osaka, Japan, to try to get negotiations back on track. Mr. Trump emerged from the meeting saying that China had agreed to buy some American farm goods. In return, he said, the United States would hold off on imposing additional tariffs and approve the sale of some nonsensitive goods to Huawei, the Chinese telecommunications giant that the United States government has blocked from buying American technology over national security concerns.

Even that truce has not unfolded as Mr. Trump planned. China has been preparing to make agricultural purchases, and on Sunday the state-run Xinhua News Agency reported that millions of tons of American soybeans had been shipped to China. But elsewhere, Chinese officials have continued to insist that they are not making purchases as a condition of the talks.

“In order to better meet the needs of the domestic market, some Chinese enterprises are willing to purchase some agricultural produce from the United States,” a spokesman from the Chinese Commerce Ministry said in a briefing on Thursday. He added that there was “no direct relationship” between the resumption of trade talks and the purchases.

The Trump administration has continued to follow through on the agreements the president made in Osaka. Mr. Trump has temporarily backed off his threat to impose tariffs on an additional $300 billion of Chinese imports. And his administration is considering granting waivers that would allow American companies like Google and Micron Technology to sell Huawei nonsensitive goods like handset components that are widely available on the international market.

But it remains unclear exactly what type of American products Huawei would be allowed to buy, and if the limitations would cripple its business.

“China is looking to go back to the status quo before the trade war started, and to rewind the clock” to before Huawei was blacklisted from purchasing American goods, said Andy Mok, a trade specialist at the Center for China and Globalization in Beijing. “The biggest threat right now is what happens on Huawei.”

Some Trump administration officials believe the president would benefit politically by holding out for a tougher deal. Democrats would be quick to criticize any agreement with China, and politicians of both parties have warned about the national security threat of permitting further sales to Huawei.

But while Mr. Trump insists that the American economy is still insulated from the trade war, economic data suggests that the tensions with China, America’s largest trading partner, are taking a toll.

Data released on Friday showed that the American economy slowed in the second quarter of the year, with gross domestic product expanding at an annual rate of just 2.1 percent as net exports and business investment slumped. The Federal Reserve has frequently cited the trade war as a problem for the economy, and it is expected to cut interest rates on Wednesday to help keep the economic expansion going.

Big American companies whose performance has faltered are also citing tariffs and trade tensions on both sides of the Pacific as a reason. Caterpillar cited cooling activity in China, a major market, when it reported falling sales growth for the second quarter, while Hasbro, Nintendo and other companies have discussed plans to move part of their supply chains out of China to countries like Vietnam.

The trade war is also dragging on the Chinese economy. The shift of multinational companies out of China, a trend that was already underway as a result of rising Chinese wages, could have a corrosive effect on growth.

But a sense has emerged in China that the country can afford to wait for a better trade deal from the Trump administration, or from another president. The Chinese economy is decelerating, but the process has been gradual. Further increases in the country’s already huge amount of infrastructure spending have cushioned the shock.

China’s exports to the United States have dipped, but they have not plunged during the trade war, falling 8.5 percent in the first half of this year compared with the same period last year. But exports to the rest of the world have been up slightly.

“At this point, I don’t think people worry so much about the trade war anymore,” said Weijian Shan, a prominent Chinese economist and financier in Hong Kong. “Most of them don’t see a real negative effect on their businesses. The panic has subsided.”